Rogers 2006 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 R OGE RS COM MUN I C ATIO NS I NC . 2 0 0 6 AN NUAL R EPO R T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

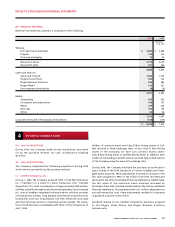

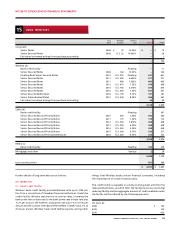

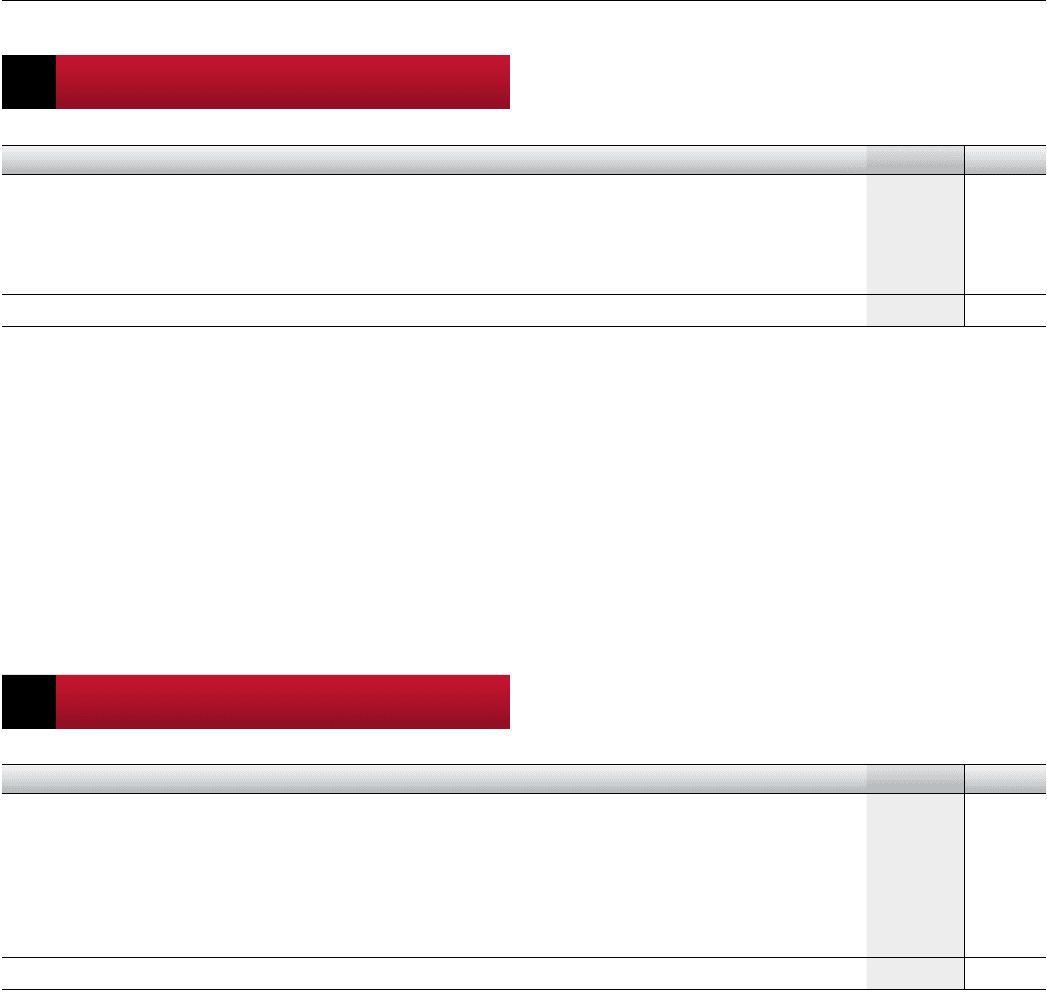

13 D EFERRED CHA RGES

2006 2005

Financing costs $ 59 $ 67

Pre-operating costs 8 12

CRTC commitments 23 34

Deferred installation costs (note 2(c)(iv)) 17 8

Other 11 11

$ 118 $ 132

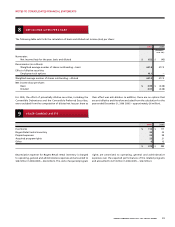

of $75 million in operating funds to provide certain benefits to the

Canadian broadcasting system. In prior years, the Company agreed

to pay $50 million in public benefits over seven years relating to the

CRTC grant of a new television licence in Toronto, $6 million relating

to the purchase of 13 radio stations and the remainder relating

to a CRTC decision permitting the purchase of Rogers Sportsnet

Inc. (“Sportsnet”), Rogers (Toronto) Ltd. and Rogers (Alberta) Ltd.

The amount of these liabilities, included in accounts payable and

accrued liabilities and other long-term liabilities, is $32 million at

December 31, 2006 (2005 – $40 million). Deferred charges related to

these commitments are being amortized over periods ranging from

six to seven years.

Amortization of deferred charges for 2006 amounted to $25 million

(2005 – $35 million). Accumulated amortization as at December 31,

2006 amounted to $121 million (2005 – $116 million).

Financing costs of $5 million were deferred in connection with the

amendments to certain credit facilities in 2005.

In connection with the repayment of certain long-term debt during

2005, and amendments made to certain credit facilities, the Company

wrote off deferred financing costs of $3 million (note 15(d)).

The Company has committed to the Canadian Radio-television and

Telecommunications Commission (“CRTC”) to spend an aggregate

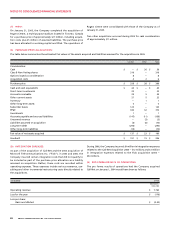

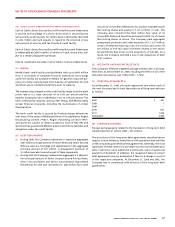

14 O THER LONG-T ERM ASSETS

\

2006 2005

Deferred pension asset (note 19) $ 34 $ 32

Program rights 26 23

Long-term deposits 32 –

Long-term receivables 10 2

Indefeasible right of use agreement 16 26

Cash surrender value of life insurance 14 14

Other 20 16

$ 152 $ 113