Rogers 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

RO GER S CO MMU NIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

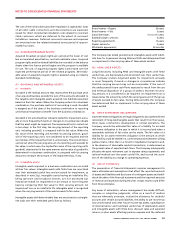

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

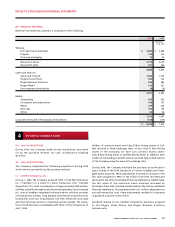

4 BUS INESS COMBI NATI ONS

(A) 20 06 ACQUISITIONS:

During 2006, the Company made various acquisitions, accounted

for by the purchase method, for cash consideration totalling

$6 million.

(B) 2005 ACQUISITIONS:

The Company completed the following acquisitions during 2005

which were accounted for by the purchase method:

(i) Call-Net Enterprises Inc.:

On July 1, 2005, the Company acquired 100% of Call-Net Enterprises

Inc. (“Call-Net”) in a share for share transaction (the “Call-Net

Acquisition”) for total consideration of approximately $328 million.

Call-Net, primarily through its wholly owned subsidiary, Sprint Canada

Inc., was a Canadian integrated communications solutions provider

of home phone, wireless, long distance and Internet access services to

households, and local, long distance, toll free, enhanced voice, data

and Internet access services to businesses across Canada. The opera-

tions of Call-Net were consolidated with those of the Company as of

July 1, 2005.

Holders of common shares and Class B Non Voting shares of Call-

Net received a fixed exchange ratio of two Class B Non-Voting

shares of the Company for each 4.25 common shares and/or

Class B Non-Voting shares of Call-Net held by them. In addition, each

holder of outstanding Call-Net options received fully-vested options

of the Company using the same 4.25 exchange ratio.

During 2006, the Company finalized the purchase price allocation

upon receipt of the final valuations of certain tangible and intan-

gible assets acquired. These adjustments included an increase in the

fair value assigned to PP&E of $22 million from that recorded and

disclosed in the 2005 consolidated financial statements. Additionally,

the fair value of the subscriber bases acquired increased by

$24 million from that recorded and disclosed in the 2005 consolidated

financial statements. Accompanied with a $1 million adjustment to

accrued transaction costs, these adjustments resulted in a decrease

in goodwill acquired of $47 million.

Goodwill related to the Call-Net Acquisition has been assigned

to the Rogers Home Phone and Rogers Business Solutions

business units.

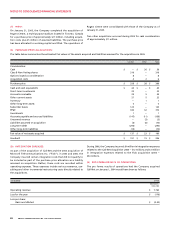

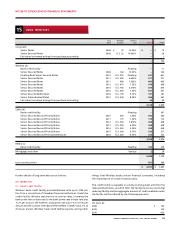

(B) PRODUCT REVENUE:

Revenue from external customers is comprised of the following:

2006 2005

(Restated –

note 2(b))

Wireless:

Post paid (voice and data) $ 4,084 $ 3,384

Prepaid 214 210

One-way messaging 15 20

Network revenue 4,313 3,614

Equipment sales 267 246

4,580 3,860

Cable and Telecom:

Cable and Internet 1,944 1,735

Rogers Home Phone 355 150

Rogers Business Solutions 596 284

Rogers Retail 310 327

Intercompany eliminations (4) (4)

3,201 2,492

Media:

Advertising 555 503

Circulation and subscription 149 137

Retail 279 252

Blue Jays 163 149

Other 64 56

1,210 1,097

Corporate items and intercompany eliminations (153) (115)

$ 8,838 $ 7,334