Rogers 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 R OGE RS COM MUN I C ATIO NS I NC . 2 0 0 6 AN NUAL R EPO R T

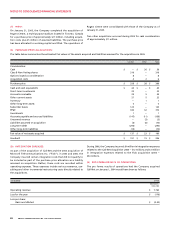

and has reclassified prior year figures to reflect this accounting,

resulting in a $148 million reduction of both revenue and cost

of sales in 2005. As a result of this reclassification, there was

no change to previously reported net income (loss), operating

income, reported cash flows or the amounts recorded in the

consolidated balance sheets.

(iv) In 2006, the Company adopted the provisions of Emerging Issues

Committee (“EIC”) Abstract 162, Stock-Based Compensation for

Employees Eligible to Retire Before the Vesting Date. Where a

stock-based compensation plan contains provisions that allow an

employee to continue vesting in a stock-based award after the

employee has retired, EIC 162 requires that the compensation

cost attributable to such an award be expensed immediately

for employees who are eligible to retire at the date of grant.

For an employee who will become eligible to retire during the

vesting period of an award, EIC 162 requires that compensation

cost be recognized as an expense over the period from the date

of grant to the date the employee becomes eligible to retire.

EIC 162 was applied retroactively to all stock-based compensa-

tion awards, with restatement of prior periods. The adoption of

EIC 162 resulted in an increase in the opening 2005 deficit and

contributed surplus of $4 million and an increase in 2005 stock-

based compensation expense of less than $1 million. For 2006,

the adoption of EIC 162 resulted in incremental stock-based

compensation of less than $1 million from that which would

otherwise have been recorded.

Certain other comparative figures have been reclassified to conform

with the current year’s presentation.

(C ) REVENUE RECOGNITION:

The Company’s principal sources of revenue and recognition of these

revenues for financial statement purposes are as follows:

(i) Monthly subscriber fees in connection with wireless and wireline

services, cable, telephony, Internet services, rental of equip-

ment, network services and media subscriptions are recorded as

revenue on a pro rata basis as the service is provided;

(ii) Revenue from airtime, roaming, long-distance and optional ser-

vices, pay-per-use services, video rentals, and other sales of products

are recorded as revenue as the services or products are delivered;

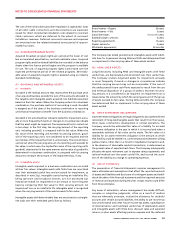

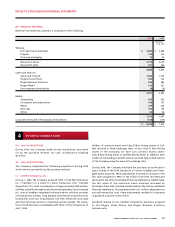

1 NAT URE OF THE BUSI NESS

Rogers Communications Inc. (“RCI”) is a Canadian communications

company, with substantially all of its operations and sales in Canada,

engaged in wireless voice, messaging and data services through

its wholly owned subsidiary, Rogers Wireless Communications Inc.

(“Wireless”); cable television, high-speed Internet access, cable

and circuit-switch telephony, data networking and video retailing

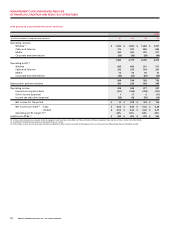

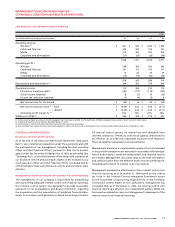

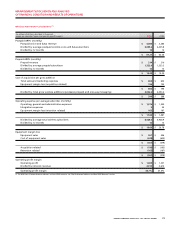

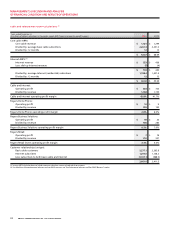

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

(TABUL AR AMOUN T S IN MILLIONS OF C A NADIAN DOLL ARS , EXCEPT PE R SHA RE AM OUNTS)

YEAR S END ED DECEMBER 31, 2006 AND 2005

(“Rogers Retail”) through its wholly owned subsidiary, Rogers Cable

Inc. (“Cable”); and radio and television broadcasting, televised home

shopping, publishing, and sports entertainment through its wholly

owned subsidiary, Rogers Media Inc. (“Media”). RCI and its subsid-

iary companies are collectively referred to herein as the “Company”.

2 SIG NIFICANT AC COUN TING POLICI ES

(A) BASIS OF PRESENTATION:

The consolidated financial statements are prepared in accordance

with Canadian generally accepted accounting principles (“GAAP”)

and differ in certain significant respects from United States GAAP as

described in note 26.

The consolidated financial statements include the accounts of RCI

and its subsidiary companies. Intercompany transactions and bal-

ances are eliminated on consolidation.

Investments over which the Company is able to exercise significant

influence are accounted for by the equity method. Investments over

which the Company has joint control are accounted for by the pro-

portionate consolidation method. Other investments are recorded

at cost. Investments are written down when there is evidence that a

decline in value that is other than temporary has occurred.

(B) RESTATEMENT AND RECL ASSIFICATION OF COMPARATIVE

FIGURES:

(i) Applicable share and per share amounts have been retroactively

adjusted to reflect a two-for-one split of the Company’s Class A

Voting and Class B Non-Voting shares in December 2006. This

stock split is described in note 20(a)(ii).

(ii) During 2006, the Company completed a reorganization whereby

ownership of the operating subsidiaries of Rogers Telecom

Holdings Inc., a wholly owned subsidiary of the Company, was

transferred to Cable. The reorganization impacted the Company’s

management reporting resulting in changes to the Company’s

reportable segments. Effective January 2006, the following are

the reportable segments of the Company: Wireless, Media, Cable

and Internet, Rogers Business Solutions, Rogers Home Phone and

Rogers Retail (formerly known as Rogers Video). Comparative

figures are presented on this basis in note 3.

Effective 2007, Rogers Retail will be responsible for the opera-

tion of all retail stores owned by the Company.

(iii) During 2006, the Company determined that certain transactions

related to the sale of wireless equipment were historically

recorded as cost of equipment sales rather than as a reduction

of equipment revenue. The Company determined these transac-

tions should be reflected as a reduction of equipment revenue