Rogers 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 RO GER S COMM UNIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

amount that remained outstanding of RCI’s (via RTHI, formerly Call-

Net Enterprises Inc.) 10.625% Senior Secured Notes due 2008 which

was redeemed on January 3, 2006; and $25 million of mortgages and

leases. In addition, Wireless paid aggregate net cash settlements of

$20 million upon the maturities in June 2006 and December 2006 of

cross-currency interest rate exchange agreements in the aggregate

notional amount of U.S. $327 million and RCI received $74 million

from the issuance of Class B Non-Voting shares under the exercise of

employee stock options.

In July 2006, Cable and Telecom

entered into an amendment to

its bank credit facility to insert

provisions for the springing

release of security in a similar

fashion as provided in all of

Cable and Telecom’s public debt

indentures. This provision pro-

vides that if Cable and Telecom

has two investment grade rat-

ings on its debt and there is no

other debt or cross-currency

interest rate exchange agree-

ment secured by a bond issued

under the Cable and Telecom

deed of trust, then the security

provided for a particular debt

instrument will be discharged

upon 45 days prior notice by

Cable and Telecom. A similar amendment has been made in each

of Cable and Telecom’s cross-currency interest rate exchange

agreements.

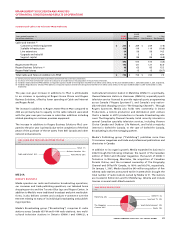

Covenant Compliance

All of the Rogers companies are currently in compliance with all

of the covenants under their respective debt instruments, and we

expect to remain in compliance with all of these covenants. Based on

our most restrictive debt covenants at December 31, 2006, we could

have borrowed approximately $2.14 billion of additional secured

long-term debt under existing credit facilities, in addition to the

$160 million outstanding at December 31, 2006.

2007 Cash Requirements

We anticipate that Wireless will generate a net cash surplus in 2007

from cash generated from operations. We also expect Wireless to

make distributions to RCI in the form of intercompany advances or

distributions of capital. We expect that Wireless has sufficient capital

resources to satisfy its cash funding requirements in 2007, including

the funding of distributions to RCI, taking into account cash from

operations and the amount available under its $700 million bank

credit facility.

We expect that Cable and Telecom will generate a net cash shortfall

in 2007. In addition, Cable and Telecom’s $450 million 7.60% Senior

Secured Second Priority Notes matured in February 2007. We expect

that Cable and Telecom will have sufficient capital resources to sat-

isfy its cash funding requirements in 2007, taking into account cash

from operations, the amount available under its $1.0 billion bank

credit facility and intercompany advances from RCI.

We expect that Media will generate a net cash surplus in 2007 and

that Media has sufficient capital resources to satisfy its cash funding

requirements in 2007, taking into account cash from operations and

the amount available under its $600 million bank credit facility.

We believe that, on an unconsolidated basis, RCI will have, taking

into account interest income and repayments of intercompany

advances, together with the receipt of rental payments paid by the

operating subsidiaries and advances or distributions from Wireless

and investments from cash on hand, sufficient capital resources to

satisfy its cash funding requirements in 2007. Effective December 31,

2006, the payment of management fees by subsidiary companies

ceased. In addition, Cable and Telecom will no longer distribute

$6 million per month on a regular basis to RCI.

In the event that we or any of our operating subsidiaries do require

additional funding, we believe that any such funding requirements

would be satisfied by issuing additional debt financing, which may

include the restructuring of existing bank credit facilities or issuing

public or private debt at any of the operating subsidiaries or at

RCI or issuing equity of RCI, all depending on market conditions. In

addition, we or one of our subsidiaries may refinance a portion of

existing debt subject to market conditions and other factors. There is

no assurance that this will or can be done.

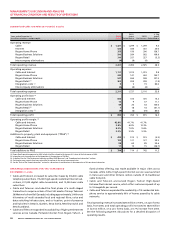

Required Principal Repayments

At December 31, 2006, the required repayments on all long-term debt

in the next five years totalled $2,459 million. The required repay-

ments in 2007 consist mainly of Cable and Telecom’s $450 million

7.60% Senior Secured Second Priority Notes which have since been

repaid at maturity in February 2007. The remaining required repay-

ments are in 2010 and 2011. The required repayments in 2010 consist

of Wireless’ $641 million (U.S. $550 million) Floating Rate Senior

Secured Notes together with $160 million outstanding under bank

credit facilities, all of which mature in 2010. The required principal

repayments in 2011 consist of Wireless’ $571 million (U.S. $490 million)

9.625% Senior Secured Notes and $460 million 7.625% Senior Secured

Notes and Cable and Telecom’s $175 million 7.25% Senior Secured

Second Priority Notes.

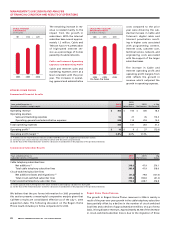

Credit Ratings

On March 6, 2007, Moody’s Investors Service upgraded the senior

secured debt ratings of Cable and Telecom and of Wireless to Baa3

(from Ba1), upgraded the senior subordinated debt rating of Wireless

to Ba1 (from Ba2) and changed the ratings outlook to stable (from

under review for possible upgrade). In addition, the corporate fam-

ily rating for RCI was withdrawn (previously Ba1), as this benchmark

rating for speculative grade companies is no longer applicable. On

January 9, 2007, Moody’s upgraded the corporate family rating of

RCI as well as the senior secured debt ratings of Cable and Telecom

and of Wireless to Ba1 (from Ba2) and upgraded the senior subor-

dinated debt rating of Wireless to Ba2 (from B1). In addition, the

ratings outlook was changed to under review for possible upgrade

(from positive outlook). On February 17, 2006, Moody’s increased the

ratings on all of the Rogers public debt. The corporate family rating

for RCI was increased to Ba2 (from Ba3) and the senior secured debt

ratings of Cable and Telecom and of Wireless were also increased

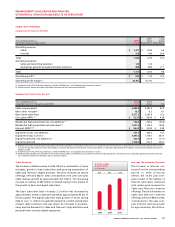

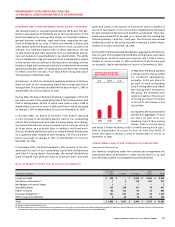

200620052004

2.7x3.9x5.3x

RATIO OF DEBT TO

OPERATING PROFIT*

($)

* Includes debt and derivatives at carr

y

in

g

value