Rogers 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 ROG E RS COM MUN I C ATIO NS I NC. 2 0 0 6 A N NUAL R EPO R T

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

5 ACCO UNTI NG POLICIES AND NON-GAAP

ME ASUR ES

KEY PERFORMANCE INDICATORS AND NON- GAAP MEASURES

We measure the success of our strategies using a number of key per-

formance indicators, which are outlined below. The following key

performance indicators are not measurements in accordance with

Canadian or U.S. GAAP and should not be considered as an alter-

native to net income or any other measure of performance under

Canadian or U.S. GAAP.

Subscriber Counts

We determine the number of subscribers to our services based on

active subscribers. A wireless subscriber is represented by each iden-

tifiable telephone number. A cable subscriber is represented by

a dwelling unit. In the case of multiple units in one dwelling, such

as an apartment building, each tenant with cable service, whether

invoiced individually or having services included in his or her rent, is

counted as one subscriber. Commercial or institutional units, such as

hospitals or hotels, are each considered to be one subscriber. When

subscribers are deactivated, either voluntarily or involuntarily for

non-payment, they are considered to be deactivations in the period

the services are discontinued. Wireless prepaid subscribers are con-

sidered active for a period of 180 days from the date of their last

revenue-generating usage.

We report wireless subscribers in two categories: postpaid and pre-

paid. Postpaid includes voice-only and data-only subscribers, as well

as subscribers with service plans integrating both voice and data.

Internet, Rogers Home Phone and Rogers Business Solutions subscrib-

ers include only those subscribers with service installed, operating

and on billing and excludes those subscribers who have subscribed to

the service but for whom installation of the service was still pending.

Effective August 2005, voluntarily deactivating cable subscribers are

required to continue service for 30 days from the date termination

is requested. This continued service period, which is consistent with

the billing and subscriber agreement terms and conditions, had the

impact of increasing net basic cable, Internet and digital household

subscriber net additions by approximately 9,500, 5,200 and 3,800,

respectively, in the twelve months ended December 31, 2005.

Subscriber Churn

Subscriber churn is calculated on a monthly basis. For any particular

month, subscriber churn for Wireless represents the number of sub-

scribers deactivating in the month divided by the aggregate number

of subscribers at the beginning of the month. When used or reported

for a period greater than one month, subscriber churn represents

the monthly average of the subscriber churn for the period.

Net work Revenu e

Network revenue, used in the Wireless segment, represents total

Wireless revenue less revenue received from the sale of hand-

set equipment. The sale of such equipment does not materially

affect our operating income as we generally sell equipment to our

distributors at a price approximating our cost to facilitate competi-

tive pricing at the retail level. Accordingly, we believe that network

revenue is a more relevant measure for Wireless’ ability to increase

its operating profit, as defined below.

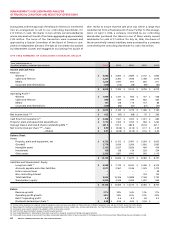

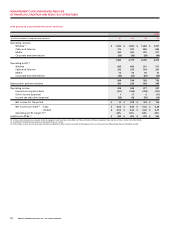

Average Revenue per User

The average revenue per user (“ARPU”) is calculated on a monthly

basis. For any particular month, ARPU represents monthly revenue

divided by the average number of subscribers during the month.

In the case of Wireless, ARPU represents monthly network revenue

divided by the average number of subscribers during the month.

ARPU, when used in connection with a particular type of subscriber,

represents monthly revenue generated from those subscribers

divided by the average number of those subscribers during the

month. When used or reported for a period greater than one month,

ARPU represents the monthly average of the ARPU calculations for

the period. We believe ARPU helps indicate whether we have been

successful in attracting and retaining higher value subscribers. Refer

to the “Supplementary Information – Non-GAAP Calculations” sec-

tion for further details on this Wireless and Cable and Telecom

calculation.

Operating Expenses

Operating expenses are segregated into three categories for assess-

ing business performance:

• Cost of sales, which is comprised of wireless equipment costs,

Rogers Retail merchandise and depreciation of Rogers Retail rental

assets, as well as cost of goods sold by The Shopping Channel;

• Sales and marketing expenses, which represent the costs to acquire

new subscribers (other than those related to equipment), such as

advertising, commissions paid to third parties for new activations,

remuneration and benefits to sales and marketing employees, as

well as direct overheads related to these activities and the costs of

operating the Rogers Retail store locations and the retail opera-

tions of Wireless stores; and

• Operating, general and administrative expenses, which include

all other expenses incurred to operate the business on a day-to-

day basis and service existing subscriber relationships, including

retention costs, inter-carrier payments to roaming partners and

long-distance carriers, programming related costs, the CRTC

contribution levy, Internet and e-mail services and printing and

production costs.

In the wireless and cable industries in Canada, the demand for ser-

vices continues to grow and the variable costs, such as commissions

paid for subscriber activations, as well as the fixed costs of acquir-

ing new subscribers are significant. Fluctuations in the number of

activations of new subscribers from period to period and the sea-

sonal nature of both wireless and cable subscriber additions result in

fluctuations in sales and marketing expenses and accordingly, in the

overall level of operating expenses. In our Media business, sales and

marketing expenses may be significant to promote publishing, radio

and television properties, which in turn attract advertisers, viewers,

listeners and readers.