Rogers 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

RO GER S CO MMU NIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

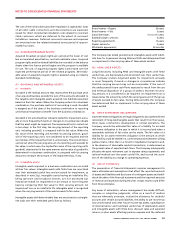

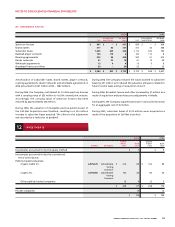

8 NET INCOME (LO SS) PER SHA RE

The following table sets forth the calculation of basic and diluted net income (loss) per share:

2006 2005

(Restated –

note 2(b))

Numerator:

Net income (loss) for the year, basic and diluted $ 622 $ (45)

Denominator (in millions):

Weighted average number of shares outstanding – basic 631.8 577.3

Effect of dilutive securities:

Employee stock options 10.1 –

Weighted average number of shares outstanding – diluted 641.9 577.3

Net income (loss) per share:

Basic $ 0.99 $ (0.08)

Diluted 0.97 (0.08)

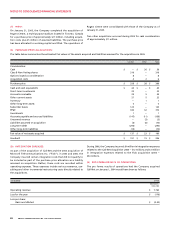

their effect was anti-dilutive. In addition, there are no options that

are anti-dilutive and therefore excluded from the calculation for the

year ended December 31, 2006 (2005 – approximately 26 million).

For 2005, the effect of potentially dilutive securities, including the

Convertible Debentures and the Convertible Preferred Securities,

were excluded from the computation of diluted net loss per share as

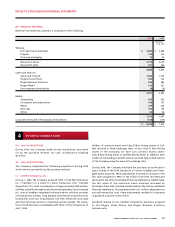

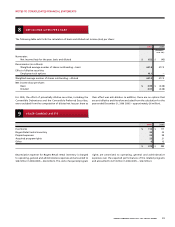

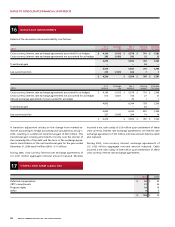

9 OTH ER CURRENT ASSE TS

2006 2005

Inventories $ 113 $ 117

Rogers Retail rental inventory 35 35

Prepaid expenses 93 99

Acquired program rights 23 21

Other 6 13

$ 270 $ 285

Depreciation expense for Rogers Retail rental inventory is charged

to operating, general and administrative expenses and amounted to

$48 million in 2006 (2005 – $64 million). The costs of acquired program

rights are amortized to operating, general and administrative

expenses over the expected performances of the related programs

and amounted to $27 million in 2006 (2005 – $26 million).