Rogers 2006 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102 R OGE R S C OMM UNI C AT ION S I N C . 20 0 6 AN N UA L R E POR T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

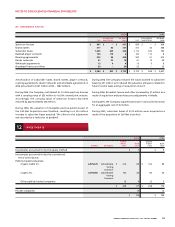

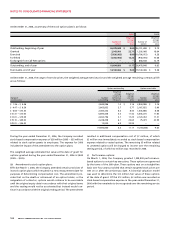

(C ) AC TUAL CONTRIBUTIONS TO THE PLANS ARE AS FOLLOWS:

Employer Employee Total

2006 $ 28 $ 15 $ 43

2005 21 14 35

Employee contributions for 2007 are assumed to be at levels similar

to 2006 on the assumption staffing levels in the Company will remain

the same on a year-over-year basis.

Expected contributions by the Company in 2007 are estimated to be

$25 million.

(D) EXPECTED C ASH FLOWS:

Expected benefit payments for funded and unfunded plans for fiscal year ending:

2007 $ 26

2008 25

2009 26

2010 26

2011 26

129

Next five years 133

$ 262

Blue Jays and Fido each have defined contribution plans with total pension expense of $2 million in 2006 (2005 – $5 million).

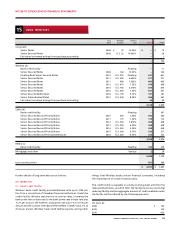

20 SHA REHO LDERS’ EQUI TY

During 2005 and 2006, the Company completed the following capital stock transactions:

Class A Voting shares Class B Non-Voting shares

Convertible Total

Number Number Preferred Contributed shareholders’

Amount of shares (000s) Amount of shares (000s) Securities surplus Deficit equity

Balances, December 31, 2004 $ 72 112,471 $ 356 437,958 $ 188 $ 2,289 $ (520) $ 2,385

Change in accounting policy related to

stock-based compensation (note 2(b)) – – – – – 4 (4) –

Net loss for the year – – – – – – (45) (45)

Stock options exercised – – 8 10,796 – 98 – 106

Stock-based compensation – – – – – 35 – 35

Shares issued in exchange for

Call-Net shares (note 4(b)) – – 14 16,929 – 310 – 324

Conversion of convertible preferred

securities (note 15(d)) – – 28 34,286 (188) 669 – 509

Dividends – – – – – – (37) (37)

Conversion of convertible debt (note 15(d)) – – 13 15,433 – 258 – 271

Conversion of Class A shares to Class B shares – (3) – 3 – – – –

Purchase price adjustment to unvested options – – – – – (20) – (20)

Balances, December 31, 2005 72 112,468 419 515,405 – 3,643 (606) 3,528

Net income for the year – – – – – – 622 622

Stock options exercised – – 6 7,827 – 61 – 67

Stock-based compensation – – – – – 32 – 32

Dividends – – – – – – (49) (49)

Balances, December 31, 2006 $ 72 112,468 $ 425 523,232 $ – $ 3,736 $ (33) $ 4,200