Rogers 2003 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report Rogers Communications Inc.

96

Notes to Consolidated Financial Statements

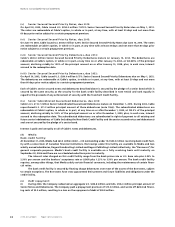

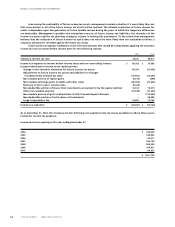

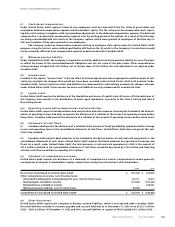

In assessing the realizability of future income tax assets, management considers whether it is more likely than not

that some portion or all of the future income tax assets will be realized. The ultimate realization of future income tax

assets is dependent upon the generation of future taxable income during the years in which the temporary differences

are deductible. Management considers the scheduled reversals of future income tax liabilities, the character of the

income tax assets and the tax planning strategies in place in making this assessment. To the extent that management

believes that the realization of future income tax assets does not meet the more likely than not realization criterion, a

valuation allowance is recorded against the future tax assets.

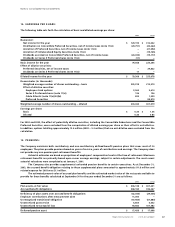

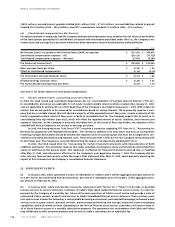

Total income tax expense (reduction) varies from the amounts that would be computed by applying the statutory

income tax rate to income before income taxes for the following reasons:

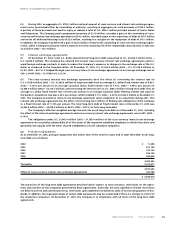

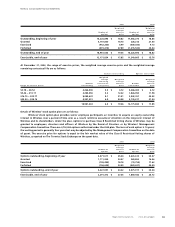

2003 2002

Statutory income tax rate 36.6% 38.6%

Income tax expense on income before income taxes and non-controlling interest $ 60,302 $ 75,683

Increase (decrease) in income taxes resulting from:

Change in the valuation allowance for future income tax assets 46,267 (13,630)

Adjustments to future income tax assets and liabilities for changes

in substantively enacted tax rates (70,502) (13,243)

Non-taxable portion of capital gains (9,610) (398)

Non-taxable exchange gains on debts and other items (46,954) (21,626)

Recovery of prior years’ income taxes (9,206) –

Non-deductible portion of losses from investments accounted for by the equity method 10,514 19,419

Other non-taxable amounts (14,549) (17,230)

Non-taxable portion of gain on disposition of AT&T Canada Deposit Receipts – (174,542)

Non-deductible portion of write-down of investments – 58,089

Large Corporations Tax 10,881 12,748

Income tax reduction $ (22,857) $ (74,730)

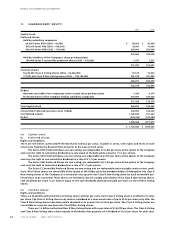

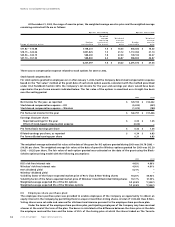

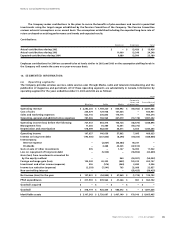

As at December 31, 2003, the Company has the following non-capital income tax losses available to reduce future years

income for income tax purposes:

Income tax losses expiring in the year ending December 31:

2004 $ 298,225

2005 166,962

2006 54,311

2007 335,128

2008 585,299

2009 146,871

2010 64,957

$ 1,651,753