Rogers 2006 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 RO G ERS CO MMU NICAT ION S IN C . 20 0 6 ANN UA L RE POR T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

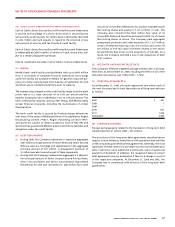

(C ) SUPPLEMENTAL DISCLOSURE OF NON- CASH TRANSACTIONS:

2006 2005

Options to acquire Class B Non-Voting shares issued in exchange for Call-Net options (note 4(b)) $ – $ 8

Class B Non-Voting shares issued in consideration for acquisition of shares of Call-Net (note 4(b)) – 316

Class B Non-Voting shares issued in consideration upon the conversion of convertible debt (note 15(d)) – 271

Class B Non-Voting shares issued in consideration upon the conversion of Preferred Securities (note 15(d)) – 697

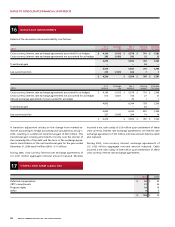

22 REL ATED PARTY TRAN SACTIONS

The Company entered into the following related party transactions:

(A) The Company has entered into certain transactions in the

normal course of business with certain broadcasters in which the

Company has an equity interest. The amounts paid to these broad-

casters are as follows:

2006 2005

Access fees paid to broadcasters accounted for by the equity method $ 19 $ 18

(B) The Company has entered into certain transactions with compa-

nies, the partners or senior officers of which are or were directors of

the Company. Total amounts paid by the Company to these related

parties are as follows:

2006 2005

Legal services and commissions paid on premiums for insurance coverage $ 2 $ 5

Telecommunication and programming services – 2

Interest charges and other financing fees – 22

$ 2 $ 29

(C ) The Company made payments to companies controlled by the

controlling shareholder of the Company as follows:

2006 2005

Charges to the Company for business use of aircraft and other administrative services $ 1 $ 1

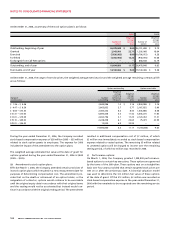

In 2005, with the approval of a Special Committee of the Board of

Directors, the Company entered into an arrangement to sell to the

controlling shareholder of the Company, for $13 million in cash, the

shares in two wholly owned subsidiaries whose only asset consists

of tax losses aggregating approximately $100 million. The Special

Committee was advised by independent counsel and engaged an

accounting firm as part of their review to ensure that the sale price

was within a range that would be fair from a financial point of view.

Further to this arrangement, on April 7, 2006, a company controlled

by the controlling shareholder of the Company purchased the shares

in one of these wholly owned subsidiaries for cash of $7 million. On

July 24, 2006, the shares of the second wholly owned subsidiary were

purchased by a company controlled by the controlling shareholder

for cash of $6 million.

These transactions are recorded at the exchange amount, being the

amount agreed to by the related parties.