Rogers 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

RO GER S CO MMU NIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

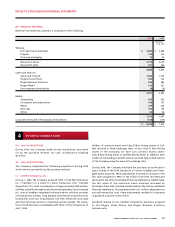

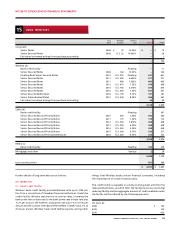

15 L ONG-TERM DE BT

Due Principal Interest

date amount rate 2006 2005

Corporate:

Senior Notes 2006 $ 75 10.50% $ – $ 75

Senior Secured Notes 2008 U.S. 22 10.625% – 26

Fair value increment arising from purchase accounting – 1

– 102

Wireless (a):

Bank credit facility Floating – 71

Senior Secured Notes 2006 160 10.50% – 160

Floating Rate Senior Secured Notes 2010 U.S. 550 Floating 641 641

Senior Secured Notes 2011 U.S. 490 9.625% 571 571

Senior Secured Notes 2011 460 7.625% 460 460

Senior Secured Notes 2012 U.S. 470 7.25% 548 548

Senior Secured Notes 2014 U.S. 750 6.375% 874 875

Senior Secured Notes 2015 U.S. 550 7.50% 641 641

Senior Secured Debentures 2016 U.S. 155 9.75% 181 181

Senior Subordinated Notes 2012 U.S. 400 8.00% 466 467

Fair value increment arising from purchase accounting 36 44

4,418 4,659

Cable (b):

Bank credit facility Floating – 267

Senior Secured Second Priority Notes 2007 450 7.60% 450 450

Senior Secured Second Priority Notes 2011 175 7.25% 175 175

Senior Secured Second Priority Notes 2012 U.S. 350 7.875% 408 408

Senior Secured Second Priority Notes 2013 U.S. 350 6.25% 408 408

Senior Secured Second Priority Notes 2014 U.S. 350 5.50% 408 408

Senior Secured Second Priority Notes 2015 U.S. 280 6.75% 326 327

Senior Secured Second Priority Debentures 2032 U.S. 200 8.75% 233 233

2,408 2,676

Media (c):

Bank credit facility Floating 160 274

Mortgages and other Various 2 28

6,988 7,739

Less current portion 451 286

$ 6,537 $ 7,453

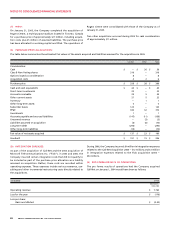

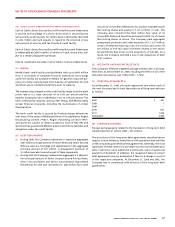

things, that Wireless satisfy certain financial covenants, including

the maintenance of certain financial ratios.

This credit facility is available on a fully revolving basis until the first

date specified below, at which time, the facility becomes a revolving/

reducing facility and the aggregate amount of credit available under

the facility will be reduced by the following amounts:

On April 30:

2008 $ 140

2009 140

2010 420

Further details of long-term debt are as follows:

(A) WIRELESS:

(i) Bank c redit facility:

Wireless’ bank credit facility provides Wireless with up to $700 mil-

lion from a consortium of Canadian financial institutions. Under the

credit facility, Wireless may borrow at various rates, including the

bank prime rate or base rate to the bank prime rate or base rate plus

13/4% per annum, the bankers’ acceptance rate plus 1% to 23/4% per

annum and the London Inter-Bank Offered Rate (“LIBOR”) plus 1% to

23/4% per annum. Wireless’ bank credit facility requires, among other