Rogers 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 ROG E RS COM MUN I C ATIO NS I NC. 2 0 0 6 A N NUAL R EPO R T

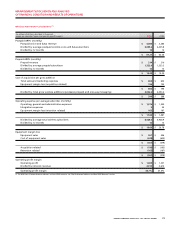

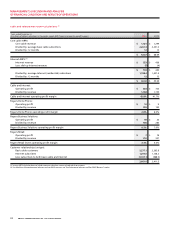

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

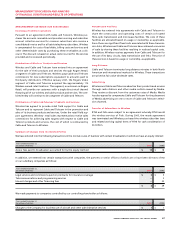

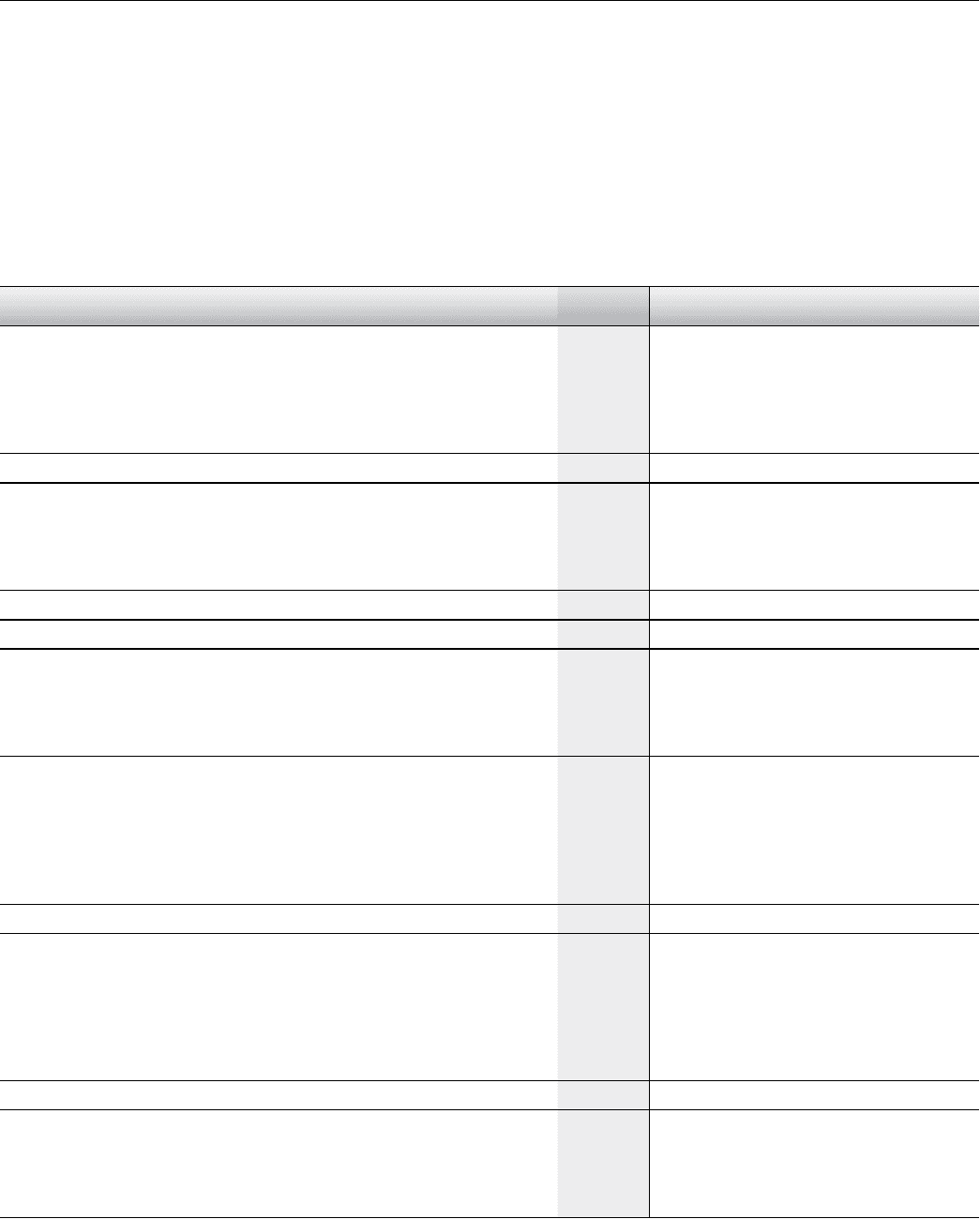

FIVE-YEAR SUMMARY OF CONSOLIDATED FINANC IAL RESULTS

Years ended December 31,

(In millions of dollars, except per share amounts) 2006 2005 2004 2003 2002

Income and Cash Flow:

Revenue

Wireless (1) $ 4,580 $ 3,860 $ 2,689 $ 2,152 $ 1,843

Cable and Telecom 3,201 2,492 1,946 1,788 1,615

Media 1,210 1,097 957 855 811

Corporate and eliminations (153) (115) (78) (59) (50)

$ 8,838 $ 7,334 $ 5,514 $ 4,736 $ 4,219

Operating Profit (2)

Wireless $ 1,969 $ 1,337 $ 950 $ 727 $ 528

Cable and Telecom 890 765 709 663 563

Media 151 128 115 107 88

Corporate and eliminations (135) (86) (41) (51) (37)

$ 2,875 $ 2,144 $ 1,733 $ 1,446 $ 1,142

Net Income (loss) (3)(5) $ 622 $ (45) $ (68) $ 76 $ 260

Cash flow from operations (4) $ 2,386 $ 1,551 $ 1,305 $ 1,031 $ 683

Property, plant and equipment expenditures $ 1,712 $ 1,355 $ 1,055 $ 964 $ 1,262

Average Class A and Class B shares outstanding (Ms) (6) 641.9 577.3 480.8 451.8 427.1

Net income (loss) per share (3)(6) – basic $ 0.99 $ (0.08) $ (0.14) $ 0.17 $ 0.53

– diluted $ 0.97 $ (0.08) $ (0.14) $ 0.16 $ 0.42

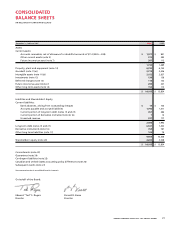

Balance Sheet:

Assets

Property, plant and equipment, net $ 6,732 $ 6,152 $ 5,487 $ 5,039 $ 5,052

Goodwill 2,779 3,036 3,389 1,892 1,892

Intangible assets 2,152 2,627 2,856 400 424

Investments 139 138 139 229 224

Other assets 2,303 1,881 1,402 905 1,115

$ 14,105 $ 13,834 $ 13,273 $ 8,465 $ 8,707

Liabilities and Shareholders’ Equity

Long-term debt (5) $ 6,988 $ 7,739 $ 8,542 $ 5,440 $ 6,319

Accounts payable and other liabilities 2,917 2,567 2,346 1,535 1,273

Future income taxes – – – – 28

Non-controlling interest – – – 193 133

Total liabilities 9,905 10,306 10,888 7,168 7,753

Shareholders’ equity 4,200 3,528 2,385 1,297 954

$ 14,105 $ 13,834 $ 13,273 $ 8,465 $ 8,707

Ratios:

Revenue growth 21% 33% 16% 12% 11%

Operating profit growth 34% 24% 20% 27% 20%

Debt (5)/operating profit 2.4 3.6 4.9 3.8 5.5

Dividends declared per share (6) $ 0.08 $ 0.06 $ 0.05 $ 0.05 $ –

(1) Certain current and prior year amounts related to equipment sales have been reclassified. See “Reclassification of Wireless Equipment Sales and Cost of Sales” section for further details.

(2) Operating profit is defined as income before depreciation, amortization, interest, income taxes, and non-operating items. See “Key Performance Indicators Non-GAAP Measures” section.

(3) Certain prior year amounts related to the adoption of EIC 162 have been restated.

(4) Cash flow from operations before changes in working capital amounts.

(5) Years ended December 31, 2004 and prior have been restated for a change in accounting of foreign exchange translation.

(6) Prior period shares and per share amounts have been retroactively adjusted to reflect a two-for-one-split of the Company’s Class A Voting and Class B Non-Voting shares on December 29, 2006.

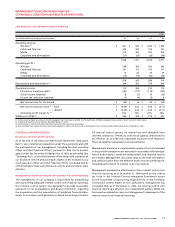

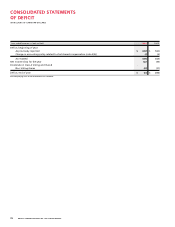

During 2005, with the approval of the Board of Directors, we entered

into an arrangement to sell to our controlling shareholder, for

$13 million in cash, the shares in two wholly owned subsidiaries

whose only asset will consist of tax losses aggregating approximately

$100 million. The terms of the transaction were reviewed and

approved by a Special Committee of the Board of Directors com-

prised of independent directors. The Special Committee was advised

by independent counsel and engaged an accounting firm as part of

their review to ensure that the sale price was within a range that

would be fair from a financial point of view. Further to this arrange-

ment, on April 7, 2006, a company controlled by our controlling

shareholder purchased the shares in one of these wholly owned

subsidiaries for cash of $7 million. On July 24, 2006, the shares of

the second wholly owned subsidiary were purchased by a company

controlled by the controlling shareholder for cash of $6 million.