Rogers 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

RO GER S CO MMU NIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

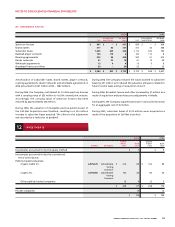

(A) C APITAL STOCK:

(i) Preferred shares:

Rights and conditions:

There are 400 million authorized Preferred shares without par

value, issuable in series, with rights and terms of each series to be

fixed by the Board of Directors prior to the issue of such series. The

Preferred shares have no rights to vote at any general meeting of

the Company. No Preferred shares have been issued.

(ii) Common shares:

Rights and conditions:

On October 30, 2006, subject to shareholder approval, the Board

of Directors approved a resolution effecting a two-for-one split of

the Company’s Class A Voting and Class B Non-Voting shares where

shareholders of record as of the close of business on December 29,

2006 would receive one additional share of the relevant class for

each share held upon distribution. The Board also approved reso-

lutions, again subject to shareholder approval, increasing the

maximum number of Class A Voting shares authorized to be issued

by 56,233,894 and requiring that all of the authorized and issued and

fully paid Class B Non-Voting shares with a par value, prior to the

split, of $1.62478 each be changed into shares without par value.

These resolutions were approved at a shareholder meeting held on

December 15, 2006.

All prior period common stock and applicable share and per share

amounts have been retroactively adjusted to reflect the split.

Reflecting the approval of these resolutions, there are 112,474,388

authorized Class A Voting shares without par value. Each Class A

Voting share is entitled to 50 votes per share. The Class A Voting

shares are convertible on a one-for-one basis into Class B Non-Voting

shares.

There are 1.4 billion authorized Class B Non-Voting shares.

During 2006, 140 Class A Voting shares were converted into Class B

Non-Voting shares.

The Articles of Continuance of the Company under the Company

Act (British Columbia) impose restrictions on the transfer, voting and

issue of the Class A Voting and Class B Non-Voting shares in order to

ensure that the Company remains qualified to hold or obtain licences

required to carry on certain of its business undertakings in Canada.

The Company is authorized to refuse to register transfers of any

shares of the Company to any person who is not a Canadian in order

to ensure that the Company remains qualified to hold the licences

referred to above.

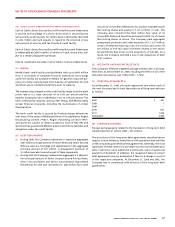

(B) DIVIDENDS:

On April 25, 2006, the Company declared a semi-annual dividend

of $0.0375 per share on each of its outstanding Class B Non-Voting

shares and Class A Voting shares. This semi-annual dividend totalling

$24 million was paid on July 4, 2006 to the shareholders of record on

June 14, 2006.

On October 30, 2006, the Board approved an increase in the annual

dividend from $0.075 to $0.16 per Class A Voting and Class B Non-

Voting share. Additionally, the Company’s dividend distribution

policy was modified to make dividend distributions on a quarterly

basis instead of semi-annually. At the same time, the Board declared

the first quarterly dividend of $0.04 per share to be paid on January 2,

2007 to shareholders of record on December 20, 2006 reflecting the

increased $0.16 per share annual dividend level and the new quar-

terly distribution schedule. The dividend payment on January 2, 2007

totalled $25 million.

The Class A Voting shares may receive a dividend at a quarterly rate

of up to $0.04 per share only after the Class B Non-Voting shares

have been paid a dividend at a quarterly rate of $0.04 per share. The

Class A Voting and Class B Non-Voting shares share equally in divi-

dends after payment of a dividend of $0.04 per share for each class.

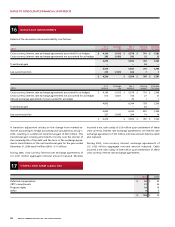

(C ) STOCK OPTIONS, SHARE UNITS AND SHARE

PURCHASE PL ANS:

As a result of the Company’s two-for-one stock split (note 20(a)(ii)),

the numbers of options, restricted share units and directors’ deferred

share units outstanding were adjusted, in accordance with existing

provisions of the plans for these awards, such that the holders of

these awards would be in the same economic position before and

after effecting the stock split. Consequently, these adjustments did

not result in a new measurement date for these awards.

All prior period numbers of options, restricted share units and direc-

tors’ deferred share units as well as exercise prices and fair values

per individual award have been retroactively adjusted to reflect the

two-for-one stock split.

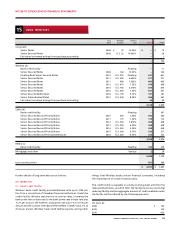

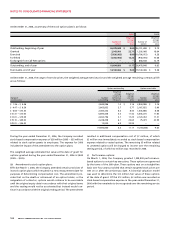

(i) Stock options:

(a) Stock option plans:

Options to purchase Class B Non-Voting shares of the Company on a

one-for-one basis may be granted to employees, directors and offi-

cers of the Company and its affiliates by the Board of Directors or by

the Company’s Management Compensation Committee. There are

30 million options authorized under the 2000 plan, 25 million options

authorized under the 1996 plan, and 9.5 million options authorized

under the 1994 plan. The term of each option is 7 to 10 years and

the vesting period is generally four years but may be adjusted by

the Management Compensation Committee on the date of grant.

The exercise price for options is equal to the fair market value of the

Class B Non-Voting shares determined as the five-day average before

the grant date as quoted on The Toronto Stock Exchange.

Effective July 1, 2006, non-executive directors will no longer receive

stock options.

On July 1, 2005, all stock options of Call-Net were exchanged for

fully-vested options of RCI (note 4(b)).