Rogers 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

RO GER S CO MMU NIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

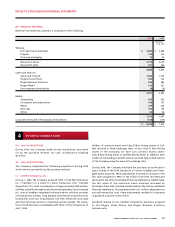

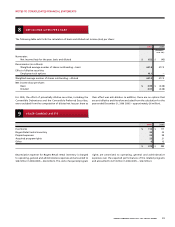

5 INV ESTMENT IN JOIN T VENTU RES

The Company has contributed certain assets to joint ventures

involved in the provision of wireless broadband Internet service

and in certain mobile commerce initiatives (notes 11(b) and 23). As

at December 31, 2006 and for the year then ended, proportionately

consolidating these joint ventures resulted in the following increases

(decreases) in the accounts of the Company:

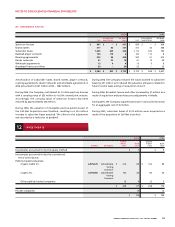

6 STO RE CLOSURE EXPE NSES

During 2006, the Company closed 21 of its Rogers Retail stores in

Ontario and Quebec. The costs to exit these stores include lease ter-

mination and involuntary severance costs totalling $3 million, as well

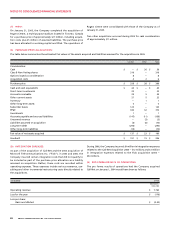

7 INC OME TAXES

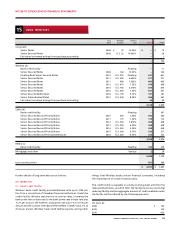

The income tax effects of temporary differences that give rise to significant portions of future income tax assets and liabilities are as follows:

2006 2005

Future income tax assets:

Non-capital income tax loss carryforwards $ 981 $ 1,389

Capital loss carryforwards 21 5

Deductions relating to long-term debt and other transactions denominated in foreign currencies 41 87

Investments 52 59

PP&E and inventory 46 87

Other deductible differences 125 149

Total future income tax assets 1,266 1,776

Less valuation allowance 150 618

1,116 1,158

Future income tax liabilities:

Goodwill and intangible assets (407) (680)

Other taxable differences (23) (18)

Total future income tax liabilities (430) (698)

Net future income tax asset 686 460

Less current portion 387 113

$ 299 $ 347

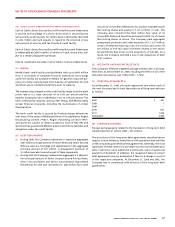

In assessing the realizability of future income tax assets, manage-

ment considers whether it is more likely than not that some portion

or all of the future income tax assets will be realized. The ultimate

realization of future income tax assets is dependent upon the gen-

eration of future taxable income during the years in which the

temporary differences are deductible. Management considers the

scheduled reversals of future income tax liabilities, the character of

the future income tax assets and available tax planning strategies

in making this assessment. To the extent that management believes

that the realization of future income tax assets does not meet the

more likely than not realization criterion, a valuation allowance is

recorded against the future income tax assets.

In making an assessment of whether future income tax assets are

more likely than not to be realized, management regularly prepares

information regarding the expected use of such assets by reference

Current assets $ 11

Long-term assets 42

Current liabilities 3

Revenue –

Expenses 20

Net income (20)

as a write-down of the related PP&E totalling $3 million for the year

ended December 31, 2006.