Rogers 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

RO GER S CO MMU NIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

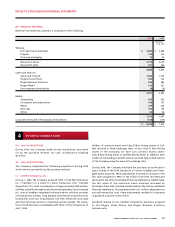

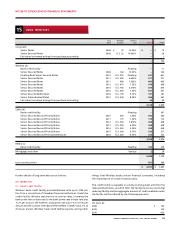

(ii) Senior Secured Second Priority Notes and Debentures:

Each of Cable’s Senior Secured Second Priority Notes and Debentures

is secured by the pledge of a senior bond which is secured by the

same security as the security for Cable’s bank credit facility described

in note 15(b)(i) and rank equally in regard to the proceeds of any

enforcement of security with the Tranche B credit facility.

Each of Cable’s Senior Secured Second Priority Notes and Debentures

is redeemable at Cable’s option, in whole or in part, at any time, sub-

ject to a certain prepayment premium.

Interest is paid semi-annually on all of Cable’s notes and debentures.

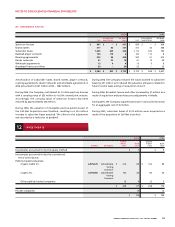

(C ) MEDIA:

Media’s bank credit facility provides Media with up to $600 million

from a consortium of Canadian financial institutions. Borrowings

under this facility are available to Media for general corporate pur-

poses on a fully revolving basis until maturity on September 30, 2010

and there are no scheduled reductions prior to maturity.

The interest rates charged on this credit facility range from the bank

prime rate or U.S. base rate plus nil to 2.0% per annum and the

bankers’ acceptance rate or LIBOR plus 1.0% to 3.0% per annum. The

bank credit facility requires, among other things, that Media satisfy

certain financial covenants, including the maintenance of certain

financial ratios.

The bank credit facility is secured by floating charge debentures

over most of the assets of Media and three of its subsidiaries, Rogers

Broadcasting Limited (“RBL”), Rogers Publishing Limited (“RPL”)

and Sportsnet, subject to certain exceptions. Each of RBL, RPL and

Sportsnet has guaranteed Media’s present and future liabilities and

obligations under the credit facility.

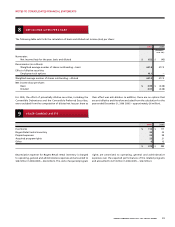

(D) DEBT REPAYMENTS:

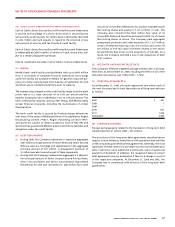

(i) During 2006, the Company redeemed or repaid an aggregate

$261 million principal amount of Senior Notes and Senior Secured

Notes as well as a mortgage and capital leases in the aggregate

principal amount of $25 million. A prepayment premium of

$1 million was also incurred as part of these repayments.

(ii) During 2005, the Company redeemed an aggregate U.S. $606 mil-

lion principal amount of Senior Secured Second Priority Notes,

Senior Secured Notes and Senior Subordinated Guaranteed

Debentures for cash and converted U.S. $225 million face value

amount of Convertible Debentures by issuing 15,432,896 Class B

Non-Voting shares and paying U.S. $0.3 million in cash. The

Company also converted the $600 million face value of its

Convertible Preferred Securities and issued 34,285,714 of Class B

Non-Voting shares in return. The Company paid aggregate

prepayment premiums and other expenses of U.S. $21 million,

wrote off deferred financing costs of $3 million and wrote off

$16 million of the fair value increment related to the Senior

Secured Notes that arose on the acquisition of Call-Net. As a

result, the Company recorded a loss on the repayment of debt

of $11 million.

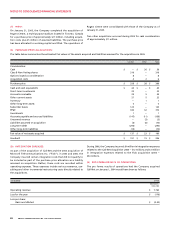

(E) WEIGHTED AVER AGE INTEREST RATE:

The Company’s effective weighted average interest rate on all long-

term debt, as at December 31, 2006, including the effect of all of the

derivative instruments, was 7.98% (2005 – 7.76%).

(F) PRINCIPAL REPAYMENTS:

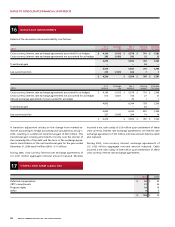

As at December 31, 2006, principal repayments due within each of

the next five years and in total thereafter on all long-term debt are

as follows:

2007 $ 451

2008 1

2009 –

2010 801

2011 1,206

Thereafter 4,493

(G) FOREIGN EXCHANGE:

Foreign exchange gains related to the translation of long-term debt

totalled less than $1 million (2005 – $33 million).

The provisions of the long-term debt agreements described above

impose, in most instances, restrictions on the operations and activities

of the companies governed by these agreements. Generally, the most

significant of these restrictions are debt incurrence and maintenance

tests, restrictions upon additional investments, sales of assets and

payment of dividends. In addition, the repayment dates of certain

debt agreements may be accelerated if there is a change in control

of the respective companies. At December 31, 2006 and 2005, the

Company was in compliance with all terms of the long-term debt

agreements.