Rogers 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report Rogers Communications Inc.

44

opportunities for mobile wireless operators to deploy hybrid high-mobility 3G and limited-mobility Wi-Fi networks, each

providing capacity and coverage under the appropriate circumstances.

WIRELESS REGULATORY DEVELOPMENTS

Contribution Funding Mechanism

In November 2000, the CRTC released a decision that fundamentally altered the mechanism used by the CRTC to collect

“contributions” to subsidize the provision of basic local wireline telephone service. Previously, the contribution was

levied on a per minute basis on long-distance services. Under the new contribution regime, which became effective

January 1, 2001, all telecommunications service providers, including wireless service providers such as Wireless, are

required to contribute a percentage of their adjusted Canadian telecommunications service revenues to a fund established

to subsidize the provision of basic local service. The percentage contribution levy was 4.5% in 2001 and 1.3% for 2002.

In 2003, an interim rate of 1.3% was set and in December 2003 the final rate was reduced to 1.1%, retroactive to January 1,

2003. The interim rate for 2004 has been set at 1.1% and the final rate for 2004 will not likely be set until December 2004.

The final rate for 2004 would likely be retroactive to January 1, 2004. (Refer to the “Wireless Risks and Uncertainties –

CRTC Revenue-based Contribution Scheme” section for further information on the CRTC contribution levy.)

Spectrum Fee Assessment Revision

Late in 2002, Industry Canada released a consultation paper proposing a new methodology for calculating spectrum fee

assessments (excluding auction spectrum). Spectrum fees are currently assessed on a per radio channel basis in the case

of 850 MHz spectrum and a per site basis for 1900 MHz spectrum. The new regime proposes an annual cost per MHz per

population for both frequency ranges, and, as a result, fees will be based on the amount of spectrum held by the carrier,

regardless of the degree of deployment or the number of sites. The final rate established by Industry Canada in December

2003 is considerably lower than the rate initially proposed. The new rates come into effect on April 1, 2004. As a result of

the new methodology, there is a nominal increase in annual spectrum fees for Rogers Wireless that will be phased in over

a seven-year period to 2011.

Spectrum Licence Issues

Late in 2003, Industry Canada released a policy document regarding a number of spectrum issues, including a discussion

on the existing spectrum cap, spectrum allocations for 3G networks and possible timing of a 3G spectrum auction.

Industry Canada has proposed a possible spectrum auction date of 2005 to 2006 for this spectrum. The FCC is expected to

auction similar spectrum in the 2004 to 2005 period. Wireless expects that Industry Canada will follow the spectrum allo-

cation of the FCC and will likely proceed with the auction in the 2005 to 2006 timeframe. A final determination on all these

matters is not expected until late 2004.

Fixed Wireless Spectrum Auction

Industry Canada announced its intention to auction one block of 30 MHz of spectrum in the 2300 MHz band, as well as

three blocks of 50 MHz of spectrum and one block of 25 MHz of spectrum in the 3500 MHz band. The auction was com-

pleted on February 16, 2004. There were over 172 geographic licence areas in Canada for each available block. Successful

bidders for the spectrum had flexibility in determining the services to be offered and the technologies to be deployed in

the spectrum. Industry Canada expects that the spectrum will be used for point-to-point or point-to-multi-point broad-

band services. Rogers Wireless participated in this spectrum auction and as a result, has committed to acquire 33 blocks of

spectrum in various licence areas for an aggregate bid price of $5.9 million.

WIRELESS COMPETITION

At the end of 2003, the highly competitive Canadian wireless industry had approximately 13.4 million wireless sub-

scribers. Competition for wireless subscribers is based on price, scope of services, service coverage, quality of service,

sophistication of wireless technology, breadth of distribution, selection of equipment, brand and marketing.

In the wireless voice and data market, Wireless competes primarily with three other wireless service providers,

and Wireless may in the future compete with other companies, including resellers, using existing or emerging wireless

technologies such as Wi-Fi or “hotspots”. Wireless messaging (or one-way paging) also competes with a number of local

and national paging providers.

In 2003, one of Wireless’ competitors, Microcell Telecommunications Inc. (“Microcell”), which operates under the

“Fido” brand, restructured its business and financing pursuant to the Companies’ Creditors Arrangement Act (Canada)

and has emerged from court protection with a significantly reduced debt load. This recapitalization may permit Microcell

to compete in the market more vigorously than it had prior to its restructuring.

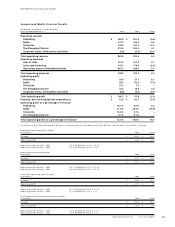

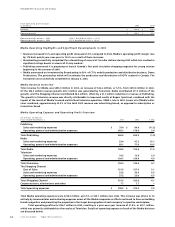

Management’s Discussion and Analysis