Rogers 2006 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 R OGE RS C OMM UNI C ATIO N S I N C . 2 0 0 6 AN NUAL R EPOR T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

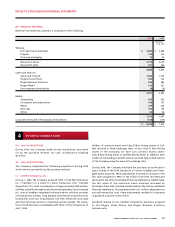

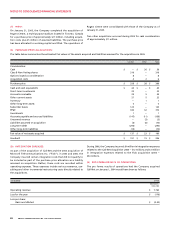

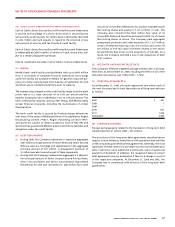

(C ) PURCHASE PRICE ALLOC ATIONS:

The table below summarizes the estimated fair values of the assets acquired and liabilities assumed for the acquisitions in 2005.

Call-Net Other Total

Consideration:

Cash $ – $ 36 $ 36

Class B Non-Voting shares 316 – 316

Options issued as consideration 8 – 8

Acquisition costs 4 2 6

Purchase price $ 328 $ 38 $ 366

Cash and cash equivalents $ 44 $ – $ 44

Short-term investments 22 – 22

Accounts receivable 29 5 34

Other current assets 27 5 32

Inventory – 1 1

Other long-term assets 5 – 5

Subscriber bases 123 – 123

PP&E 340 32 372

Investments 1 – 1

Accounts payable and accrued liabilities (147) (11) (158)

Unearned revenue – (3) (3)

Liabilities assumed on acquisition (4) (6) (10)

Long-term debt (293) – (293)

Other long-term liabilities (10) – (10)

Fair value of net assets acquired $ 137 $ 23 $ 160

Goodwill $ 191 $ 15 $ 206

During 2006, the Company incurred $9 million in integration expenses

related to the Call-Net Acquisition (2005 – $12 million) and $3 million

in integration expenses related to the Fido acquisition (2005 –

$54 million).

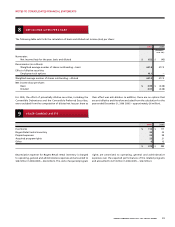

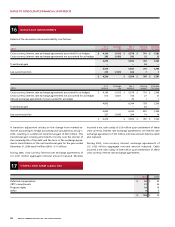

(E) PRO FORMA RESULTS OF OPERATIONS:

The pro forma results of operations had the Company acquired

Call-Net on January 1, 2004 would have been as follows:

(D) INTEGRATION EXPENSES:

As part of the acquisition of Call-Net and the 2004 acquisition of

Microcell Telecommunications Inc. (“Fido”), in 2005 and 2006, the

Company incurred certain integration costs that did not qualify to

be included as part of the purchase price allocation as a liability

assumed on acquisition. Rather, these costs are recorded within

operating expenses. These expenses include various severance, con-

sulting and other incremental restructuring costs directly related to

the acquisitions.

(ii) Other:

On January 31, 2005, the Company completed the acquisition of

Rogers Centre, a multi-purpose stadium located in Toronto, Canada

for a purchase price of approximately $27 million, including acquisi-

tion costs, plus $5 million of assumed liabilities. The purchase price

has been allocated to working capital and PP&E. The operations of

Rogers Centre were consolidated with those of the Company as of

January 31, 2005.

Two other acquisitions occurred during 2005 for cash consideration

of approximately $11 million.

(Unaudited) 2005

(Restated –

note 2(b))

Operating revenue $ 7,762

Loss for the year $ (176)

Loss per share:

Basic and diluted $ (0.30)