Rogers 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 R OGE RS COM MUN I C ATIO NS I NC . 2 0 0 6 AN NUAL R EPO R T

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

loss carryforwards. Judgments and estimates made to assess the tax

treatment of items and the need for a valuation allowance impact

the future tax balances as well as net income through the current

and future tax provisions. As at December 31, 2006 and as detailed

in Note 7 to the 2006 Audited Consolidated Financial Statements we

have tax loss carryforwards of approximately $2,715 million expiring

at various times through 2027. Our net future income tax asset,

prior to valuation allowances, totals approximately $836 million at

December 31, 2006 (2005 – $1,078 million). The recorded valuation

allowance results in a future income tax asset of $686 million, reflect-

ing that it is more likely than not that certain income tax assets will

be realized. Approximately $300 million of the income tax assets rec-

ognized in 2006 relate to assets arising on acquisitions. Accordingly,

the benefit related to these assets was recorded as a reduction

of goodwill.

Pension Plans

When accounting for defined benefit pension plans, assumptions

are made in determining the valuation of benefit obligations and

the future performance of plan assets. Delayed recognition of dif-

ferences between actual results and expected or estimated results

is a guiding principle of pension accounting. This principle results in

recognition of changes in benefit obligations and plan performance

over the working lives of the employees receiving benefits under the

plan. The primary assumptions and estimates include the discount

rate, the expected return on plan assets and the rate of compensation

increase. Changes to these primary assumptions and estimates would

impact pension expense and the deferred pension asset.

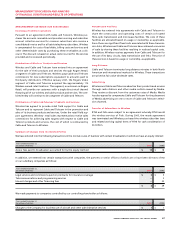

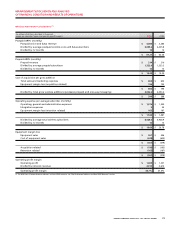

The following table illustrates the increase (decrease) in the accrued

benefit obligation and pension expense for changes in these primary

assumptions and estimates:

Impact of Changes in Pension Related Assumptions

Accrued Benefit Obligation at Pension Expense

(In millions of dollars) End of Fiscal 2006 Fiscal 2006

Discount rate 5.25% 5.25%

Impact of: 1% increase $ (82) $ (11)

1% decrease 115 16

Rate of compensation increase 3.50% 3.50%

Impact of: 0.25% increase $ 7 $ 2

0.25% decrease (7) (2)

Expected rate of return on assets N/A 6.75%

Impact of: 1% increase N/A (5)

1% decrease N/A 5

Allowance for Doubtful Account s

A significant portion of our revenue is earned from selling on credit

to individual consumers and business customers. The allowance for

doubtful accounts is calculated by taking into account factors such

as our historical collection and write-off experience, the number

of days the customer is past due and the status of the customer’s

account with respect to whether or not the customer is continuing

to receive service. As a result, fluctuations in the aging of subscriber

accounts will directly impact the reported amount of bad debt

expense. For example, events or circumstances that result in a dete-

rioration in the aging of subscriber accounts will in turn increase the

reported amount of bad debt expense. Conversely, as circumstances

improve and customer accounts are adjusted and brought current,

the reported bad debt expense will decline.

NEW ACCOUNTING STANDARDS

Stock- Based Compensatio n

In 2006, the Company adopted the provisions of Emerging Issues

Committee (“EIC”) Abstract 162, Stock-Based Compensation for

Employees Eligible to Retire Before the Vesting Date. Where a stock-

based compensation plan contains provisions that allow an employee

to continue vesting in a stock-based award after the employee has

retired, EIC 162 requires that the compensation cost attributable to

such an award be expensed immediately for employees who are

eligible to retire at the date of grant. For an employee who will

become eligible to retire during the vesting period of an award,

EIC 162 requires that compensation cost be recognized as an expense

over the period from the date of grant to the date the employee

becomes eligible to retire. EIC 162 must be applied retroactively to all

stock-based compensation awards, with restatement of prior peri-

ods. The adoption of EIC 162 resulted in an increase in the opening

2005 deficit and contributed surplus of $4 million and an increase in

2005 stock-based compensation of less than $1 million. For 2006, the

adoption of EIC 162 resulted in incremental stock-based compensa-

tion of less than $1 million from that which would otherwise have

been recorded.

Accounting Changes

In 2006, the CICA issued Handbook Section 1506, Accounting Changes

(“CICA 1506”). CICA 1506 prescribes the criteria for changing account-

ing policies, together with the accounting treatment and disclosure

of changes in accounting policies, changes in accounting estimates

and correction of errors. This new standard, to be adopted on

January 1, 2007, is not expected to have a material impact on the

Company’s consolidated financial statements.

Non-monetary Transactio ns

In 2005, the CICA issued Handbook Section 3831, Non-monetary

Transactions, (“CICA 3831”) replacing Section 3830, Non-monetary