Rogers 2006 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108 RO GERS CO MMU NICAT ION S IN C . 20 0 6 ANN UA L RE POR T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

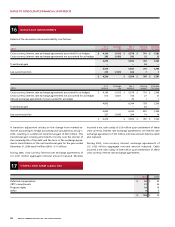

25 CON TING ENT LIA BILI TIES

(A) In August 2004, a proceeding under the Class Actions Act

(Saskatchewan) was brought against Wireless and other providers

of wireless communications services in Canada. The proceeding

involves allegations by Wireless customers of breach of contract,

misrepresentation and false advertising with respect to the sys-

tem access fee charged by Wireless to some of its customers. The

plaintiffs seek unquantified damages from the defendant wireless

communications service providers. Wireless believes it has a good

defence to the allegations. In July 2006, the Saskatchewan court

denied the plaintiffs’ application to have the proceeding certified as

a class action. However, the court granted leave to the plaintiffs to

renew their applications in order to address the requirements of the

Saskatchewan class proceedings legislation. The plaintiff’s application

to address these requirements is set to be heard by the Court on

April 4 and 5, 2007. Similar proceedings have also been brought

against Wireless and other providers of wireless communications in

most of Canada. The Company has not recorded a liability for this

contingency since the likelihood and amount of any potential loss

cannot be reasonably estimated.

In addition, on December 9, 2004, Wireless was served with a court

order compelling it to produce certain records and other informa-

tion relevant to an investigation initiated by the Commissioner of

Competition under the misleading advertising provisions of the

Competition Act with respect to its system access fee.

(B) In April 2004, a proceeding was brought against Fido and others

claiming damages totalling $160 million, specific performance,

breach of contract, breach of confidence and breach of fiduciary duty.

The proceeding is seeking to add Inukshuk Wireless Partnership, the

Company’s 50% owned joint venture, as a party to the action. The pro-

ceeding is at an early stage. The Company believes it has good defences

to the claim and no amounts have been provided in the accounts.

(C ) The Company believes that it has adequately provided for

income taxes based on all of the information that is currently avail-

able. The calculation of income taxes in many cases, however,

requires significant judgment in interpreting tax rules and regula-

tions. The Company’s tax filings are subject to audits which could

materially change the amount of current and future income tax

assets and liabilities, and could, in certain circumstances, result in the

assessment of interest and penalties.

(D) There exist certain other claims and potential claims against

the Company, none of which is expected to have a material adverse

effect on the consolidated financial position of the Company.

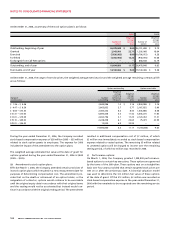

26 CANADIAN AND UNITED STATES

ACCOUNTING POLICY DIFFERENCES

The consolidated financial statements of the Company have been

prepared in accordance with GAAP as applied in Canada. In the

following respects, GAAP, as applied in the United States, differs

from that applied in Canada.

If United States GAAP were employed, net income (loss) for the year

in each year would be adjusted as follows:

2006 2005

Net income (loss) for the year based on Canadian GAAP $ 622 $ (45)

Gain on sale of cable systems (b) (4) (4)

Pre-operating costs capitalized (c) 5 (9)

Equity instruments (d) – 16

Capitalized interest, net (e) 14 3

Financial instruments (h) 19 (286)

Stock-based compensation (i) (2) 14

Income taxes (k) 128 (2)

Installation revenues, net (l) 1 2

Interest expense (m) (2) (3)

Other (1) 1

Net income (loss) for the year based on United States GAAP $ 780 $ (313)

Net income (loss) per share based on United States GAAP:

Basic $ 1.23 $ (0.54)

Diluted 1.22 (0.54)

their services to the Company, and maintains liability insurance for

its directors and officers as well as those of its subsidiaries.

The Company is unable to make a reasonable estimate of the

maximum potential amount it would be required to pay counterpar-

ties. The amount also depends on the outcome of future events and

conditions, which cannot be predicted. No amount has been accrued

in the consolidated balance sheets relating to these types of indem-

nifications or guarantees at December 31, 2006 or 2005. Historically,

the Company has not made any significant payments under these

indemnifications or guarantees.