Rogers 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

RO GER S CO MMU NIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

DIVIDENDS AND OTHER PAYMENTS ON RCI EQUITY SECURITIES

The dividend policy is reviewed periodically by the Board. The dec-

laration and payment of dividends are at the sole discretion of the

Board and depend on, among other things, our financial condition,

general business conditions, legal restrictions regarding the pay-

ment of dividends by us, some of which are referred to below, and

other factors which the Board may, from time to time, consider to be

relevant. As a holding company with no direct operations, we rely

on cash dividends and other payments from our subsidiaries and our

own cash balances to pay dividends to our shareholders. The ability

of our subsidiaries to pay such amounts to us is limited and is subject

to the various risks as outlined in this discussion, including, without

limitation, legal and contractual restrictions contained in instruments

governing subsidiary debt. All dividend amounts have been restated

to reflect a two-for-one split of our Class B Non-voting and Class A

Voting shares in December 2006.

On February 15, 2007, we declared a quarterly dividend of $0.04 per

share on each of our outstanding Class B Non-voting and Class A

Voting shares. This quarterly dividend will be paid on April 2, 2007 to

shareholders of record on March 15, 2007.

During 2006, the Board declared dividends in aggregate of $0.0775

per share on each of its outstanding Class B Non-Voting shares, and

Class A Voting shares, $0.0375 of which were paid on July 4, 2006 to

shareholders of record on June 14, 2006, and $0.04 of which were paid

on January 2, 2007 to shareholders of record on December 20, 2006.

In October 2006, our Board of Directors (“the Board”) declared

a 113% increase to the dividend paid for each of our outstanding

Class B Non-Voting shares and Class A Voting shares. Accordingly,

the annual dividend per share increased from $0.075 per share to

$0.16 per share, on a post-split basis. In addition, the Board modi-

fied our dividend distribution policy to make dividend distributions

on a quarterly basis instead of semi-annually. The first such distri-

bution was made on January 2, 2007, to shareholders of record on

December 20, 2006.

In December 2005, the Board declared a 50% increase to the divi-

dend paid for each of our outstanding Class B Non-Voting shares

and Class A Voting shares. Accordingly, the annual dividend per

share increased from $0.05 per share to $0.075 per share, and were

paid twice yearly in the amount of $0.0375 per share to holders of

record of such shares on the record date established by the Board

for each dividend at the time such dividend was declared. These divi-

dends were scheduled to be paid on or about the first trading day

following January 1 and July 1 each year. The first such semi-annual

dividend pursuant to the policy was paid on January 6, 2006 to share-

holders of record on December 28, 2005.

During 2005, the Board declared dividends in aggregate of $0.0625 per

share on each of its outstanding Class B Non-Voting shares, and Class A

Voting shares, $0.025 of which were paid on July 2, 2005 to share-

holders of record on June 14, 2005 and $0.0375 of which were paid

on January 6, 2006 to shareholders of record on December 28, 2005.

In May 2004, the Board adopted

a dividend policy that provided

for dividends aggregating,

annually, $0.05 per share to

be paid on each outstanding

Class A Voting share and Class B

Non-Voting share. Pursuant to

this policy, the dividends were

paid twice yearly in the amount

of $0.025 per share to holders

of record of such shares on the

record date.

During 2004, the Board declared

dividends in aggregate of $0.05

per share on each of its out-

standing Class B Non-Voting

shares, Class A Voting shares

and Series E Preferred shares, $0.025 of which were paid on July 2,

2004 to shareholders of record on June 16, 2004 and $0.025 of

which were paid on January 2, 2005 to shareholders of record on

December 12, 2004.

COMMITMENTS AND OTHER CONTRACTUAL OBLIGATIONS

Contrac tual O bligations

Our material obligations under firm contractual arrangements are

summarized below at December 31, 2006. See also Notes 15, 23, and

24 to the 2006 Audited Consolidated Financial Statements.

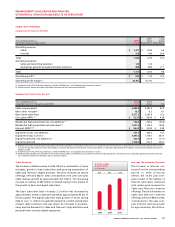

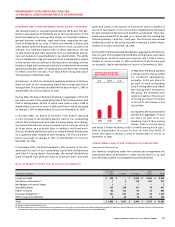

200620052004

$0.16$0.075$0.05

ANNUALIZED DIVIDENDS

PER SHARE AT YEAR END

($)

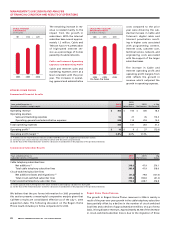

Material Obligatio ns Under Firm Cont ractual Arrangement s

Less Than After

(In millions of dollars) 1 Year 1–3 Years 4–5 Years 5 Years Total

Long-term debt $ 450 $ – $ 2,008 $ 4,492 $ 6,950

Derivative instruments (1) 7 9 198 493 707

Mortgages and capital leases 1 1 – – 2

Operating leases 163 248 151 79 641

Player contracts 82 143 95 73 393

Purchase obligations (2) 781 957 29 30 1,797

Other long-term liabilities 2 63 18 20 103

Total $ 1,486 $ 1,421 $ 2,499 $ 5,187 $ 10,593

(1) Amounts reflect net disbursements only.

(2) Purchase obligations consist of agreements to purchase goods and services that are enforceable and legally binding and that specify all significant terms including fixed or minimum quantities to be purchased,

price provisions and timing of the transaction. In addition, we incur expenditures for other items that are volume-dependent.