Rogers 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 R OGE RS COM MUN I C ATIO NS I NC . 2 0 0 6 AN NUAL R EPO R T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Borrowings under the credit facility are secured by the pledge of a

senior bond issued under a deed of trust, which is secured by sub-

stantially all the assets of Wireless and certain of its subsidiaries,

subject to certain exceptions and prior liens.

(ii) Senior Notes and Debentures:

Each of Wireless’ Senior Secured Notes and Debentures is secured by

the pledge of a senior bond that is secured by the same security as

the security for the bank credit facility described in note 15(a)(i) and

ranks equally with the bank credit facility.

Interest is paid semi-annually on all of Wireless’ notes and debentures,

with the exception of Wireless’ Floating Rate Senior Secured Notes

for which Wireless pays interest on a quarterly basis.

Each of Wireless’ Senior Secured Notes and Debentures and Senior

Subordinated Notes is redeemable, in whole or in part, at Wireless’

option, at any time, subject to a certain prepayment premium. The

following two note issues have specific prepayment premiums.

Wireless’ U.S. $550 million of Floating Rate Senior Secured Notes are

redeemable in whole or in part, at Wireless’ option, at any time on or

after December 15, 2006 at 102.0% of the principal amount, declining

ratably to 100.0% of the principal amount on or after December 15,

2008, plus, in each case, interest accrued to the redemption date.

The Company pays interest on the Floating Rate Notes at LIBOR plus

3.125%, reset quarterly.

Wireless’ U.S. $400 million Senior Subordinated Notes are redeem-

able in whole or in part, at Wireless’ option, at any time up to

December 15, 2008, subject to a certain prepayment premium and

at any time on or after December 15, 2008 at 104.0% of the principal

amount, declining ratably to 100.0% of the principal amount on or

after December 15, 2010.

(iii) Fair value inc rement arising from purchase accounting:

The fair value increment on long-term debt is a purchase accounting

adjustment required by GAAP as a result of the acquisition of the

minority interest of Wireless during 2004. Under GAAP, the purchase

method of accounting requires that the assets and liabilities of

an acquired enterprise be revalued to fair value when allocating

the purchase price of the acquisition. This fair value increment is

recorded only on consolidation at the RCI level and is not recorded

in the accounts of Wireless. The fair value increment is amortized

over the remaining term of the related debt and recorded as part

of interest expense. The fair value increment, applied against the

specific debt instruments of Wireless to which it relates, results in

the following carrying values at December 31, 2006 and 2005 of the

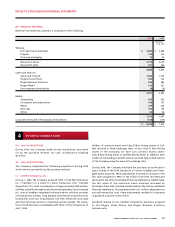

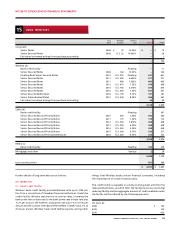

Wireless debt in the Company’s consolidated accounts:

2006 2005

Senior Secured Notes, due 2006 10.50% $ – $ 162

Senior Secured Notes, due 2010 Floating 643 644

Senior Secured Notes, due 2011 9.625% 600 606

Senior Secured Notes, due 2011 7.625% 461 462

Senior Secured Notes, due 2012 7.25% 551 551

Senior Secured Notes, due 2014 6.375% 859 857

Senior Secured Notes, due 2015 7.50% 644 644

Senior Secured Debentures, due 2016 9.75% 192 193

Senior Subordinated Notes, due 2012 8.00% 468 468

Total $ 4,418 $ 4,587

(B) CABLE:

(i) Bank c redit facility:

Cable’s bank credit facility provides Cable with up to $1 billion of

available credit, comprised of a $600 million Tranche A credit facility

and a $400 million Tranche B credit facility, both of which are avail-

able on a fully revolving basis until maturity on July 2, 2010 and there

are no scheduled reductions prior to maturity.

In July 2006, Cable entered into an amendment to its bank credit

facility to insert provisions for the springing release of security in a

similar fashion as provided in all of Cable’s public debt indentures.

This provision provides that if Cable has two investment grade ratings

on its debt and there is no other debt or cross-currency interest rate

exchange agreement secured by a bond issued under the Cable deed

of trust, then the security provided for a particular debt instrument

will be discharged upon 45 days’ prior notice by Cable. A similar

amendment has also been made in each of Cable’s cross-currency

interest rate exchange agreements.

Cable’s bank credit facility is secured by the pledge of a senior bond

issued under a deed of trust which is secured by substantially all of

the assets of Cable and certain of its subsidiaries, subject to certain

exceptions and prior liens. In addition, under the terms of an inter-

creditor agreement, the proceeds of any enforcement of the security

under the deed of trust would be applied first to repay any obli-

gations outstanding under the Tranche A credit facility. Additional

proceeds would be applied pro rata to repay all other obligations of

Cable secured by senior bonds, including the Tranche B credit facility

and all of Cable’s Senior Secured Notes and Debentures.

Cable’s bank credit facility requires, among other things, that Cable

satisfy certain financial covenants, including the maintenance of

certain financial ratios. The interest rate charged on the bank credit

facility ranges from nil to 2.0% per annum over the bank prime rate

or base rate or 0.625% to 3.25% per annum over the bankers’ accep-

tance rate or LIBOR.