Rogers 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 R OGE RS COM MUN I C ATIO NS I NC . 2 0 0 6 AN NUAL R EPO R T

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

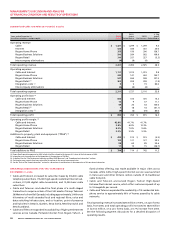

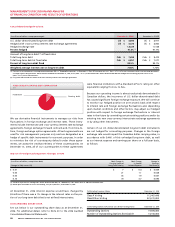

Con solidated Hedged Position

(In millions of dollars, except percentages) December 31, 2006 December 31, 2005

U.S. dollar-denominated long-term debt US $ 4,895 US $ 4,917

Hedged with cross-currency interest rate exchange agreements US $ 4,475 US $ 4,802

Hedged exchange rate 1.3229 1.3148

Percent hedged 91.4% (1) 97.7%

Amount of long-term debt (2) at fixed rates:

Total long-term debt Cdn $ 7,658 Cdn $ 8,410

Total long-term debt at fixed rates Cdn $ 6,851 Cdn $ 7,077

Percent of long-term debt fixed 89.5% 84.1%

Weighted average interest rate on long-term debt 7.98% 7.76%

(1) Pursuant to the requirements for hedge accounting under AcG-13, “Hedging Relationships”, at December 31, 2006, RCI accounted for 93.6% (2005 – 87.3%) of its cross-currency interest rate exchange agreements

as hedges against designated U.S. dollar-denominated debt. At December 31, 2006, 85.6% (2005 – 85.2%) of consolidated U.S. dollar-denominated debt was hedged for accounting purposes versus 91.4%

(2005 – 97.7%) on an economic basis.

(2) Long-term debt includes the effect of the cross-currency interest rate exchange agreements.

were financial institutions with a Standard & Poor’s rating (or other

equivalent) ranging from A+ to AA+.

Because our operating income is almost exclusively denominated in

Canadian dollars, the incurrence of U.S. dollar-denominated debt

has caused significant foreign exchange exposure. We will continue

to monitor our hedged position on an economic basis with respect

to interest rate and foreign exchange fluctuations and, depending

upon market conditions and other factors, may adjust our hedged

position with respect to foreign exchange fluctuations or interest

rates in the future by unwinding certain existing positions and/or by

entering into new cross-currency interest rate exchange agreements

or by using other instruments.

Certain of our U.S. dollar-denominated long-term debt instruments

are not hedged for accounting purposes. Changes in the foreign

exchange rate would impact the Canadian dollar carrying value, in

accordance with GAAP, of this unhedged long-term debt, as well

as our interest expense and earnings per share on a full-year basis,

as follows:

We use derivative financial instruments to manage our risks from

fluctuations in foreign exchange and interest rates. These instru-

ments include interest rate and cross-currency interest rate exchange

agreements, foreign exchange forward contracts and, from time-to-

time, foreign exchange option agreements. All such agreements are

used for risk management purposes only and are designated as a

hedge of specific debt instruments for economic purposes. In order

to minimize the risk of counterparty default under these agree-

ments, we assess the creditworthiness of these counterparties. At

December 31, 2006, all of our counterparties to these agreements

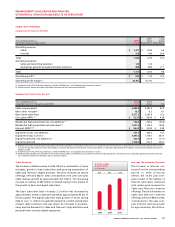

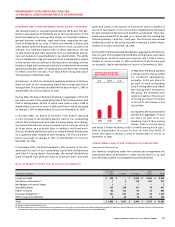

Impact of Foreign Exchange Rate Changes on EPS

(In millions of dollars, except share data) Cdn$ Change in Cdn$ Change Change in

Carrying Value of in Annual Earnings

Change in Cdn$ versus US$ Long-Term Debt (1) Interest Expense Per Share (2)

$ 0.01 $ 7 $ 0.4 $ 0.009

0.03 21 1.1 0.028

0.05 35 1.9 0.047

0.10 70 3.7 0.094

(1) Canadian equivalent of unhedged U.S. dollar-denominated debt, on a GAAP basis, if U.S. dollar costs an additional Canadian cent.

(2) Based upon the number of shares outstanding, on a post-split basis, at December 31, 2006.

At December 31, 2006 interest expense would have changed by

$8 million if there was a 1% change in the interest rates on the por-

tion of our long-term debt that is not at fixed interest rates.

OUTSTANDING SHARE DATA

Set out below is our outstanding share data as at December 31,

2006. For additional detail, refer to Note 20 to the 2006 Audited

Consolidated Financial Statements.

Outstanding Common Shares December 31, 2006

Class A Voting 112,467,648

Class B Non-Voting 523,231,804

Outstanding Options to Purchase Class B Non-Voting Shares December 31, 2006

Outstanding Options 19,694,860

Number of Outstanding Options Exercisable 14,160,866

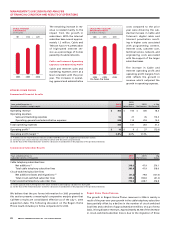

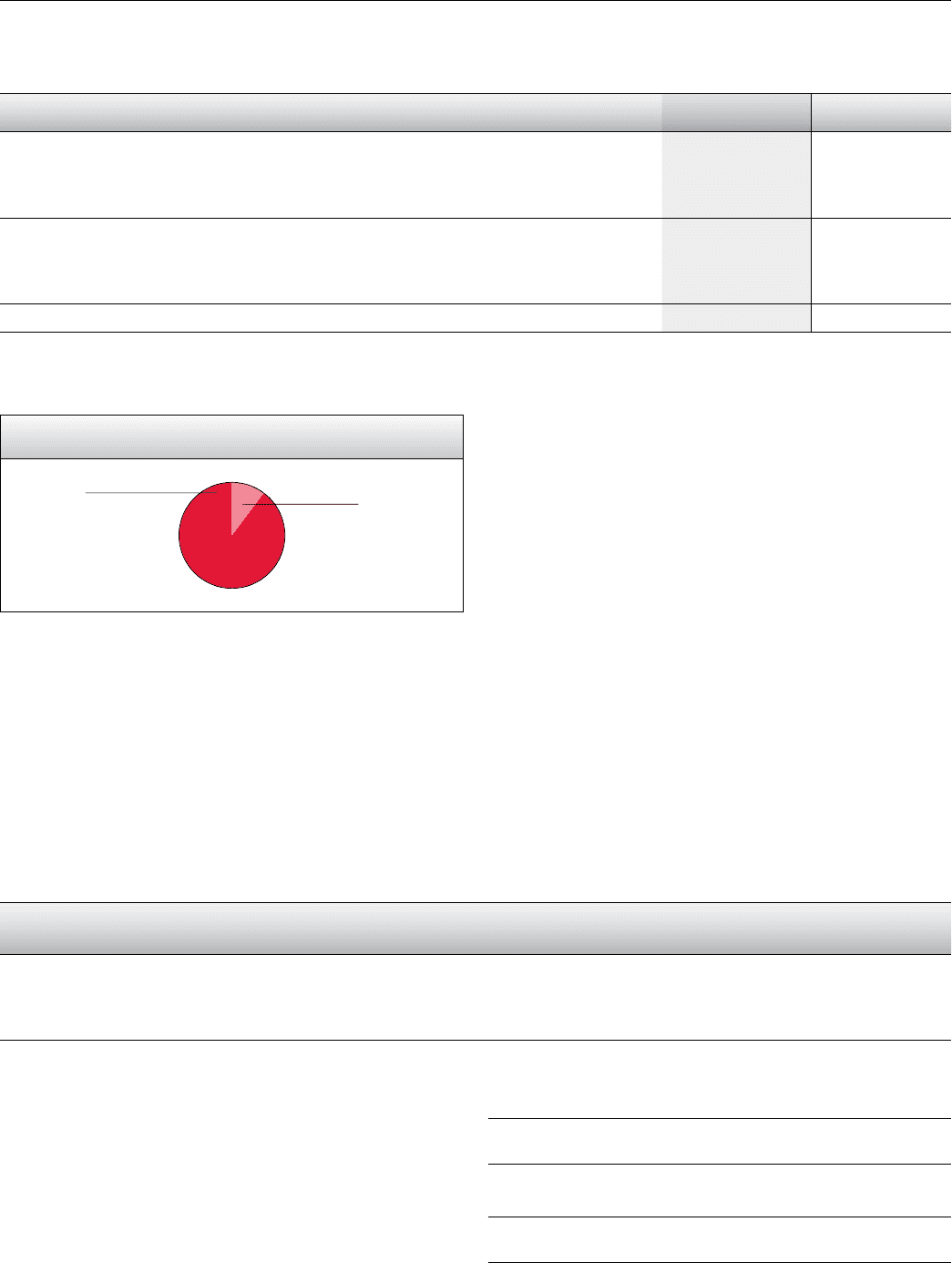

FIXED VERSUS FLOATING DEBT COMPOSITION

(%)

Fixed 89.5%

Floating 10.5%