Rogers 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

RO GER S CO MMU NIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

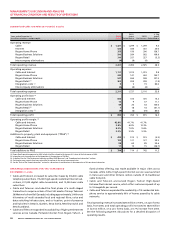

Media Operating Expenses

Operating expenses for 2006

increased by $90 million from

2005. The increase in Media

operat i n g e x p e n ses a r e

primarily due to higher base-

ball player payroll at Sports

Entertainment, increased pro-

gramming costs at Sportsnet

associated with World Cup

Soccer and the return of NHL

hockey after a lock-out during

the 2005 season, as well as costs

associated with Publishing’s

launch of the Canadian edition

of Hello! and Chocolat maga-

zines. Also, OMNI’s acquisition

of OMNI BC and launch of OMNI

Manitoba, the consolidation

of The Biography Channel Canada and G4TechTV Canada, as well

as Radio’s launch of three maritime stations in the fourth quarter of

2005 led to increased costs. Higher sales volumes resulted in higher

cost of sales at The Shopping Channel. These cost increases were par-

tially offset by lower general and administrative costs.

Media Operating Profit

Operating profit for 2006

increased $23 million over

2005, and the operating profit

margin was 12.5% compared

to 11.7% in 2005. The changes

discussed above drove the year-

over-year increases in Media’s

operating profit, as well as the

corresponding increase in oper-

ating profit margins.

Additions to Media PP&E

Total additions to Media’s PP&E

in 2006 were $48 million, com-

pared to $40 million in 2005.

The increase in 2006 was pri-

marily due to enhancements

and renovations at the Rogers Centre sports and entertainment

venue in Toronto.

3 CONSOLIDATE D LI QUIDITY AND FIN ANCING

LIQUIDIT Y AND CAPITAL RESOURCES

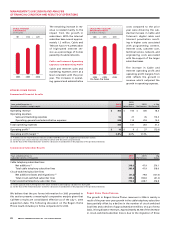

Operations

For 2006, cash generated from operations before changes in non-

cash operating items, which is calculated by adjusting to remove the

effect of all non-cash items from net income, increased to $2,386 mil-

lion from $1,551 million in 2005. The $835 million increase is primarily

the result of the increase in operating profit of $731 million and the

decrease in interest expense of $79 million.

Taking into account the

changes in non-cash working

capital items for the year

ended December 31, 2006, cash

generated from operations

was $2,461 million, compared

to $1,253 million in 2005.

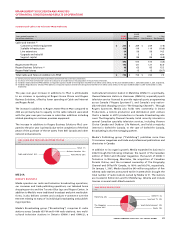

The cash flow generated from

operations of $2,461 million,

together with the following

items, resulted in total net funds

of approximately $2,537 mil-

lion raised in the year ended

December 31, 2006:

• Receipt of $74 million from

the issuance of Class B Non-

Voting shares under the exercise of employee stock options; and

• Addition of $2 million of cash on hand as a result of acquisitions.

Net funds used during 2006 totalled approximately $2,452 million,

the details of which include:

• Additions to PP&E of $1,578 million, net of $134 million related

changes in non-cash working capital;

• $160 million for the repayment at maturity of Wireless’ $160 mil-

lion 10.5% Senior Secured Notes;

• An aggregate net repayment of $452 million of outstanding

advances under our bank credit facilities;

• $75 million for the repayment at maturity of RCI’s 10.50% Senior

Notes;

• $26 million to fund the redemption of our U.S. $22 million remain-

ing outstanding amount of RCI’s (via RTHI, formerly Call-Net

Enterprises Inc.) 10.625% Senior Secured Notes due 2008;

• An aggregate $25 million net repayment of mortgage and capital

leases;

• The payment of an aggregate $20 million on termination of cross-

currency interest rate exchange agreements;

• The payment of dividends of $47 million on our Class A Voting and

Class B Non-Voting shares;

• Additions to program rights of $32 million; and

• Other acquisitions and net investments of $37 million, including

the final phase of an acquisition of certain CLEC assets.

Taking into account the $104 million cash deficiency at the beginning

of the year, the cash deficiency at December 31, 2006 was $19 million.

Financing

Our long-term debt is described in Note 15 to the 2006 Audited

Consolidated Financial Statements.

During 2006, the following financing activities took place. An aggre-

gate $738 million of debt was repaid consisting of: $452 million of

outstanding advances under our bank credit facilities; $160 million

aggregate principal amount at maturity on June 1, 2006 of Wireless’

10.50% Senior Secured Notes due 2006; $75 million aggregate princi-

pal amount at maturity on February 14, 2006 of RCI’s 10.50% Senior

Notes due 2006; $26 million (U.S. $22 million) aggregate principal

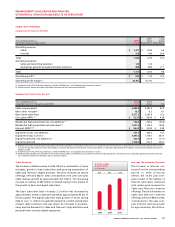

200620052004

$1,210$1,097$957

MEDIA

REVENUE

(In millions of dollars)

200620052004

$151$128$115

MEDIA

OPERATING PROFIT

(In millions of dollars)

200620052004

$2,386$1,551$1,305

CONSOLIDATED CASH FLOW

FROM OPERATIONS

(In millions of dollars)