Rogers 2006 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

RO GER S CO MMU NIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

in respect of LCT in 2006. The recovery of $5 million recorded in 2006

relates primarily to the reduction of certain amounts previously

accrued for income tax.

We recorded net future income tax expense in 2006 of $61 million.

Future income tax expense resulted primarily from the utilization of

non-capital loss carryforwards, the benefit of which had previously

been recognized, net of a reduction of the valuation allowance for

future income tax assets. Based on management’s assessment of the

expected realization of future income tax assets during 2006, we

reduced the valuation allowance recorded against certain future

income tax assets by $468 million to reflect that it is more likely than

not that the future income tax assets will be realized. Approximately

$300 million of the reduction in the valuation allowance related to

future income tax assets arising from acquisitions. Accordingly, the

benefit related to these assets has been reflected as a reduction of

goodwill in the amount of $209 million and a reduction of other

intangible assets in the amount of $91 million.

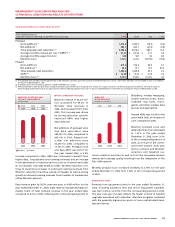

Net Income (Loss) and Earnings (Loss) per Share

We recorded net income of $622 million in 2006, or basic earnings per

share of $0.99 (diluted – $0.97), compared to a net loss of $45 million

or a basic and diluted loss per share of $0.08 in 2005. This increase in

net income was primarily due to the growth in operating profit as dis-

cussed above, as well as the decrease in interest on long-term debt.

EMPLOYEES

Employee remuneration represents a material portion of our

expenses. At December 31, 2006, we had approximately 22,500

full-time equivalent employees (“FTEs”) across all of our operating

groups, including our shared services organization and corporate

office, representing an increase of approximately 1,500 from the level

at December 31, 2005. The increase is primarily due to an increase

in our shared services, partially offset by reductions associated with

the integration of Call-Net during the year. Total remuneration paid

to employees (both full and part-time) in 2006 was approximately

$1,462 million, an increase of $241 million from $1,221 million in 2005.

BASIS OF PRO FORMA INFORMATION

Certain financial and operating data information and tables in this

MD&A has been prepared on a pro forma basis as if the acquisition of

Call-Net had occurred on January 1, 2004. Such information is based

on our historical financial statements, the historical financial state-

ments of Call-Net and the accounting for this business combination.

Although we believe this presentation provides certain relevant

contextual and comparative information for existing operations,

the unaudited pro forma consolidated financial and operating

data presented in this document is for illustrative purposes only

and does not purport to represent what the results of operations

actually would have been if the acquisition of Call-Net had occurred

on January 1, 2004, nor does it purport to project the results of oper-

ations for any future period.

This pro forma information reflects, among other things, adjust-

ments to Call-Net’s historically reported financial information to

conform to our accounting policies and the impacts of purchase

accounting. The pro forma adjustments are based upon certain esti-

mates and assumptions that we believe are reasonable. Accounting

policies used in the preparation of these statements are those dis-

closed in our 2006 Audited Consolidated Financial Statements and

Notes thereto.