Rogers 2006 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 ROG ERS CO MMU N ICAT I ONS INC . 2006 ANN UA L RE P ORT

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

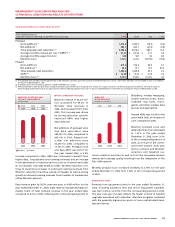

Depreciation and Amortization Expense

Depreciation and amortization expense was $95 million higher in

2006, compared to 2005. The increase primarily reflects the addi-

tional depreciation and amortization recognized on property, plant

and equipment (“PP&E”) expenditures and intangible assets arising

from acquisitions during 2005.

Operating Income

Operating income was $1,291 million in 2006, an increase of $636 mil-

lion, or 97.1%, from $655 million in 2005, reflecting growth in Wireless,

Cable and Telecom, and Media, partially offset by the increase in

depreciation and amortization expense as discussed previously.

Interest Expense on Long-Term Debt

The reduction in interest expense in 2006 compared to 2005 is primar-

ily due to the decrease in debt of more than $750 million, including

the impact of cross-currency interest rate exchange agreements.

This decrease in debt was largely the result of the repayment at

maturity in February 2006 of RCI’s $75 million 10.50% Senior Notes,

the repayment in June 2006 of the 10.5% Wireless Senior Secured

Notes in the aggregate principal amount outstanding of $160 mil-

lion, Wireless’ July 2006 repayment of a mortgage in the aggregate

principal amount outstanding of $22 million, and aggregate net

repayments under our various bank credit facilities of approximately

$452 million.

Loss on Repayment of Lon g -Term Debt

During 2006, we redeemed $26 million (U.S. $22 million) of RCI’s (via

RTHI, formerly Call-Net Enterprises Inc.) 10.625% Senior Secured

Notes due 2008, resulting in a loss on repayment of long-term debt

of $1 million. In 2005, we redeemed U.S. $114 million of Cable and

Telecom’s 11% Senior Subordinated Guaranteed Debentures due

2015 and $238 million of the 10.625% Senior Secured Notes due 2008.

These redemptions resulted in a loss on repayment of long-term

debt of $11 million in the year ended December 31, 2005, including

the write-off of the related deferred financing costs and deferred

transitional loss.

Foreign Exchange Gain

The foreign exchange gain of $2 million in 2006 arose primarily from

the strengthening of the Canadian dollar during 2006 from $1.1659

at December 31, 2005 to $1.1653 at December 31, 2006, favourably

affecting the translation of the unhedged portion of our U.S. dollar-

denominated debt. In the year ended December 31, 2005, a foreign

exchange gain of $35 million arose, given a 3.77 cent increase in the

Canadian dollar relative to the U.S. dollar.

Change in Fair Value of Derivative Instruments

The changes in fair value of the derivative instruments were primar-

ily the result of the changes in the Canadian dollar relative to that of

the U.S. dollar, as described above, and the resulting change in fair

value of our cross-currency interest rate exchange agreements not

accounted for as hedges.

Other Income

Other income of $10 million in 2006 and $2 million in 2005 was pri-

marily associated with investment income received from certain of

our investments, net of write-downs required to reflect other than

temporary declines in the values of certain investments.

Income Tax Exp ense

Current income tax expense has historically consisted primarily of

the Canadian Federal Large Corporations Tax (“LCT”). Due to the

elimination of this tax during 2006, no amount has been expensed

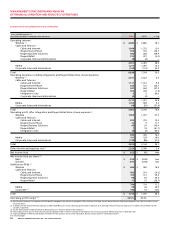

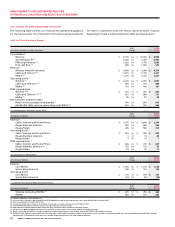

Reconciliation of Operating Profit to Net Income (Loss)

Years ended December 31,

(In millions of dollars) 2006 2005 % Chg

Operating profit (1) $ 2,875 $ 2,144 34.1

Depreciation and amortization (1,584) (1,489) 6.4

Operating income 1,291 655 97.1

Interest expense on long-term debt (620) (699) (11.3)

Loss on repayment of long-term debt (1) (11) (90.9)

Foreign exchange gain 2 35 (94.3)

Change in the fair value of derivative instruments (4) (25) (84.0)

Other income 10 2 n/m

Income tax reduction (expense)

Current 5 (11)

Future (61) 9 n/m

Net income (loss) $ 622 $ (45) n/m

(1) As defined. See the “Key Performance Indicators and Non-GAAP Measures” section.

The items listed below represent the consolidated income and

expense amounts that are required to reconcile operating profit to

net income (loss) as defined under Canadian GAAP.