Rogers 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 ROG ERS CO MMU N ICAT ION S IN C . 20 0 6 ANN UA L RE PORT

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

subsidies related to new and existing subscribers are recorded as a

reduction of equipment revenues;

• Installation fees and activation fees charged to subscribers do not

meet the criteria as a separate unit of accounting. As a result, in

Wireless, these fees are recorded as part of equipment revenue

or, in the case of Cable and Telecom, are deferred and amortized

over the related service period. The related service period for

Cable and Telecom ranges from 26 to 48 months, based on sub-

scriber disconnects, transfers of service and moves. Incremental

direct installation costs related to re-connects are deferred to the

extent of deferred installation fees and amortized over the same

period as these related installation fees. New connect installation

costs are capitalized to PP&E and amortized over the useful life of

the related assets;

• Advertising revenue is recorded in the period the advertising airs

on the Company’s radio or television stations and the period in

which advertising is featured in the Company’s media publications;

• Monthly subscription revenues received by television stations for

subscriptions from cable and satellite providers are recorded in

the month in which they are earned;

• Blue Jays’ revenue from home game admission and concessions is

recognized as the related games are played during the baseball

regular season. Revenue from radio and television agreements is

recorded at the time the related games are aired. The Blue Jays

also receive revenue from the Major League Baseball Revenue

Sharing Agreement which distributes funds to and from member

clubs, based on each club’s revenues. This revenue is recognized

in the season in which it is earned, when the amount is estimable

and collectibility is reasonably assured; and

• Multi-product discounts incurred as Wireless, Cable and Telecom

and Media products and services provided are charged directly to

the revenue for the products and services to which they relate.

We offer certain products and services as part of multiple deliverable

arrangements. We divide multiple deliverable arrangements into

separate units of accounting. Components of multiple deliverable

arrangements are separately accounted for provided the delivered

elements have stand-alone value to the customers and the fair value

of any undelivered elements can be objectively and reliably deter-

mined. Consideration for these units is measured and allocated

amongst the accounting units based upon their fair values and our

relevant revenue recognition policies are applied to them. We rec-

ognize revenue once persuasive evidence of an arrangement exists,

delivery has occurred or services have been rendered, fees are fixed

and determinable and collectibility is reasonably assured.

Unearned revenue includes subscriber deposits, installation fees and

amounts received from subscribers related to services and subscrip-

tions to be provided in future periods.

Subscriber Acquisition and Retention Costs

We operate within a highly-competitive industry and generally incur

significant costs to attract new subscribers and retain existing sub-

scribers. All sales and marketing expenditures related to subscriber

acquisitions, retention and contract renewals, such as commissions,

and the cost associated with the sale of customer premises equip-

ment, are expensed as incurred.

A large percentage of the subscriber acquisition and retention costs,

such as equipment subsidies and commissions, are variable in nature

and directly related to the acquisition or renewal of a subscriber.

In addition, subscriber acquisition and retention costs on a per sub-

scriber acquired basis fluctuate based on the success of promotional

activity and the seasonality of the business. Accordingly, if we expe-

rience significant growth in subscriber activations or renewals during

a period, expenses for that period will increase.

Capitalization of Direct Labour and Overhead

During construction of new assets, direct costs plus a portion of

applicable overhead costs are capitalized. Repairs and maintenance

expenditures are charged to operating expenses as incurred.

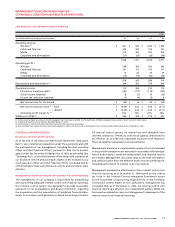

CRITICAL ACCOUNTING ESTIMATES

This MD&A has been prepared with reference to our 2006 Audited

Consolidated Financial Statements and Notes thereto, which have

been prepared in accordance with Canadian GAAP. The preparation

of these financial statements requires management to make esti-

mates and assumptions that affect the reported amounts of assets,

liabilities, revenues and expenses, and the related disclosure of

contingent assets and liabilities. These estimates are based on man-

agement’s historical experience and various other assumptions that

are believed to be reasonable under the circumstances, the results

of which form the basis for making judgments about the reported

amounts of assets, liabilities, revenue and expenses that are not

readily apparent from other sources. Actual results could differ from

those estimates. We believe that the accounting estimates discussed

below are critical to our business operations and an understanding

of our results of operations or may involve additional management

judgment due to the sensitivity of the methods and assumptions

necessary in determining the related asset, liability, revenue and

expense amounts.

Purchase Price Allocations

During 2005, we acquired Call-Net Enterprises Inc. and the Rogers

Centre. The allocations of the purchase prices for these transac-

tions involved considerable judgment in determining the fair values

assigned to the tangible and intangible assets acquired and the

liabilities assumed on acquisition. Among other things, the deter-

mination of these fair values involved the use of discounted cash

flow analyses, estimated future margins, estimated future subscrib-

ers, estimated future royalty rates, the use of information available

in the financial markets and estimates as to costs to close duplicate

facilities and buy out certain contracts. Refer to Note 4 of the 2006

Audited Consolidated Financial Statements for certain updates made

during 2006 to the purchase price allocations. Should actual rates,

cash flows, costs and other items differ from our estimates, this may

necessitate revisions to the carrying value of the related assets and

liabilities acquired, including revisions that may impact net income

in future periods.

Useful Lives of PP&E

We depreciate the cost of PP&E over their respective estimated

useful lives. These estimates of useful lives involve considerable

judgment. In determining the estimates of these useful lives, we

take into account industry trends and company-specific factors,

including changing technologies and expectations for the in-service