Rogers 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 ROG ERS CO MMU N ICAT ION S IN C . 20 0 6 ANN UA L RE PORT

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Fido’s wireless network was also a GSM-based network operating

on the 1900 MHz frequency band. During 2005, Wireless completed

the process of integrating the Rogers Wireless and Fido GSM/GPRS

networks. This network integration enabled Wireless to increase the

density and quality of its wireless coverage while also reducing costs

through the elimination of redundant cell sites and other network

facilities.

Including the acquired Fido spectrum, Wireless holds 25 MHz of

contiguous spectrum across Canada in the 850 frequency range

and 60 MHz in the 1900 frequency range across the country with

the exception of Southwestern Ontario, Northern Quebec, and the

Yukon, Northwest and Nunavut territories where Wireless holds

50 MHz in the 1900 frequency range.

Wireless also holds certain broadband fixed wireless spectrum in the

2300 MHz, 2500 MHz and 3500 MHz frequency ranges. In September

2005, Wireless, together with Bell Canada, announced the formation

of an equally-owned joint venture called Inukshuk to construct a

pan-Canadian wireless broadband network that will be based on the

evolving World Interoperability for Microwave Access (“WiMAX”)

standards. Both companies have contributed fixed wireless spectrum

holdings to the joint venture, along with access to their respective

cellular towers and network backhaul facilities. The fixed wireless

network acts as a wholesale provider of capacity to each of the joint

venture partners who in turn market, sell, support and bill for their

respective service offerings over the network.

WIRELESS STRATEGY

Wireless’ goal is to drive profitable subscriber and revenue growth

within the Canadian wireless communications industry, and its strat-

egy is designed to maximize cash flow and return on invested capital.

The key elements of its strategy are as follows:

• Enhancing its scale and competitive position in the Canadian wire-

less communications market;

• Focusing on voice and data services that are attractive to youth,

families, and small and medium-sized businesses to optimize its

customer mix;

• Delivering on customer expectations by improving handset reli-

ability, network quality and customer service while reducing

subscriber deactivations, or churn;

• Increasing revenue from existing customers by utilizing analytical

tools to target customers likely to purchase optional services such

as voicemail, caller line ID, text messaging and wireless Internet;

• Enhancing sales distribution channels to increase focus on targeted

customer segments;

• Maintaining the most technologically advanced, high quality and

pervasive wireless network possible; and

• Leveraging relationships across the Rogers group of companies to

provide bundled product and service offerings at attractive prices,

in addition to implementing cross-selling, joint sales distribution

initiatives, and infrastructure sharing initiatives.

RECENT WIRELESS INDUSTRY

TRENDS

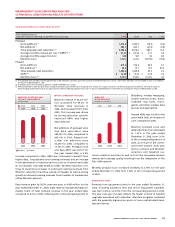

Focus on Cu stomer Retention

The wireless communications

industry’s current market

pene tration in Canada is

approximately 57% of the

population, compared to

approximately 75% in the U.S.

and approximately 115% in the

United Kingdom, and Wireless

expects the Canadian wire-

less industry to continue to

grow by approximately 4 to

5 percentage points of pen-

etration each year. This deeper

penetration drives a need for

increased focus on customer

satisfaction, the promotion of

new data and voice services

and features and customer

retention. As discussed below,

the Canadian Radio-television

and Tele c o mmun i c atio n s

Commission (“CRTC”) is imple-

menting Wireless Number

Portability (“WNP”) which will

result in customer satisfaction

and retention becoming even

more critical over time.

Demand for Sophisticated

Data Applic ations

The ongoing development

of wireless data transmission

technologies has led develop-

ers of wireless devices, such as

handsets and other hand-held

devices, to develop more sophis-

ticated wireless devices with

increasingly advanced capabili-

ties, including access to e-mail

and other corporate informa-

tion technology platforms,

news, sports, financial infor-

mation and services, shopping

services, photos, music, and

streaming video clips, mobile

television, and other functions.

Wireless believes that the

introduction of such new appli-

cations will drive the growth

for data transmission services.

As a result, wireless providers will likely continue to upgrade their

wireless networks to be able to offer the data transmission capabili-

ties required by these new applications.

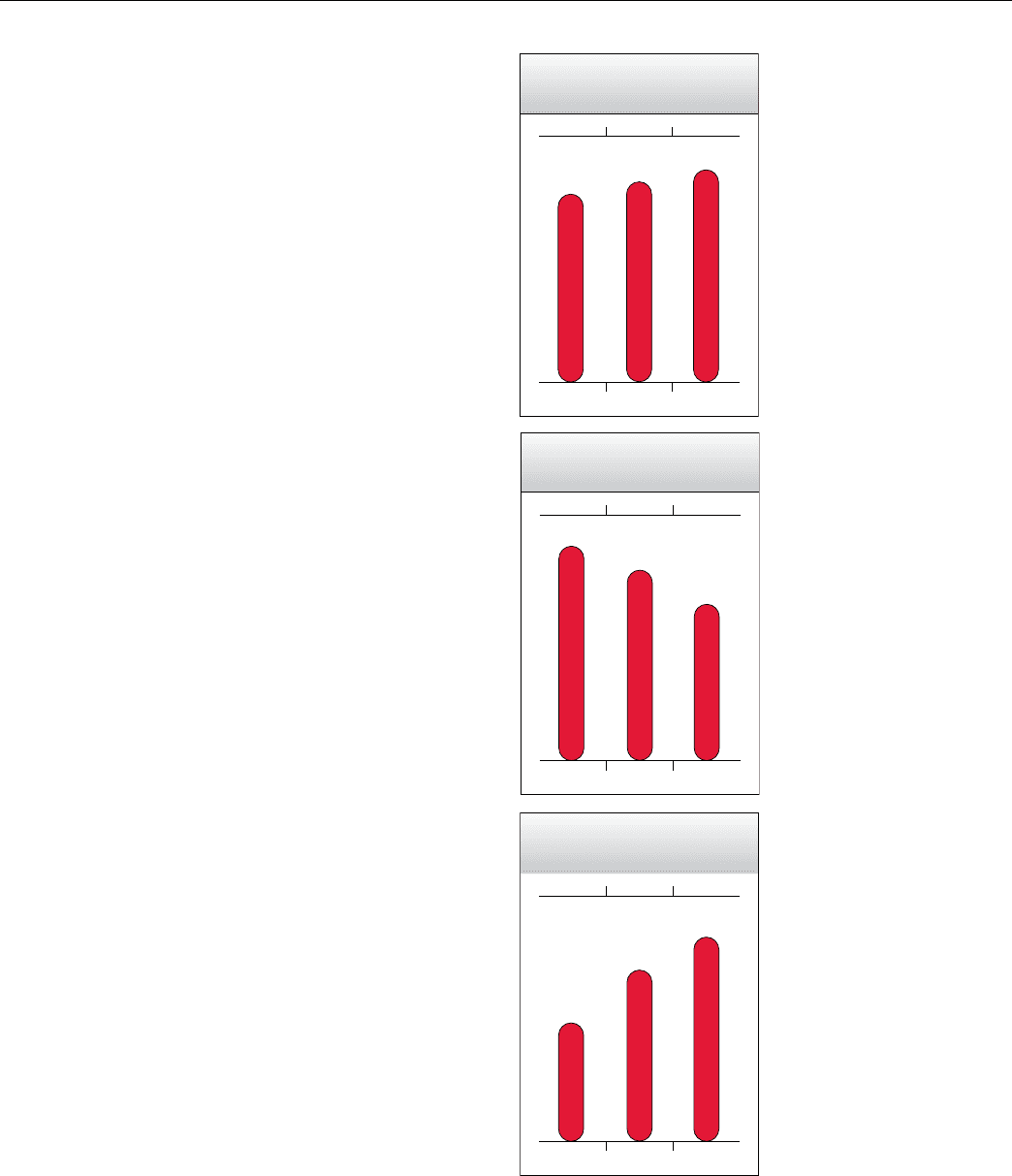

200620052004

$67.27$63.56$59.50

WIRELESS POSTPAID

MONTHLY ARPU

($)

200620052004

1.32%1.61%1.81%

WIRELESS POSTPAID

MONTHLY CHURN

(%)

200620052004

$4,313$3,614$2,502

WIRELESS NETWORK

REVENUE

(In millions of dollars)