Rogers 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

RO GER S CO MMU NIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Migration to Nex t Generation Wireless Technology

The ongoing development of wireless data transmission technolo-

gies and the increased demand for sophisticated wireless services,

especially data communications services, have led wireless providers

to migrate towards the next generation of digital voice and data

broadband wireless networks. These networks are intended to pro-

vide wireless communications with wireline quality sound, far higher

data transmission speeds and streaming video capabilities. These

networks support a variety of increasingly advanced data applica-

tions, including broadband Internet access, multimedia services and

seamless access to corporate information systems, including desktop,

client and server-based applications which can be accessed on a local,

national or international basis.

Development of Additional Technologies

The development of wireless, Internet Protocol (“IP”)-based tech-

nologies and the development of IP-based applications used by

consumers may accelerate the widespread adoption of 3G digital

voice and data networks. Two key wireless broadband technologies

are developing in addition to 3G, namely WiFi and WiMAX.

WiFi (the IEEE 802.11 industry standard) allows suitably equipped

devices, such as laptop computers and personal digital assistants,

to connect to a wireless access point. These access points utilize

unlicenced spectrum and the wireless connection is only effective

within a local area radius of approximately 50–100 metres of the

access point, and at theoretical shared network/user speeds of up

to 200 megabits per second. As the technology is primarily designed

for in-building wireless access, large numbers of access points must

be deployed to cover the selected local geographic area, and must

also be interconnected with a broadband network to supply the

connectivity to the Internet. Future enhancements to the range of

WiFi service and the networking of WiFi access points may provide

additional opportunities for wireless operators or municipal WiFi

network operators, each providing capacity and coverage under the

appropriate circumstances.

WiMAX, based on the IEEE 802.16 standard, is a technology that is

being developed to enable broadband speeds over wide area wire-

less networks at a cost point to enable mass market adoption. By

contrast with WiFi, WiMAX is a cellular-like technology that operates

in defined, licenced frequency bands and is thereby not hampered

by interference from other applications and services using the same

frequencies. The technology is designed to operate everywhere from

inside an individual building to tens of kilometres in range and,

depending upon the amount of spectrum allocated and available,

can provide shared or dedicated access to hundreds of megabits of

capacity. There are two main applications of WiMAX today: fixed

WiMAX applications are point-to-multipoint enabling broadband

access to homes and businesses, whereas mobile WiMAX offers the

full mobility of cellular networks at broadband speeds. Both fixed

and mobile applications of WiMAX are engineered to help deliver

ubiquitous, high-throughput wide area broadband wireless services

at a low cost.

ACQUISITION OF FIDO AND PRIVATIZATION OF WIRELESS

Wireless’ acquisition of Fido was successfully completed effective

November 9, 2004 and made it the largest wireless operator in

Canada and the only Canadian wireless provider operating on the

world standard GSM wireless technology platform. Refer to Note 4

to the 2006 Audited Consolidated Financial Statements for more

details regarding this transaction.

On December 31, 2004, we successfully completed an exchange offer

to purchase all of the publicly-owned Class B Restricted Voting shares

of RWCI, with the consideration being 3.5 RCI Class B Non-Voting

shares for each RWCI Class B share held, and RWCI became a wholly

owned subsidiary of RCI.

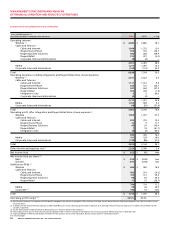

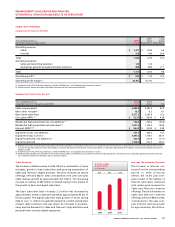

WIRELESS OPERATING AND FINANCIAL RESULTS

For purposes of this discussion, revenue has been classified according

to the following categories:

• Network revenue, which includes revenue derived from:

• postpaid (voice and data), which consists of revenues gener-

ated principally from monthly fees, airtime and long-distance

charges, optional service charges, system access fees and roam-

ing charges;

• prepaid, which consists of revenues generated principally from

the advance sale of airtime, usage and long-distance charges;

and

• one-way messaging, which consists of revenues generated from

monthly fees and usage charges.

• Equipment sales which consist of revenue generated from the sale

of hardware and accessories to independent dealers, agents and

retailers, and directly to subscribers through direct fulfillment by

Wireless’ customer service groups, websites and telesales, net of

subsidies.

Operating expenses are segregated into the following categories for

assessing business performance:

• Cost of equipment sales, representing costs related to equipment

revenue;

• Sales and marketing expenses, consisting of costs to acquire new

subscribers such as advertising, commissions paid to third par-

ties for new activations, remuneration and benefits to sales and

marketing employees as well as direct overheads related to these

activities;

• Operating, general and administrative expenses, consisting pri-

marily of network operating expenses, customer care expenses,

retention costs, including residual commissions paid to distribution

channels, Industry Canada licencing fees associated with spectrum

utilization, inter-carrier payments to roaming partners and long

distance carriers, CRTC contribution levy and all other expenses

incurred to operate the business on a day-to-day basis; and

• Integration expenses, relating to the integration of Fido opera-

tions, including certain severance costs, consulting, certain costs of

conversion of billing and other systems.