Rogers 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELIVERING

RESULTS

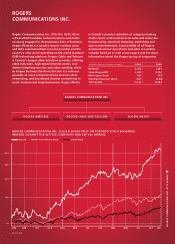

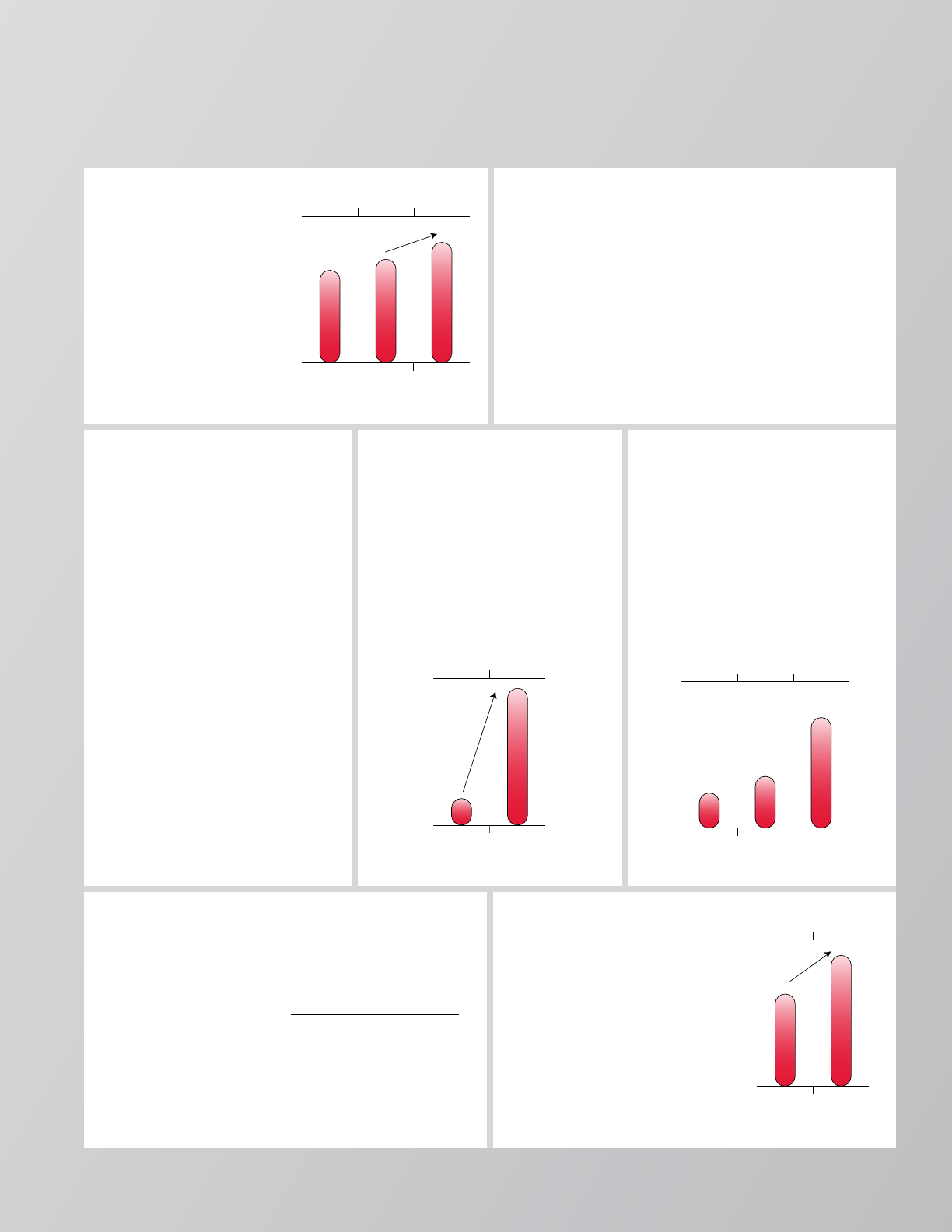

14%

200620052004

$ 8.8$ 7.8

CONSOLIDATED REVENUE

(billions of dollars)

$7.0

Leverage top-line growth with scale efficiencies

and cost containment to deliver operating profit

growth in excess of revenue growth.

WHAT WE SAID:

Delivered 31% pro forma growth in operating profit with

a 428 basis point expansion in operating profit margins.

WHAT WE DID:

31%Operating

Profit Growth

Leverage networks, channels

and brand to drive 11%

pro forma revenue growth.

WHAT WE SAID:

Delivered 14% consolidated

pro forma revenue growth,

with each of Wireless,

Cable and Telecom, and

Media delivering

double-digit growth.

WHAT WE DID:

Continue to strengthen

balance sheet with reduction in

leverage to approximately 3.5 times

debt to operating profit.

WHAT WE SAID:

Reduced balance sheet leverage

to approximately 2.7 times debt

to operating profit with strong

operating profit growth and

debt repayments.

WHAT WE DID:

Significantly accelerate the

deployment of cable telephony

during 2006.

WHAT WE SAID:

Expanded coverage area from 81%

to 90% of cable territory and

grew base of cable telephony

subscribers sevenfold from

48,000 to 366,000.

WHAT WE DID:

41%

20062005

707500

RGUs

Deliver increased growth in cable

revenue generating units (“RGUs”).

WHAT WE SAID:

Cable RGU growth was up 41%

from 2005, led by increased

growth in cable telephony and

basic cable subscribers combined

with continued healthy Internet

and digital cable growth.

WHAT WE DID:

Modestly but consistently

increase dividends over time.

WHAT WE SAID:

Rogers more than

doubles

dividend

for 2007

WHAT WE DID:

200720062005

16¢7.5¢

DIVIDEND RATE

5¢

Drive increased wireless

postpaid ARPU while

continuing to reduce

postpaid churn.

WHAT WE SAID:

Postpaid wireless ARPU

grew by 5.8% while

postpaid churn reduced

from 1.6% to 1.3%.

WHAT WE DID:

ARPU

W5.8%

CHURN

U18%

7X

20062005

36648

CABLE TELEPHONY SUBSCRIBERS

(000s)

Debt Leverage

Reduced

30%

For a detailed discussion of our performance against targets, and our targets for 2007, please see the sections of our 2006 Annual MD&A later in

this report entitled 2006 Performance Against Targets and 2007 Financial and Operating Guidance.