Rogers 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

RO GER S CO MMU NIC AT ION S IN C . 20 0 6 ANN UA L RE POR T

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

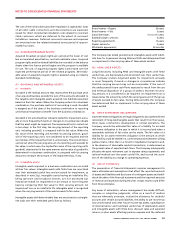

(iii) Revenue from the sale of wireless and cable equipment is

recorded when the equipment is delivered and accepted by

the independent dealer or subscriber in the case of direct sales.

Equipment subsidies related to new and existing subscribers are

recorded as a reduction of equipment revenues;

(iv) Installation fees and activation fees charged to subscribers

do not meet the criteria as a separate unit of accounting. As

a result, in Wireless these fees are recorded as part of equip-

ment revenue or, in Cable, are deferred and amortized over

the related service period. The related service period for Cable

ranges from 26 to 48 months, based on subscriber disconnects,

transfers of service and moves. Incremental direct installation

costs related to reconnects are deferred to the extent of

deferred installation fees and amortized over the same period

as these related installation fees. New connect installation costs

are capitalized to property, plant and equipment (“PP&E”) and

amortized over the useful life of the related assets;

(v) Advertising revenue is recorded in the period the advertis-

ing airs on the Company’s radio or television stations and the

period in which advertising is featured in the Company’s media

publications;

(vi) Monthly subscription revenues received by television stations

for subscriptions from cable and satellite providers are recorded

in the month in which they are earned;

(vii) The Toronto Blue Jays Baseball Club’s (“Blue Jays”) revenue

from home game admission and concessions is recognized as the

related games are played during the baseball regular season.

Revenue from radio and television agreements is recorded at

the time the related games are aired. The Blue Jays also receive

revenue from the Major League Baseball Revenue Sharing

Agreement which distributes funds to and from member clubs,

based on each club’s revenues. This revenue is recognized in the

season in which it is earned, when the amount is estimable and

collectibility is reasonably assured; and

(viii) Multi-product discounts incurred as Wireless, Cable and Media

products and services are provided are charged directly to the

revenue for the products and services to which they relate.

The Company offers certain products and services as part of multiple

deliverable arrangements. The Company divides multiple deliver-

able arrangements into separate units of accounting. Components

of multiple deliverable arrangements are separately accounted

for provided the delivered elements have stand-alone value to the

customers and the fair value of any undelivered elements can be

objectively and reliably determined. Consideration for these units is

measured and allocated amongst the accounting units based upon

their fair values and the Company’s relevant revenue recognition

policies are applied to them. The Company recognizes revenue once

persuasive evidence of an arrangement exists, delivery has occurred

or services have been rendered, fees are fixed and determinable and

collectibility is reasonably assured.

Unearned revenue includes subscriber deposits, installation fees and

amounts received from subscribers related to services and subscrip-

tions to be provided in future periods.

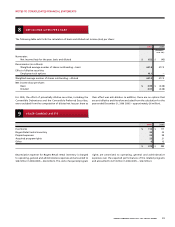

(D) SUBSCRIBER ACQUISITION AND RETENTION COSTS:

Except as described in note 2(c)(iv), as it relates to cable installation

costs, the Company expenses the costs related to the acquisition or

retention of subscribers.

(E) STOCK-BASED COMPENSATION AND OTHER STOCK- BASED

PAYMENTS:

The Company accounts for all stock option plans using the fair value

method. The estimated fair value is amortized to expense over the

period in which the related services are rendered, which is usually

the vesting period or, as applicable, over the period to the date an

employee is eligible to retire, whichever is shorter.

Stock-based awards that are settled in cash, may be settled in cash at

the option of employees or directors, or that the Company intends

to settle in cash, including restricted stock units and directors’

deferred share units, are recorded as liabilities. The measurement of

the liability and compensation cost for these awards is based on the

intrinsic value of the awards. Compensation cost for the awards is

recorded in income over the vesting period of the award. Changes

in the Company’s payment obligation during the vesting period

are recorded in income over the vesting period. Changes in the

Company’s payment obligation after the vesting period but prior to

the settlement date are recognized immediately in income. The pay-

ment amount is established for these awards on the date of exercise

of the award by the employee or director.

Under the terms of the Company’s employee share accumulation

plan, participating employees can contribute a specified percentage

of their regular earnings through regular payroll deductions which

are then used to purchase Class B Non-Voting shares of the Company.

On a quarterly basis, the Company makes certain defined contribu-

tion matches, which are recorded as compensation expense.

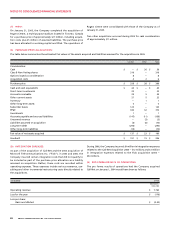

(F) DEPRECIATION:

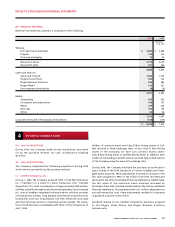

PP&E and Rogers Retail rental inventory are depreciated over their

estimated useful lives as follows:

Asset Basis Rate

Buildings Mainly diminishing balance 5% to 62/3%

Towers, headends and transmitters Straight line 62/3% to 25%

Distribution cable and subscriber drops Straight line 5% to 20%

Network equipment Straight line 62/3% to 331/3%

Wireless network radio base station equipment Straight line 121/2% to 141/3%

Computer equipment and software Straight line 141/3% to 331/3%

Customer equipment Straight line 20% to 331/3%

Leasehold improvements Straight line Over shorter of estimated

useful life and lease term

Rogers Retail rental inventory Mainly diminishing balance 6 months

Other Mainly diminishing balance 20% to 331/3%