Rogers 2006 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

RO GER S CO MMU NIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

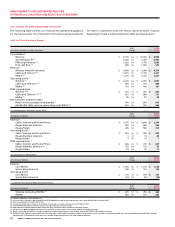

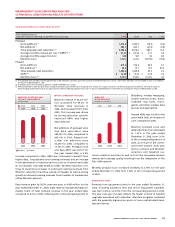

Our consolidated revenue was $8,838 million in 2006, an increase of

$1,504 million, or 20.5%, from $7,334 million in 2005. Of the increase,

Wireless contributed $720 million, Cable and Telecom $709 million,

and Media $113 million, offset by an increase in corporate items and

eliminations of $38 million.

Our consolidated operating profit was $2,875 million, an increase of

$731 million, or 34.1%, from $2,144 million in 2005. Of this increase,

Wireless contributed $632 million, Cable and Telecom contributed

$125 million, and Media contributed $23 million. Consolidated

operating profit as a percentage of operating revenue (“operating

profit margin”) increased to 32.5% in 2006 from 29.2% in 2005. On

a consolidated basis, we recorded net income of $622 million for

the year ended December 31, 2006, as compared to a net loss of

$45 million in 2005.

Refer to the respective individual segment discussions for details of

the revenue, operating expenses, operating profit and additions to

PP&E of Wireless, Cable and Telecom, and Media.

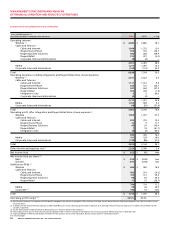

2006 Performance Against Targets

The following table sets forth the guidance ranges for selected full

year financial and operating metrics that we provided for 2006, as

revised during the year, versus the actual results we achieved for the

year. As indicated in the table, we either met or exceeded our oper-

ating and financial targets in all categories.

Ori gina l 2006 Gu idan ce Updates from 2006

(In millions of dollars, except subscribers) (At February 9, 2006) Original Guidance Actual

Revenue

Wireless (network revenue) $ 4,125 to $ 4,175 $ 4,125 to $ 4,300 $ 4,313

Cable and Telecom 3,110 to 3,185 3,110 to 3,217 3,201

Media 1,165 to 1,205 1,165 to 1,205 1,210

Operating profit (1)

Wireless (2) $ 1,730 to $ 1,780 $ 1,730 to $ 1,905 $ 1,997

Cable and Telecom (3) 825 to 860 825 to 877 899

Media 115 to 120 115 to 130 151

PP&E expenditures (4)

Wireless $ 600 to $ 650 $ 600 to $ 650 $ 624

Cable and Telecom 640 to 695 640 to 751 751

Net subscriber additions (000s)

Retail wireless postpaid and prepaid 525 to 575 525 to 575 610

Basic cable 0 to 10 0 to 10 13

Digital households 175 to 225 175 to 225 221

High-speed Internet 125 to 175 125 to 175 155

Residential cable telephony 200 to 250 200 to 300 318

Rogers Telecom integration $ 50 to $ 65 $ 50 to $ 65 $ 52

(1) Before RCI corporate expenses and management fees paid to RCI.

(2) Excludes operating losses related to the Inukshuk fixed wireless initiative and costs associated with the integration of Fido Solutions Inc. (“Fido”).

(3) Excludes costs associated with the integration of Call-Net.

(4) Does not include Corporate, Inukshuk or Media PP&E expenditures or the PP&E expenditures related to the Call-Net integration.