Rogers 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

RO GER S CO MMU NIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

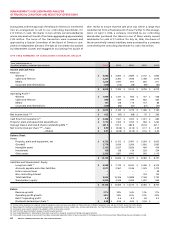

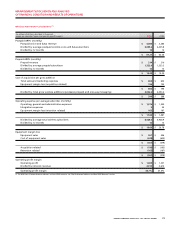

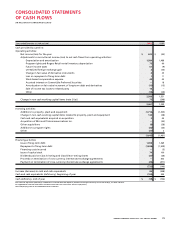

2005 Quarterly Consolidated Financial Summar y

2005

(In millions of dollars, except per share amounts) Q1 Q2 Q3 Q4

Operating revenue

Wireless (1) $ 851 $ 933 $ 1,026 $ 1,050

Cable and Telecom 505 500 726 761

Media 219 293 285 300

Corporate and eliminations (17) (25) (33) (40)

1,558 1,701 2,004 2,071

Operating profit (2)

Wireless 298 364 383 292

Cable and Telecom 181 172 195 217

Media 12 44 33 39

Corporate and eliminations (15) (15) (22) (34)

476 565 589 514

Depreciation and amortization (3) 344 362 379 404

Operating income 132 203 210 110

Interest on long-term debt (3) (183) (177) (176) (163)

Other income (expense) 8 (3) 18 (22)

Income tax reduction (expense) (3) (4) (3) 8

Net income (loss) for the period $ (46) $ 19 $ 49 $ (67)

Net income (loss) per share (4) – basic $ (0.09) $ 0.04 $ 0.08 $ (0.11)

– diluted $ (0.09) $ 0.04 $ 0.08 $ (0.11)

Operating profit margin % (2) 31% 33% 29% 25%

Additions to PP&E (2) $ 260 $ 345 $ 319 $ 431

(1) Certain current and prior year amounts related to equipment sales have been reclassified. See “Reclassification of Wireless Equipment Sales and Cost of Sales” section for further details.

(2) As defined in “Key Performance Indicators Non-GAAP Measures” section.

(3) Certain prior year amounts have been reclassified to conform to the current year presentation.

(4) Prior period per share amounts have been retroactively adjusted to reflect a two-for-one split of the Company’s Class A Voting and Class B Non-Voting shares on December 29, 2006.

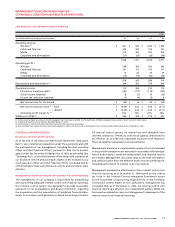

All internal control systems, no matter how well designed, have

inherent limitations. Therefore, even those systems determined to

be effective can provide only reasonable assurance with respect to

financial statement preparation and presentation.

Management maintains a comprehensive system of controls intended

to ensure that transactions are executed in accordance with manage-

ment’s authorization, assets are safeguarded, and financial records

are reliable. Management also takes steps to see that information

and communication flows are effective and to monitor performance,

including performance of internal control procedures.

Management assessed the effectiveness of our internal control over

financial reporting as of December 31, 2006 based on the criteria

set forth in the Internal Control-Integrated Framework issued

by the Committee of Sponsoring Organizations of the Treadway

Commission (COSO). Based on this assessment, management has

concluded that, as of December 31, 2006, our internal control over

financial reporting is effective. Our independent auditor, KPMG LLP,

has issued an attestation report on Management’s assessment of the

internal control over financial reporting.

CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

As of the end of the period covered by this report (the “Evaluation

Date”), we conducted an evaluation (under the supervision and with

the participation of our management, including the chief executive

officer and chief financial officer), pursuant to Rule 13a-15 promul-

gated under the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), of the effectiveness of the design and operation of

our disclosure controls and procedures. Based on this evaluation, our

chief executive officer and chief financial officer concluded that as

of the Evaluation Date such disclosure controls and procedures were

effective.

Management ’s Repor t on Internal Control Over Financial Reporting

The management of our company is responsible for establishing

and maintaining adequate internal control over financial reporting.

Our internal control system was designed to provide reasonable

assurance to our management and Board of Directors regarding

the preparation and fair presentation of published financial state-

ments in accordance with generally accepted accounting principles.