Rogers 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

2008 was a year of unprecedented change

and many challenges for Rogers, yet

the company performed well financially,

delivering 12% revenue growth and

10% growth in both adjusted operating

profit and free cash flow, defined as adjusted

operating profit less capital expenditures

and interest expense. We were able to

deliver this respectable growth in the face

of progressively deteriorating economic

conditions and at the same time absorb

dilutive upfront investments to rapidly drive

wireless smartphone adoption.

Our subscriber growth continued at healthy

rates in 2008 reflecting the quality of our

service offerings and the increasing daily

relevance of our products to consumers and

businesses. Our wireless subscribers now

total nearly 8 million, while Internet, digital

TV and cable telephony subscriber levels

all increased.

We also continued to invest in our networks

and systems at a healthy rate. Partially as

a result, both our wireless and cable busi-

nesses are able to claim that their products

are the fastest and most reliable.

To fund the purchase of 20MHz of national

AWS spectrum that we acquired at auction

and to term out a portion of short-term

borrowing, we were successful during

August 2008 in issuing US$1.75 billion of

investment grade notes on very favour-

able terms despite extreme volatility in the

credit markets.

At the start of 2008, our Board approved

a doubling of the annual dividend to

$1.00 per share and also instituted the

company’s first ever share buyback

program, which combined to provide for

a balanced, tax efficient and shareholder

friendly allocation of a material portion of

the free cash flow the business generated.

In February 2009, we announced that

we would further increase the dividend to

$1.16 and that we were refreshing our share

buyback program for 2009.

While 2008 was obviously a very challeng-

ing period in the global equity markets,

the RCI.b shares, which declined 19% on

the TSX, actually outperformed the wire-

less and cable peer groups and the North

American broad market indexes, which all

declined by more significant amounts.

2009 will almost certainly bring many more

challenges to the economy, to our sector,

and to Rogers. As we go forward, our asset

mix and strategy are set, and our primary

focus is on execution. We have a tremendous

opportunity to continue enhancing our

customer service, sharpen our marketing

and customer relationship management

capabi lities, and become more efficient.

Our plan for 2009 strikes a healthy balance

between continued growth, the return

of increasing amounts of our growing free

cash flow to shareholders, and prudent

investments in our networks, systems and

service delivery platforms that will help assure

that such growth continues in the future.

If you live in Canada, please sample and

subscribe to Rogers’ many services. They will

entertain you, inform you and help keep

you in touch.

Thank you for your investment, confidence

and continued support.

Alan D. Horn

Chairman of the Board

Rogers Communications Inc.

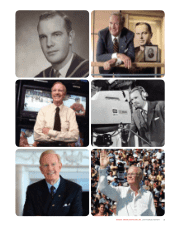

In December 2008, we mourned the passing

of Ted Rogers, the company’s founder and

Chief Executive Officer. Ted was one of a

kind who built this company from one

FM radio station nearly 50 years ago into

what is today Canada’s largest wireless,

cable and media company. His absence

has been felt very much by his friends and

colleagues at Rogers during these past

few difficult months and he will be sadly

missed, but never forgotten.

Over the past several years, one of Ted’s

most urgent focuses had been to ensure

that Rogers Communications was what

he liked to call ‘industrial strength’. After

decades of rapid growth, he wanted to

make sure that the time was taken and the

investments were made to put in place the

infrastructure, management, processes and

financial strength to secure the company

both today and into the future.

Despite the challenging economic

environment and competitive landscape,

Rogers Communications is arguably in the

strongest position it has ever been –

financially, organizationally, structurally

and operationally. The company has excel-

lent positions in the fastest growing mar-

kets in the communications industry; has

powerful and well respected brands that

stand strongly for innovation, entrepre-

neurial spirit, choice and value; is a leading

provider of services that are increasingly

becoming necessities in today’s world; has

proven performance-oriented management

with solid industry expertise, technical

depth and company tenures; and is finan-

cially strong with an investment grade bal-

ance sheet, $1.8 billion of available liquidity

and no debt maturities until May 2011.

Fellow Shareholders

“While 2009 will almost certainly bring more challenges to the economy, to our sector, and

to Rogers, our plan strikes a healthy balance between continued growth, the return of

increasing amounts of our growing free cash flow to shareholders, and prudent investments

in our networks, systems and service delivery platforms that will help ensure that such

growth continues in the future.”

Alan D. Horn