Rogers 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

RO GER S CO MMU NIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

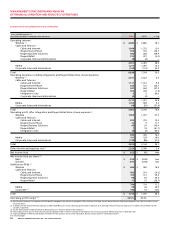

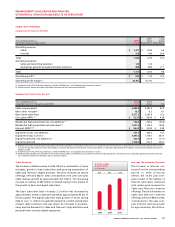

Summarized Wireless Su bscriber Results

Years ended December 31,

(Subscriber statistics in thousands, except ARPU, churn and usage) 2006 2005 Chg % Chg

Postpaid

Gross additions (1) 1,375.2 1,453.5 (78.3) (5.4)

Net additions (1) 580.1 603.1 (23.0) (3.8)

Total postpaid retail subscribers (1) 5,398.3 4,818.2 580.1 12.0

Average monthly revenue per user (“ARPU”) (2) $ 67.27 $ 63.56 $ 3.71 5.8

Average monthly usage (minutes) 545 503 42 8.3

Monthly churn 1.32% 1.61% (0.29%) (18.0)

Prepaid

Gross additions 615.4 576.5 38.9 6.7

Net additions (3) 30.2 15.7 14.5 92.4

Total prepaid retail subscribers 1,380.0 1,349.8 30.2 2.2

ARPU (2) $ 13.49 $ 13.20 $ 0.29 2.2

Monthly churn (3) 3.70% 3.54% 0.16% 4.5

(1) Total postpaid retail subscribers include approximately 31,000 subscribers acquired as part of the purchase of Call-Net Enterprises Inc. on July 1, 2005. These subscribers are not included in gross or net additions

for the year ended December 31, 2005.

(2) As defined. See the “Key Performance Indicators and Non-GAAP Measures” section.

(3) Effective November 9, 2004, the deactivation of prepaid subscribers acquired from Fido is recognized after 180 days of no usage to conform to the Wireless prepaid churn definition. This had the impact of

decreasing prepaid subscriber net losses by approximately 12,000 and reducing prepaid churn by 0.10% in the year ended December 31, 2005. There was no impact on the year ended December 31, 2006.

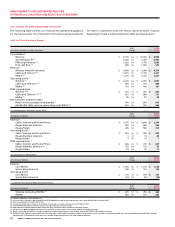

Wireless Net work Revenue

Network revenue of $4,313 mil-

lion accounted for 94.2% of

Wireless’ total revenues in

2006, and increased 19.3% from

2005. This increase was driven

by strong subscriber growth,

improved ARPU and higher

data revenues.

Net additions of postpaid voice

and data subscribers were

580,100 for 2006, compared to

603,100 in 2005. Prepaid sub-

scriber net additions were

30,200 for 2006, compared to

15,700 in 2005. Postpaid voice

and data ARPU was $67.27 for

the year ended 2006, a 5.8%

increase compared to 2005. ARPU has continued to benefit from

higher data, long distance and roaming revenues and an increase

in the penetration of optional services such as voicemail and caller

ID. As Canada’s only GSM-based provider, Wireless expects to con-

tinue to experience increases in outbound roaming revenues from

Wireless’ subscribers traveling outside of Canada, as well as strong

growth in inbound roaming revenues from travellers to Canada who

utilize Wireless’ network.

Data revenue grew by 54.5% year-over-year, to $459 million for the

year ended December 31, 2006. Data revenue represented approxi-

mately 10.6% of total network revenue in the year ended 2006,

compared to 8.2% in 2005, reflecting the continued rapid growth of

BlackBerry, wireless messaging,

mobile Internet access, down-

loadable ring tones, music,

games, and other wireless data

services and applications.

Prepaid ARPU was $13.49 for the

year ended 2006, an increase of

2.2% compared to 2005.

Monthly postpaid voice and

data subscriber churn decreased

to 1.32% in the year ended

December 31, 2006, from 1.61%

in the corresponding period of

2005, as a result of the contin-

ued trend toward multi-year

service contracts and Wireless’

proactive and targeted cus-

tomer retention activities as well as from the increased network

density and coverage quality resulting from the integration of the

Fido GSM network.

Monthly prepaid churn increased modestly to 3.70% for the year

ended December 31, 2006 from 3.54% in the corresponding period

of 2005.

Equipment Sales

Revenue from equipment sales for the year ended December 31,

2006, including activation fees and net of equipment subsidies,

was $267 million, up 8.5% from the corresponding period in 2005.

The year-over-year increase reflects the higher volume of handset

upgrades associated with subscriber retention programs combined

with the generally higher price points of more sophisticated hand-

sets and devices.

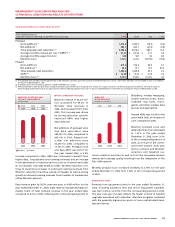

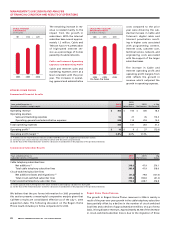

200620052004

WIRELESS POSTPAID AND

PREPAID SUBSCRIBERS

(In thousands)

5,3984,8184,184

1,3801,3501,334

Postpaid Prepaid

200620052004

$459$297$142

WIRELESS

DATA REVENUE

(In millions of dollars)