Rogers 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 ROG ERS COM MUN IC AT I ONS INC . 2006 A NNUAL REP ORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Depreciation expense for Rogers Retail rental inventory is charged

to operating, general and administrative expenses. Depreciation for

PP&E is charged to depreciation and amortization expense.

(G) INCOME TA XES:

Future income tax assets and liabilities are recognized for the future

income tax consequences attributable to differences between the

financial statement carrying amounts of existing assets and liabilities

and their respective tax bases. Future income tax assets and liabilities

are measured using enacted or substantively enacted tax rates

expected to apply to taxable income in the years in which those

temporary differences are expected to be recovered or settled. A

valuation allowance is recorded against any future income tax asset

if it is not more likely than not that the asset will be realized. Income

tax expense is generally the sum of the Company’s provision for cur-

rent income taxes and the difference between opening and ending

balances of future income tax assets and liabilities.

(H) FOREIGN CURRENCY TR ANSL ATION:

Monetary assets and liabilities denominated in a foreign currency

are translated into Canadian dollars at the exchange rate in effect

at the balance sheet dates and non-monetary assets and liabilities

and related depreciation and amortization expenses are translated

at the historical exchange rate. Revenue and expenses, other than

depreciation and amortization, are translated at the average rate

for the month in which the transaction was recorded. Exchange

gains or losses on translating long-term debt are recognized in the

consolidated statements of income. Foreign exchange gains are

primarily related to the translation of long-term debt.

(I) DERIVATIVE INSTRUMENTS:

The Company uses derivative financial instruments to manage risks

from fluctuations in exchange rates and interest rates. These instru-

ments include cross-currency interest rate exchange agreements,

interest rate exchange agreements, foreign exchange forward con-

tracts and, from time to time, foreign exchange option agreements.

All such instruments are only used for risk management purposes.

The Company formally documents the relationship between deriva-

tive instruments and the hedged items, as well as its risk management

objective and strategy for undertaking various hedge transactions.

At the instrument’s inception, the Company also formally assesses

whether the derivatives are highly effective at reducing or modifying

currency risk related to the future anticipated interest and principal

cash outflows associated with the hedged item. Effectiveness requires

a high correlation of changes in fair values or cash flows between the

hedged item and the hedging item. On a quarterly basis, the Company

confirms that the derivative instruments continue to be highly effec-

tive at reducing or modifying interest rate or foreign exchange risk

associated with the hedged items. Derivative instruments that meet

these criteria are carried at their intrinsic value.

For those instruments that do not meet the above criteria, variations

in their fair value are marked-to-market on a current basis, with the

resulting gains or losses recorded in or charged against income.

(J) NET INCOME (LOSS) PER SHARE:

The Company uses the treasury stock method for calculating diluted

net income (loss) per share. The diluted net income (loss) per share

calculation considers the impact of employee stock options and

other potentially dilutive instruments, as described in note 8.

(K) INVENTORIES:

Inventories are primarily valued at the lower of cost, on a first-in,

first-out basis, and net realizable value. Rogers Retail rental inven-

tory, which includes videocassettes, DVDs and video games, is

depreciated to its estimated residual value. The residual value of

Rogers Retail rental inventory is recorded as a charge to operating

expense upon the sale of Rogers Retail rental inventory. Depreciation

of Rogers Retail rental inventory is charged to operating, general

and administrative expenses on a diminishing-balance basis over a

six-month period.

(L) DEFERRED CHARGES:

The costs of obtaining bank and other debt financing are deferred

and amortized on a straight-line basis over the life of the debt to

which they relate.

During the development and pre-operating phases of new products

and businesses, related incremental costs are deferred and amortized

on a straight-line basis over periods of up to five years.

(M) PENSION BENEFITS:

The Company accrues its pension plan obligations as employees render

the services necessary to earn the pension. The Company uses the

current settlement discount rate to measure the accrued pension

benefit obligation and uses the corridor method to amortize actu-

arial gains or losses (such as changes in actuarial assumptions and

experience gains or losses) over the average remaining service life of

the employees. Under the corridor method, amortization is recorded

only if the accumulated net actuarial gains or losses exceed 10% of

the greater of accrued pension benefit obligation and the fair value

of the plan assets at the beginning of the year.

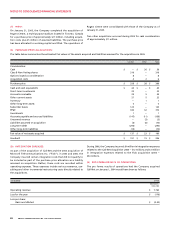

The Company uses the following methods and assumptions for pen-

sion accounting:

(i) The cost of pensions is actuarially determined using the pro-

jected benefit method prorated on service and management’s

best estimate of expected plan investment performance, salary

escalation, compensation levels at the time of retirement and

retirement ages of employees. Changes in these assumptions

would impact future pension expense.

(ii) For the purpose of calculating the expected return on plan

assets, those assets are valued at fair value.

(iii) Past service costs from plan amendments are amortized on a

straight-line basis over the average remaining service period of

employees.

(N) PROPERT Y, PL ANT AND EQUIPMENT:

PP&E are recorded at cost. During construction of new assets, direct

costs plus a portion of applicable overhead costs are capitalized.

Repairs and maintenance expenditures are charged to operating

expenses as incurred.