Rogers 2006 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 RO GER S COMM UNIC AT ION S IN C . 20 0 6 ANN UA L RE PORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

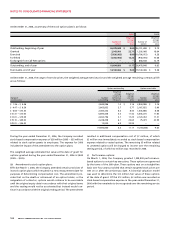

2006 2005

Current service cost (employer portion) $ 24 $ 15

Interest cost 32 29

Expected return on plan assets (33) (30)

Amortization:

Transitional asset (10) (10)

Realized gains included in income 1 1

Net actuarial loss 10 8

Net periodic pension cost $ 24 $ 13

Accrued benefit asset $ 34 $ 13

Accumulated other comprehensive income (loss) (97) 19

Net amount recognized in balance sheet $ (63) $ 32

In addition to the amounts disclosed above, under United States

GAAP, the accrued benefit liability related to the Company’s sup-

plemental unfunded pension benefits for certain executives was

$19 million (2005 – $16 million).

(R) RECENT UNITED STATES ACCOUNTING PRONOUNCEMENTS:

In December 2006, the Company adopted Staff Accounting Bulletin

No. 108, Considering the Effects of Prior Year Misstatements when

Quantifying Misstatements in Current Year Financial Statements

(“SAB 108”). SAB 108 clarifies the way that a company should eval-

uate identified unadjusted errors for materiality. The Company

elected, as allowed under SAB 108, to reflect the effect of initially

applying the guidance by adjusting the carrying amount of respec-

tive accounts at the beginning of 2006 and recording an offsetting

adjustment to the opening balance of deficit in 2006. Accordingly,

the Company recorded a cumulative adjustment to decrease deficit

by $28 million related to the accounting for financial instruments

under United States GAAP.

In November 2004, the FASB issued SFAS No. 151, Inventory Costs, an

amendment of ARB No. 43, Chapter 4 (“SFAS 151”). This statement

amends the guidance in ARB No. 43, Chapter 4, Inventory Pricing, to

clarify the accounting for abnormal amounts of idle facility expense,

freight, handling costs, and wasted material (spoilage). SFAS 151

requires that those items be recognized as current-period charges. In

addition, this statement requires that allocation of fixed production

overheads to costs of conversion be based upon the normal capacity

of the production facilities. The provisions of SFAS 151 were effective

for the Company on January 1, 2006. This revised standard did not

have a material impact on the results of the Company under United

States GAAP.

SFAS No. 153, Exchanges Of Non-Monetary Assets – an Amendment of

APB Opinion 29 (“SFAS 153”), was issued in December 2004. APB Opin ion

29 is based on the principle that exchanges of non-monetary assets

should be measured based on the fair value of assets exchanged.

SFAS 153 amends APB Opinion 29 to eliminate the exception for non-

monetary exchanges of similar productive assets and replaces it with

a general exception for exchanges of non-monetary assets that do

not have commercial substance. The standard was effective for the

Company for non-monetary asset exchanges occurring in fiscal 2006

and was applied prospectively. The revised standard did not have a

material impact on the results of the Company under United States

GAAP.

In June 2005, the FASB issued SFAS No. 154, Accounting Changes and

Error Corrections, a replacement of APB Opinion No. 20, Accounting

Changes (“Opinion 20”), and FASB Statement No. 3, Reporting

Accounting Changes in Interim Financial Statements (“SFAS 154”).

The Statement applies to all voluntary changes in accounting princi-

ple, and changes the requirements for accounting for and reporting

of a change in accounting principle. SFAS 154 requires retrospective

application to prior periods’ financial statements of a voluntary

change in accounting principle unless it is impracticable. SFAS 154

requires that a change in method of depreciation, amortization,

or depletion for long-lived, non-financial assets be accounted for

as a change in accounting estimate that is affected by a change in

accounting principle. Opinion 20 previously required that such a

change be reported as a change in accounting principle. SFAS 154

was effective for accounting changes and corrections of errors made

in fiscal years beginning after December 15, 2005. This standard did

not have a material impact on the results of the Company under

United States GAAP.

In June 2006, the FASB issued Interpretation No. 48, Accounting for

Uncertainty in Income Taxes, an Interpretation of SFAS 109. This

interpretation prescribes the measurement and recognition criteria

of a tax position taken or expected to be taken in a tax return. This

interpretation is effective for the Company beginning January 1,

2007. The Company is currently assessing the impact of this standard.

In September 2006, the FASB issued SFAS 157, Fair Value Measurements.

This new standard defines fair value, establishes a framework for

measuring fair value under generally accepted accounting principles

and expands disclosures about fair value measurements. This new

standard is effective for the Company beginning January 1, 2008.

The Company is currently assessing the impact of this standard.