Rogers 2006 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

RO GER S CO MMU NIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(M) ACQUISITION OF WIRELESS:

At December 31, 2004, the Company acquired the outstanding shares

of Wireless not owned by the Company and exchanged the out-

standing stock options of Wireless for stock options in the Company.

United States GAAP requires that the intrinsic value of the unvested

options issued be determined as of the consummation date of the

transaction and be recorded as deferred compensation. Canadian

GAAP requires that the fair value of unvested options be recorded as

deferred compensation. Under United States GAAP, this results in an

increase in goodwill in the consolidated accounts of the Company of

$6 million, with a corresponding adjustment to contributed surplus.

Under Canadian GAAP, as part of the purchase price equation, the

derivative instruments of Wireless were recorded at their fair value

at the date of acquisition. The fair value increment is amortized to

interest expense over the remaining terms of the derivative instru-

ments. Under United States GAAP, the derivative instruments are

recorded at fair value. Therefore, under United States GAAP, the

fair value increment related to derivative instruments is reduced by

$20 million with an offsetting decrease to goodwill. As a conse-

quence, the amortization of the fair value increment is not required

under United States GAAP.

(N) CONSOLIDATED STATEMENTS OF C ASH FLOWS:

(i) Canadian GAAP permits the disclosure of a subtotal of the

amount of funds provided by operations before change in non-

cash operating items in the consolidated statements of cash

flows. United States GAAP does not permit this subtotal to

be included.

(ii) Canadian GAAP permits bank advances to be included in the

determination of cash and cash equivalents in the consolidated

statements of cash flows. United States GAAP requires that bank

advances be reported as financing cash flows. As a result, under

United States GAAP, the total increase in cash and cash equivalents

in 2006 in the amount of $85 million reflected in the consolidated

statements of cash flows would be decreased by $85 million and

financing activities cash flows would decrease by $85 million.

The total decrease in cash and cash equivalents in 2005 in the

amount of $348 million reflected in the consolidated statements

of cash flows would be decreased by $104 million and financing

activities cash flows would be increased by $104 million.

(O) CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME (LOSS):

United States GAAP requires the disclosure of a statement of com-

prehensive income (loss). Comprehensive income (loss) generally

encompasses all changes in shareholders’ equity, except those arising

from transactions with shareholders.

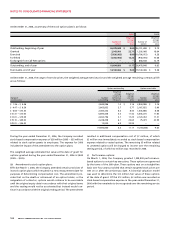

2006 2005

Net income (loss) based on United States GAAP $ 780 $ (313)

Other comprehensive income, net of income taxes:

Unrealized holding gains (losses) arising during the year 71 (1)

Realized gains included in income, net of income taxes – (10)

Minimum pension liability, net of income taxes (3) –

Comprehensive income (loss) based on United States GAAP $ 848 $ (324)

(P) OTHER DISCLOSURES:

United States GAAP requires the Company to disclose accrued liabili-

ties, which is not required under Canadian GAAP. Accrued liabilities

included in accounts payable and accrued liabilities as at December 31,

2006 were $1,287 million (2005 – $1,069 million). At December 31,

2006, accrued liabilities in respect of PP&E totalled $153 million

(2005 – $104 million), accrued interest payable totalled $109 million

(2005 – $113 million), accrued liabilities related to payroll totalled

$234 million (2005 – $177 million), and CRTC commitments totalled

$9 million (2005 – $40 million).

(Q) PENSIONS:

The Company implemented SFAS No. 132, Employers Disclosures

about Pensions and Other Post-retirement Benefits – an amend-

ment of FASB Statements No. 87, 88 and 106, in 2004. The following

summarizes the additional disclosures required and different pension-

related amounts recognized or disclosed in the Company’s accounts

under United States GAAP: