Rogers 2006 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 ROG ERS CO MMU N ICAT ION S IN C . 20 0 6 ANN UA L RE PORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

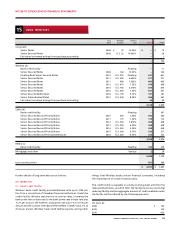

At December 31, 2006, a summary of the stock option plans is as follows:

2006 2005

Weighted Weighted

average average

Number of exercise Number of exercise

options price options price

Outstanding, beginning of year 26,478,848 $ 9.62 36,151,698 $ 9.19

Granted 2,043,900 22.71 1,205,068 18.64

Exercised (7,826,982) 8.80 (10,796,072) 9.28

Forfeited (1,000,906) 12.22 (940,394) 10.68

Exchanged from Call-Net options – – 858,548 12.19

Outstanding, end of year 19,694,860 11.17 26,478,848 9.62

Exercisable, end of year 14,160,866 $ 9.65 19,140,406 $ 9.38

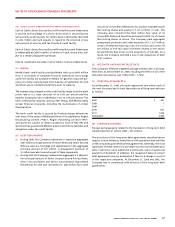

At December 31, 2006, the range of exercise prices, the weighted average exercise price and the weighted average remaining contractual life

are as follows:

Options outstanding Options exercisable

Weighted

average Weighted Weighted

remaining average average

Range of Number contractual exercise Number exercise

exercise prices outstanding life (years) price exercisable price

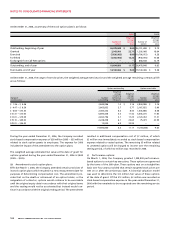

$ 1.36 – $ 4.46 2,844,986 1.0 $ 3.16 2,844,986 $ 3.16

$ 4.47 – $ 6.59 2,663,852 3.7 5.77 2,167,852 5.99

$ 6.60 – $10.30 2,400,332 6.4 8.45 1,445,886 8.58

$10.31 – $13.00 6,893,436 5.5 11.42 5,503,270 11.60

$13.01 – $19.09 2,650,796 3.7 17.25 2,123,453 17.31

$19.10 – $29.00 2,228,458 6.1 22.63 75,419 22.59

$29.01 – $36.00 13,000 6.9 33.95 – –

19,694,860 4.5 11.17 14,160,866 9.65

resulted in additional compensation cost of $7 million, of which

$2 million was immediately recorded as stock-based compensation

expense related to vested options. The remaining $5 million related

to unvested options will be charged to income over the remaining

vesting period, of which $2 million was recorded in 2006.

(c) Performance options:

On March 1, 2006, the Company granted 1,398,800 performance-

based options to certain key executives. These options are governed

by the terms of the 2000 plan. These options vest on a straight-line

basis over four years provided that certain targeted stock prices are

met on or after the anniversary date. A binomial valuation model

was used to determine the $12 million fair value of these options

at the date of grant. Of this $12 million, $2 million was recorded as

stock-based compensation expense in the year ended December 31,

2006 with the remainder to be recognized over the remaining service

period.

During the year ended December 31, 2006, the Company recorded

stock-based compensation expense of $28 million (2005 – $35 million)

related to stock option grants to employees. The expense for 2006

includes the impact of the amendment to the option plans.

The weighted average estimated fair value at the date of grant for

options granted during the year ended December 31, 2006 is $8.89

(2005 – $8.05).

(b) Amendment to stock option plans:

Effective March 1, 2006, the Company amended certain provisions of

its stock option plans which resulted in a new measurement date for

purposes of determining compensation cost. The amendment pro-

vides that on the death or retirement of an option holder, or the

resignation of a director, options would continue to be exercisable

until the original expiry date in accordance with their original terms

and the vesting would not be accelerated but instead would con-

tinue in accordance with the original vesting period. The amendment