Rogers 2006 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90 R OGE RS COM MUNI C ATIO N S I N C . 2 0 0 6 AN NUAL R EPOR T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

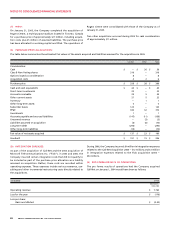

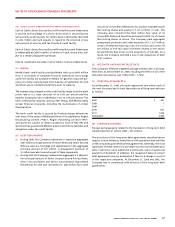

to its internal income forecasts. Based on management’s estimates of

the expected realization of future income tax assets, during 2006 the

Company reduced the valuation allowance to reflect that it is more

likely than not that certain future income tax assets will be realized.

Approximately $300 million of the reduction in the valuation allow-

ance related to future income tax assets arising from acquisitions.

Accordingly, the benefit related to these assets has been reflected

as a reduction of goodwill in the amount of $209 million and other

intangible assets in the amount of $91 million.

The valuation allowance at December 31, 2006 includes $70 million

of future income tax assets relating to foreign non-capital loss carry-

forwards and $80 million of future income tax assets relating to

capital losses and similar items.

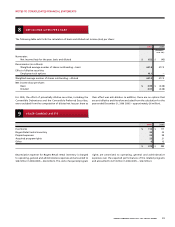

In 2000, the Company received a $241 million payment (the

“Termination Payment”) from Le Group Vidéotron Ltée (“Vidéotron”)

in respect of the termination of a merger agreement between the

Company and Vidéotron. The Canada Revenue Agency (“CRA”)

disagreed with the Company’s tax filing position in respect of

the Termination Payment and in May 2006, issued a Notice of

Reassessment. The Company has negotiated a settlement with the

CRA which resulted in a $67 million reduction to the non-capital

income tax losses carried forward by the Company. As a result, a

corresponding future income tax charge of $25 million was recorded

for 2006.

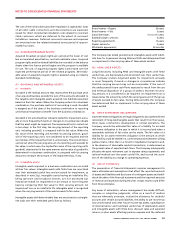

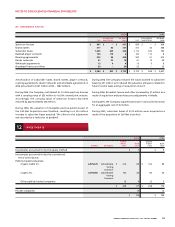

Income tax expense varies from the amounts that would be com-

puted by applying the statutory income tax rate to income (loss)

before income taxes for the following reasons:

As at December 31, 2006, the Company had approximately $127 mil-

lion in non-capital income tax losses available in foreign subsidiaries

expiring between 2021 and 2026.

As at December 31, 2006, the Company had approximately $131 mil-

lion in capital losses available.

2006 2005

Statutory income tax rate 35.8% 36.1%

Income tax expense (reduction) on income (loss) before income taxes $ 243 $ (16)

Increase (decrease) in income taxes resulting from:

Difference between rates applicable to subsidiaries in other jurisdictions (12) 1

Change in the valuation allowance for future income tax assets (168) 11

Adjustments to future income tax assets and liabilities for changes in substantively enacted rates (14) (23)

Stock-based compensation 15 14

Large Corporations Tax – 10

Other items (8) 5

Income tax expense $ 56 $ 2

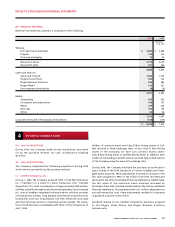

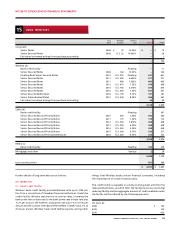

As at December 31, 2006, the Company has the following non-capital income tax losses available to reduce future years‘ income for income

tax purposes:

Income tax losses expiring in the year ending December 31:

2007 $ 156

2008 668

2009 229

2010 183

2011 –

Thereafter 1,479

$ 2,715