Rogers 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 RO GERS CO MMU NICAT ION S IN C . 20 0 6 ANN UA L RE POR T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

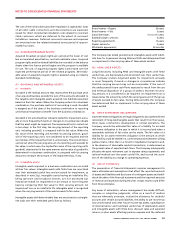

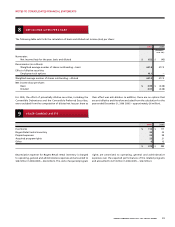

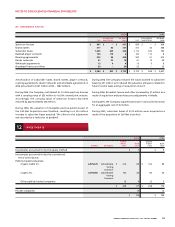

10 P ROPERTY, PL ANT AND EQU IPME NT

Details of PP&E are as follows:

2006 2005

Accumulated Net book Accumulated Net book

Cost depreciation value Cost depreciation value

Land and buildings $ 561 $ 102 $ 459 $ 405 $ 77 $ 328

Towers, headends and transmitters 898 451 447 743 362 381

Distribution cable and subscriber drops 4,288 2,303 1,985 4,081 2,070 2,011

Network equipment 4,420 2,233 2,187 3,870 1,889 1,981

Wireless network radio base station equipment 1,619 1,210 409 1,502 1,105 397

Computer equipment and software 1,789 1,319 470 1,568 1,129 439

Customer equipment 922 513 409 714 405 309

Leasehold improvements 293 169 124 260 152 108

Other 614 372 242 534 336 198

$ 15,404 $ 8,672 $ 6,732 $ 13,677 $ 7,525 $ 6,152

PP&E not yet in service and therefore not depreciated at December 31,

2006 amounted to $403 million (2005 – $365 million).

Other primarily includes miscellaneous equipment and vehicles.

Depreciation expense for 2006 amounted to $1,172 million (2005 –

$1,075 million).

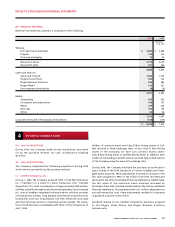

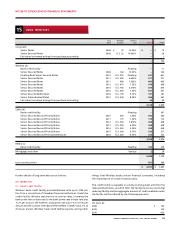

11 G OODWILL AND INT ANGIBLE ASS ETS

(A) GOODWILL:

A summary of the changes to goodwill is as follows:

2006 2005

Opening balance $ 3,036 $ 3,389

Adjustments to Call-Net purchase allocation (note 4(b)) (47) 191

Adjustments to Wireless purchase allocation – (54)

Adjustments to Fido purchase allocation – (26)

Adjustments to other purchase allocations (6) (9)

Other acquisitions (note 4(a)) 5 –

Reduction in valuation allowance for acquired future income tax assets (note 7) (209) (452)

Closure of divisions – (3)

$ 2,779 $ 3,036

During 2005, the purchase price allocations related to the 2004 acqui-

sitions of Fido and the remaining minority interests in Wireless were

adjusted to reflect final valuations of tangible and intangible assets

acquired and to reflect adjustments to various liabilities assumed

on acquisition. The offset of these adjustments was recorded as a

charge to goodwill.

The Company wrote off goodwill of $3 million during 2005 related to

the closure of two of its divisions.