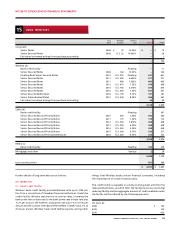

Rogers 2006 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98 R OG E RS COM MUN I C ATIO NS I NC. 2 0 0 6 AN NUAL R EPO R T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

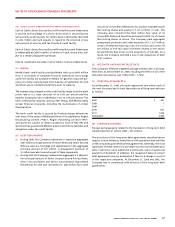

16 D ERIVATIVE INSTR UMENTS

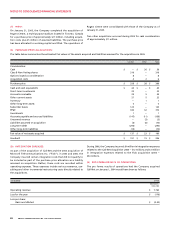

Details of the derivative instruments liability is as follows:

U.S. $ Exchange Cdn. $ Carrying Estimated

2006 notional rate notional amount fair value

Cross-currency interest rate exchange agreements accounted for as hedges $ 4,190 1.3313 $ 5,578 $ 710 $ 1,282

Cross-currency interest rate exchange agreements not accounted for as hedges 285 1.1993 342 12 12

4,475 5,920 722 1,294

Transitional gain – – 54 –

4,475 5,920 776 1,294

Less current portion 275 1.1870 326 7 7

$ 4,200 $ 5,594 $ 769 $ 1,287

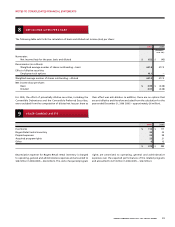

U.S. $ Exchange Cdn. $ Carrying Estimated

2005 notional rate notional amount fair value

Cross-currency interest rate exchange agreements accounted for as hedges $ 4,190 1.3313 $ 5,578 $ 710 $ 1,308

Cross-currency interest rate exchange agreements not accounted for as hedges 612 1.2021 736 27 27

Interest exchange agreements not accounted for as hedges – – 30 1 1

4,802 6,344 738 1,336

Transitional gain – – 63 –

4,802 6,344 801 1,336

Less current portion 327 1.2045 394 14 14

$ 4,475 $ 5,950 $ 787 $ 1,322

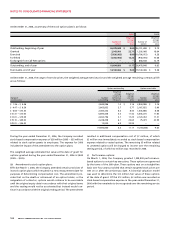

incurred a net cash outlay of $20 million upon settlement of these

cross-currency interest rate exchange agreements. An interest rate

exchange agreement of $30 million notional amount held by Cable

also matured.

During 2005, cross-currency interest exchange agreements of

U.S. $333 million aggregate notional amount matured. Cable

incurred a net cash outlay of $69 million upon settlement of these

cross-currency interest rate exchange agreements.

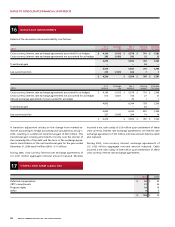

A transition adjustment arising on the change from marked-to-

market accounting to hedge accounting was calculated as at July 1,

2004, resulting in a deferred transitional gain of $80 million. This

transitional gain is being amortized to income over the shorter of

the remaining life of the debt and the term of the exchange agree-

ments. Amortization of the net transitional gain for the year ended

December 31, 2006 was $9 million (2005 – $11 million).

During 2006, cross-currency interest rate exchange agreements of

U.S. $327 million aggregate notional amount matured. Wireless

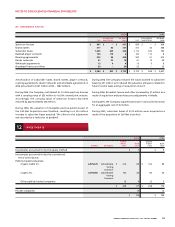

17 O THER LONG-T ERM LIABILITIES

2006 2005

Deferred compensation $ 54 $ 25

CRTC commitments 21 26

Program rights 19 18

Other 9 5

$ 103 $ 74