Rogers 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 ROG ERS COM MUN ICAT I ONS INC . 2006 ANN UAL RE P ORT

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

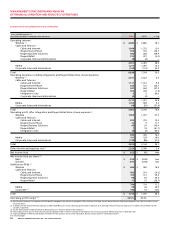

2007 Full Year Guidance Ranges

200 7 2006

(In millions of dollars, except subscribers) Range Actual

Consolidated

Revenue $ 9,700 to $ 10,000 $ 8,838

Operating profit (1) 3,250 to 3,400 2,887

PP&E expenditures (1) 1,625 to 1,750 1,669

Free cash flow (2) 800 to 1,000 543

Revenue

Wireless (network revenue) $ 4,900 to $ 5,000 $ 4,313

Cable and Telecom (A) 3,615 to 3,700 3,201

Media (B) 1,275 to 1,325 1,210

Operating profit (3)

Wireless (4) $ 2,250 to $ 2,350 $ 1,997

Cable and Telecom (A)(1) 935 to 975 899

Media (B) 150 to 160 151

PP&E expenditures

Wireless (C)(5) $ 675 to $ 725 $ 624

Cable and Telecom (A)(1)(6) 815 to 880 751

Media (7) 85 to 95 48

Net subscriber additions (000s)

Retail wireless postpaid and prepaid (8) 500 to 600 610

Residential cable revenue generating units (RGUs) (9) 625 to 725 666

(A) Supplementary Cable and Telecom detail:

200 7 2006

(In millions of dollars) Range Actual

Revenue

Cable, Internet and Home Phone $ 2,570 to $ 2,600 $ 2,299

Rogers Business Solutions 560 to 600 596

Rogers Retail 485 to 500 310

Operating profit (1)

Cable, Internet and Home Phone $ 925 to $ 950 $ 843

Rogers Business Solutions 5 to 15 49

Rogers Retail 5 to 10 7

PP&E expenditures (1)

Cable, Internet and Home Phone $ 665 to $ 700 $ 657

Rogers Business Solutions (6) 125 to 150 83

Rogers Retail 25 to 30 11

(B) Supplementary Media detail:

200 7 2006

(In millions of dollars) Range Actual

Revenue

Core Media $ 1,095 to $ 1,135 $ 1,034

Sports Entertainment 180 to 190 176

Operating profit

Core Media $ 175 to $ 190 $ 167

Sports Entertainment (25) to (30) (16)

(C) Supplementary Wireless PP&E expenditures detail:

200 7 2006

(In millions of dollars) Range Actual

Wireless (excluding HSDPA) (5) $ 425 to $ 450 $ 360

HSDPA 250 to 275 264

(1) Excludes integration related expenditures.

(2) Free cash flow is defined as operating profit less PP&E expenditures and interest expense and is not a term defined under Canadian GAAP.

(3) Before management fees paid to RCI in 2006.

(4) Excludes operating losses related to the Inukshuk fixed wireless initiative estimated to be $35 million in 2007.

(5) Excludes PP&E expenditures related to Inukshuk of approximately $25 million in 2007.

(6) Rogers Business Solutions PP&E excludes integration costs estimated to be $25 million to $30 million in 2007.

(7) The increase in Media PP&E primarily reflects the relocation and construction of new studio facilities for Rogers SportsNet.

(8) Wireless subscriber net additions exclude any potential subscriber adjustments associated with the planned TDMA/analog network turndown.

(9) Residential cable RGUs are comprised of basic cable subscribers, digital cable households, residential high-speed Internet subscribers and residential cable and circuit-switched telephony subscribers. Includes

approximately 75,000 migrations from the circuit-switched telephony platform to the cable telephony platform.

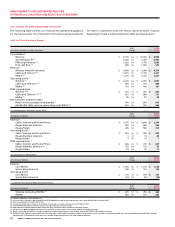

2007 FINANCIAL AND OPERATING GUIDANCE

The following table outlines our financial and operational guidance

for the full year 2007. This information is forward-looking and should

be read in conjunction with the section above entitled “Caution

Regarding Forward-Looking Statements, Risks and Assumptions.”