Rogers 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 ROG E RS COM MUN I C ATIO NS I NC. 2 0 0 6 A N NUAL R EPO R T

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The remaining increase in rev-

enue is related mainly to the

impact from the growth in

subscribers. With the Internet

subscriber base now at approxi-

mately 1.3 million, Cable and

Telecom has 37.1% penetration

of high-speed Internet ser-

vice as a percentage of homes

passed by its cable networks.

Cable a nd Int e rnet O p erating

Expenses and Operating Profit

Cable and Internet sales and

marketing expenses were at a

level consistent with the prior

year. The increases in operat-

ing, general and administrative

costs compared to the prior

year were driven by the sub-

stantial increase in Cable and

Telecom’s digital cable and

Internet penetration result-

ing in higher costs associated

with programming content,

Internet costs, customer care,

technical service, network, and

engineering costs associated

with the support of the larger

subscriber bases.

The increase in Cable and

Internet operating profit and

operating profit margins from

2005 reflects the growth in

revenue which outpaced the

growth in operating expenses.

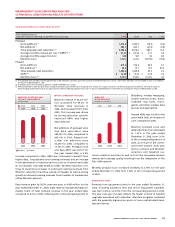

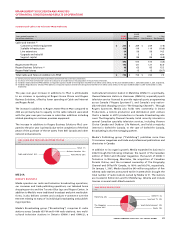

200620052004

1,2911,136931

CABLE INTERNET

SUBSCRIBERS

(In thousands)

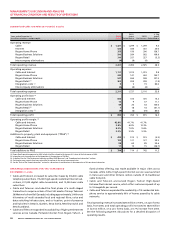

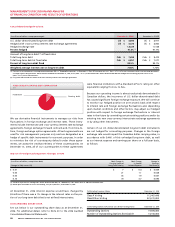

20062005

Pro forma

2004

Pro forma

$890$815$808

CABLE AND TELECOM

OPERATING PROFIT

(In millions of dollars)

ROGERS HOME PHONE

Summarized Financial Results

2005

Years ended December 31, 2006 Actual 2005 % Chg

(In millions of dollars, except margin) Actual Reclassified (2) Pro Forma (3) Pro Forma (3)

Operating revenue $ 355 $ 150 $ 300 18.3

Operating expenses

Sales and marketing expenses 96 27 45 113.3

Operating, general and administrative expenses 249 114 218 14.2

Total operating expenses 345 141 263 31.2

Operating profit (1) $ 10 $ 9 $ 37 (73.0)

Operating profit margin (1) 2.8% 6.0% 12.3%

(1) As defined. See the “Key Performance Indicators and Non-GAAP Measures” and “Supplementary Information” sections.

(2) Certain prior year amounts have been reclassified to conform with the current year presentation.

(3) See the “Basis of Pro Forma Information” section for a discussion of considerations in the preparation of this pro forma information.

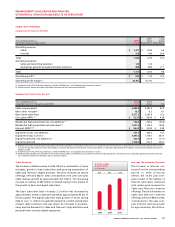

Summarized Subscriber Results

Years ended December 31, 2006 2005 Chg

(Subscriber statistics in thousands) Actual Pro Forma (2) Actual

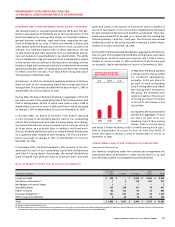

Cable telephony subscriber lines

Net additions (1) 318.0 47.9 270.1

Total cable telephony subscriber lines 365.9 47.9 318.0

Circuit-switched subscriber lines

Net additions (losses and migrations) (1) (41.2) 79.8 (121.0)

Total circuit-switched subscriber lines 349.6 390.8 (41.2)

Total residential telephony subscriber lines 715.5 438.7 276.8

(1) Includes approximately 36,700 migrations from circuit-switched to cable telephony subscriber lines during 2006.

(2) See the “Basis of Pro Forma Information” section for a discussion of considerations in the preparation of this pro forma information.

We believe that the pro forma information for 2005 presented in

this section presents a meaningful comparative analysis given that

Call-Net’s results are consolidated effective as of the July 1, 2005

acquisition date. The following discussion on the Rogers Home

Phone results includes pro forma comparisons for 2005.

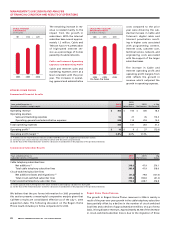

Rogers Home Phone Revenue

The growth in Rogers Home Phone revenues in 2006 is mainly a

result of the year-over-year growth in the cable telephony subscriber

base partially offset by a decline in the number of circuit-switched

local lines and a decline of approximately $18 million, on a pro forma

basis, in long distance revenues. Approximately 36,700 of the decrease

in circuit-switched subscriber lines is due to the migration of those