Rogers 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84 R OGE RS C OMM UNI C ATION S I N C . 20 0 6 AN N UA L R EPOR T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

pension asset and the recoverability of long-lived assets, goodwill

and intangible assets, which require estimates of future cash flows.

For business combinations, key areas of estimation and judgment

include the allocation of the purchase price and related integration

and severance costs.

Significant changes in the assumptions, including those with respect

to future business plans and cash flows, could materially change the

recorded carrying amounts.

(T) RECENT C ANADIAN ACCOUNTING PRONOUNCEMENTS:

(i) Non-monetary transactions:

In 2005, The Canadian Institute of Chartered Accountants (“CICA”)

issued Handbook Section 3831, Non-monetary Transactions (“CICA

3831”), replacing Section 3830, Non-monetary Transactions. CICA 3831

requires that an asset exchanged or transferred in a non-monetary

transaction must be measured at its fair value except when:

(a) the transaction lacks commercial substance;

(b) the transaction is an exchange of a product or property held for

sale in the ordinary course of business for a product or property

to be sold in the same line of business to facilitate sales to cus-

tomers other than the parties to the exchange;

(c)

neither the fair value of the asset received nor the fair value of

the asset given up is reliably measurable; or

(d) the transaction is a non-monetary, non-reciprocal transfer to

owners that represents a spin-off or other form of restructuring

or liquidation.

In these cases, the transaction must be measured at the carrying

value. The new requirements were effective for transactions occur-

ring on or after January 1, 2006. This new standard has not had a

material impact on the Company’s consolidated financial statements.

(ii) Accounting changes:

In 2006, the CICA issued Handbook Section 1506, Accounting Changes

(“CICA 1506”). CICA 1506 prescribes the criteria for changing account-

ing policies, together with the accounting treatment and disclosure

of changes in accounting policies, changes in accounting estimates

and correction of errors. This new standard, to be adopted on

January 1, 2007, is not expected to have a material impact on the

Company’s consolidated financial statements.

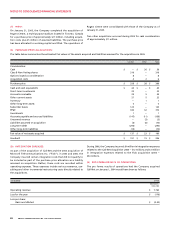

(iii) Financial instruments:

In 2005, the CICA issued Handbook Section 3855, Financial Instru-

ments – Recognition and Measurement, Handbook Section 1530,

Compre hensive Income, Handbook Section 3251, Equity, and

Handbook Section 3865, Hedges. The new standards are effective for

the Company’s interim and annual financial statements commencing

January 1, 2007.

A new statement entitled “Consolidated Statements of Compre-

hensive Income (Loss)” will be added to the Company’s consolidated

financial statements and will include net income (loss) as well as

other comprehensive income (loss). Accumulated other comprehen-

sive income (loss) will form part of shareholders’ equity.

Under these standards, all of the Company’s financial assets will be

classified as available-for-sale or as loans and receivables. Available-

for-sale investments will be carried at fair value on the consolidated

balance sheets, with changes in fair value recorded in other com-

prehensive income (loss). Loans and receivables and all financial

liabilities will be carried at amortized cost using the effective inter-

est method. Upon adoption, the Company has determined that

none of its financial assets will be classified as held-for-trading or

held-to-maturity and none of its financial liabilities will be classi-

fied as held-for-trading. The impact of the classification provisions

of the new standards will be an adjustment of the carrying value of

available-for-sale investments to fair value and is estimated to be an

increase of $212 million, with a corresponding increase in opening

accumulated other comprehensive income.

All derivatives, including embedded derivatives that must be sepa-

rately accounted for, will be measured at fair value, with changes in

fair value recorded in the consolidated statements of income unless

they are effective cash flow hedging instruments. The changes in

fair value of cash flow hedging derivatives will be recorded in other

comprehensive income (loss), to the extent effective, until the

variability of cash flows relating to the hedged asset or liability is

recognized in the consolidated statements of income. Any hedge

ineffectiveness will be recognized in net income (loss) immediately.

The impact of remeasuring hedging derivatives at fair value on

January 1, 2007 will be recognized in opening deficit and opening

accumulated other comprehensive income (loss), as appropriate.

The impact of remeasuring hedging derivatives on the consolidated

financial statements on January 1, 2007 is estimated to be an increase

in derivative instruments of approximately $571 million, an increase

in opening deficit of $10 million and a decrease in opening accu-

mulated other comprehensive income of $393 million, net of income

taxes of approximately $168 million.

In addition, the unamortized deferred transitional gain of $54 million

will be eliminated upon adoption, the impact of which is estimated

to be an increase to opening deficit of $38 million, net of income

taxes of approximately $16 million.

The Company is currently assessing the impact of the requirement

to recognize non-financial derivatives and embedded derivatives at

fair value.

Effective January 1, 2007, the Company will record all financing costs

for financial assets and financial liabilities in income as incurred. The

Company had previously deferred these costs and amortized them

over the term of the related debt. The carrying value of deferred

costs at December 31, 2006 of $59 million, net of related income taxes,

will be charged to opening deficit on transition on January 1, 2007.

In 2006, the CICA issued Handbook Section 3862, Financial Instruments –

Disclosures, and Handbook Section 3863, Financial Instruments –

Presentation. These new standards will be effective for the Company

beginning January 1, 2008. The Company is currently assessing the

impact of these two new standards.

(iv) C apital disclosures:

In 2006, the CICA issued Handbook Section 1535, Capital Disclosures

(“CICA 1535”). CICA 1535 requires that an entity disclose information

that enables users of its financial statements to evaluate an entity’s

objectives, policies and processes for managing capital including

disclosures of any externally imposed capital requirements and the

consequences for non-compliance. The new standard will be effec-

tive for the Company effective January 1, 2008.