Rogers 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

RO GER S CO MMU NIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(d) Assumptions:

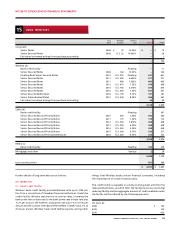

The fair values of options granted or amended during 2006 and 2005 were based on the following assumptions:

2006 2005

Risk-free interest rate 3.94% – 4.47% 4.00%

Dividend yield 0.27% – 0.48% 0.27%

Volatility factor of the future expected market prices of Class B Non-Voting shares 35.46% – 42.30% 42.30%

Weighted average expected life of the options 4.8 – 5.6 years 5.4 years

units. During the year ended December 31, 2006, the Company

granted 73,353 directors’ deferred share units (2005 – 42,271). At

December 31, 2006, 263,291 (2005 – 265,396) directors’ deferred share

units were outstanding. Stock-based compensation expense for the

year ended December 31, 2006 related to these directors’ deferred

share units was $5 million (2005 – $3 million). There is no unrecog-

nized compensation related to directors’ deferred share units since

these awards vest immediately when granted.

(iv) Employee share accumulation plan:

The employee share accumulation plan allows employees to volun-

tarily participate in a share purchase plan. Under the terms of the

plan, employees of the Company can contribute a specified percent-

age of their regular earnings through regular payroll deductions.

The designated administrator of the plan then purchases, on a

monthly basis, Class B Non-Voting shares of the Company on the

open mar ket on behalf of the employee. At the end of each quarter,

the Company makes a contribution of 25% of the employee’s con-

tribution in the quarter. The administrator then uses this amount

to purchase additional shares of the Company on behalf of the

employee, as outlined above.

Compensation expense amounted to $4 million for the year ended

December 31, 2006 (2005 – $3 million).

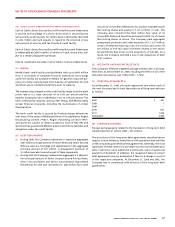

(ii) Restric ted share unit plan:

The restricted share unit plan enables employees, officers and direc-

tors of the Company to participate in the growth and development

of the Company. Under the terms of the plan, restricted share units

are issued to the participant and the units issued vest over a period

not to exceed three years from the grant date.

On the vesting date, the Company, at its option, shall redeem all

of the participants’ restricted share units in cash or by issuing one

Class B Non-Voting share for each restricted share unit. The Company

has reserved 4,000,000 Class B Non-Voting shares for issuance under

this plan.

During the year ended December 31, 2006, the Company granted

506,964 restricted share units (2005 – 506,402). At December 31,

2006, 1,037,668 (2005 – 595,534) restricted share units were outstand-

ing. These restricted share units vest at the end of three years from

the grant date. Stock-based compensation expense for the year

ended December 31, 2006 related to these restricted share units was

$12 million (2005 – $4 million). Unrecognized stock-based compen-

sation expense as at December 31, 2006 related to these restricted

share units was $20 million (2005 – $9 million).

(iii) Directors’ deferred share unit plan:

The directors’ deferred share unit plan enables directors of the

Company to elect to receive their remuneration in deferred share

21 CONSOLIDATED STATEMENTS OF CASH FLOWS

AND SUPPLEMENTAL INFORMATION

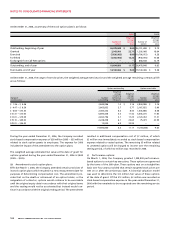

(A) CHANGE IN NON-C ASH WORKING C APITAL ITEMS:

2006 2005

Increase in accounts receivable $ (198) $ (183)

Increase (decrease) in accounts payable and accrued liabilities 243 (61)

Increase in unearned revenue 51 16

Increase in deferred charges and other assets (21) (70)

$ 75 $ (298)

(B) SUPPLEMENTAL C ASH FLOW INFORMATION:

2006 2005

Income taxes paid $ 5 $ 16

Interest paid 650 706