Rogers 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 ROG ERS COM MUN ICAT I ONS INC . 2006 ANN UAL RE P ORT

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

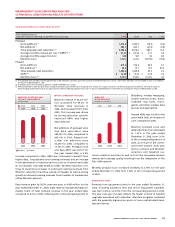

Reclassification of Wireless Equipment Sales and Cost of Sales

During 2006, Wireless determined that certain equipment subsidies

paid to third party distributors with respect to handset upgrade

activities were historically recorded as cost of equipment sales rather

than as a reduction of equipment revenue. Wireless determined

these subsidies should be reflected as a reduction of equipment rev-

enue and have reclassified current and prior year figures to reflect

this accounting. This resulted in a $206 million reduction in both

equipment revenue and cost of equipment sales in the year ended

December 31, 2006 and reductions of $147 million, $94 million,

$56 million and $48 million for the years ended December 31, 2005,

2004, 2003 and 2002, respectively. There was no change to previously

reported net income (loss) or operating income as a result of this

reclassification. Also, there is no impact on reported cash flow, the

balance sheet, or any Wireless key performance indicators, including

network revenue, ARPU, cost of acquisition, average monthly oper-

ating expense per user or operating profit margin as a percentage of

network revenue. Included in the supplemental information section

is a schedule which presents reclassified results for each quarter of

2005 and 2006 conformed to the current presentation. Reclassified

annual results for the last five years are also included in the supple-

mental information section.

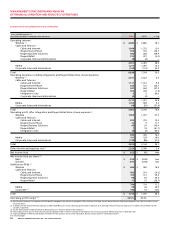

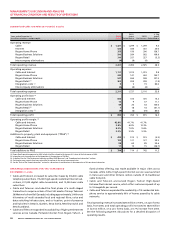

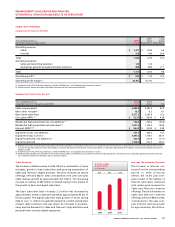

Summarized Wireless Financial Results

Years ended December 31,

(In millions of dollars, except margin) 2006 2005 % Chg

Operating revenue

Postpaid $ 4,084 $ 3,384 20.7

Prepaid 214 210 1.9

One-way messaging 15 20 (25.0)

Network revenue 4,313 3,614 19.3

Equipment sales (1) 267 246 8.5

Total operating revenue 4,580 3,860 18.7

Operating expenses

Cost of equipment sales (1) 628 625 0.5

Sales and marketing expenses 604 604 –

Operating, general and administrative expenses 1,376 1,240 11.0

Integration expenses (2) 3 54 (94.4)

Total operating expenses 2,611 2,523 3.5

Operating profit (3)(4) $ 1,969 $ 1,337 47.3

Operating profit margin as % of network revenue (4) 45.7% 37.0%

Additions to property, plant and equipment (“PP&E”) (4) $ 684 $ 585 16.9

(1) Certain current and prior year amounts related to equipment sales and cost of equipment sales have been reclassified. See the “Reclassification of Wireless Equipment Sales and Cost of Sales” section.

(2) Expenses incurred relate to the integration of the operations of Fido.

(3) Operating profit includes a loss of $25 million and $5 million for the years ended December 31, 2006 and December 31, 2005, respectively, related to the Inukshuk fixed wireless initiative.

(4) As defined. See the “Key Performance Indicators and Non-GAAP Measures” section.

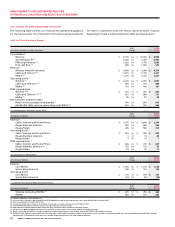

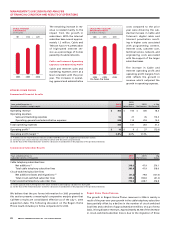

Wireless Operating Highlights for the Year Ended December 31, 2006

• Operating revenue increased by 18.7% to $4,580 million in 2006

from $3,860 million in 2005.

• Strong subscriber growth continued in 2006, with net postpaid

additions of 580,100 and net prepaid additions of 30,200.

• Postpaid subscriber monthly churn was 1.32%, the lowest in

Wireless’ history, compared to 1.61% in 2005.

• Postpaid monthly ARPU (average revenue per user) increased 5.8%

from 2005 to $67.27, aided by strong increases in wireless data

revenue.

• Revenues from wireless data services grew approximately 54.5%

year-over-year to $459 million in 2006 from $297 million in 2005,

and represented approximately 10.6% of network revenue com-

pared to 8.2% in 2005.

• Operating profit grew 47.3% year-over-year.

• The Fido integration was essentially completed entering 2006,

with the two GSM networks now fully integrated and all postpaid

and prepaid retail Fido subscribers migrated onto the Wireless

billing platforms.

• Wireless successfully launched its HSDPA network in the Golden

Horseshoe markets of Ontario. This next generation broadband

wireless technology, which Wireless continues to deploy across

other major markets, is the fastest mobile wireless data service

available in Canada.