Rogers 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual ReportRogers Communications Inc. 57

Exposure to Paper, Printing and Postage Costs

A significant portion of Publishing’s operating expenses consist of paper, printing and postage expenses. Paper is

Publishing’s single largest raw material expense, representing approximately 5.7% of Publishing’s operating expenses in

2003. Publishing depends upon outside suppliers for all of its paper supplies, holds relatively small quantities of paper in

stock itself, and is unable to control paper prices, which can fluctuate considerably. Moreover, Publishing is generally

unable to pass paper cost increases on to customers. Printing costs represented approximately 10% of Publishing’s operat-

ing expenses in 2003. Publishing relies on third parties for all of its printing services. In addition, Publishing relies on the

Canadian Postal Service to distribute a large percentage of its publications. A material increase in paper prices, printing

costs or postage could have a material adverse effect on Publishing’s business, results of operations or financial condition.

Potential Impacts from Regulatory Decisions

Media expects the CRTC to review the Commercial Radio Policy 1998 in 2005 to address issues such as multiple licence

ownership and Canadian content. In the interim, the CRTC will review satellite radio issues, including the establishment

of a satellite radio policy and licensing framework.

The CRTC has released its digital television policy, covering issues such as priority carriage and simultaneous sub-

stitution. Media believes that the CRTC policy provides an effective framework for the growth and development of digital

television broadcasting in Canada. A forthcoming CRTC consultation also will seek to establish a framework for the tran-

sition or migration of analog to digital for specialty services.

The cable and telecommunications industries in Canada generally promote the easing or elimination of foreign

ownership restrictions. If successful, the easing or elimination of such ownership restrictions may cause or require inte-

grated communications companies, such as the Company, to establish a separate ownership structure for their

broadcasting content entities.

Copyright liability pressures continue to affect radio and television services. The Copyright Board is considering

proposed changes to both Tariff 2 (Broadcast TV) and Tariff 17 (Non-broadcast TV). While the Society of Composers,

Authors and Music Publishers of Canada (“SOCAN”) has sought tariff increases for each of these tariffs, certain specialty

services, including Rogers Sportsnet, also have sought tariff payment adjustments that explicitly recognize the differing

value of music for different genres of services. SOCAN and the Neighbouring Rights Collective Society (“NRCC”) also have

proposed increases to each of their respective radio tariffs, with the NRCC also seeking to eliminate important revenue

threshold and all-talk station tariff payment exemptions.

In a January 2004 decision, the CRTC renewed the broadcasting licence for Rogers Sportsnet. Although no other

expenditure or programming requirements were imposed and a certain degree of additional programming flexibility was

afforded, the renewal denied a proposed increase to Rogers Sportsnet’s basic wholesale fee. Rogers Sportsnet’s basic

rate will remain at $0.78. Although a strong majority of Rogers Sportsnet subscribers are not on basic, the basic rate can

also influence rate negotiations for carriage of Rogers Sportsnet on discretionary tiers. With TSN’s rate at $1.07, Rogers

Sportsnet will continue to operate with a comparative disadvantage to TSN.

Pressures regarding the favourable channel placement of The Shopping Channel below the first cable tier will

likely increase. The CRTC is currently considering a policy change which could require cable BDUs to carry mandatory ser-

vices (i.e. APTN, CPAC and TVA) below the first cable tier. This decision, along with the licensing of new local TV stations,

has the potential to affect The Shopping Channel’s placement in some cable systems.

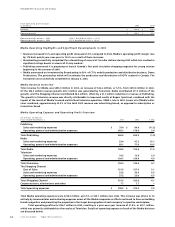

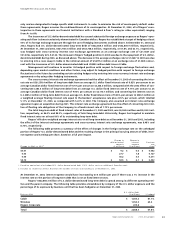

CONSOLIDATED LIQUIDITY AND CAPITAL RESOURCES

This discussion is based upon the Company’s annual Audited Consolidated Statements of Income and the Consolidated

Statements of Cash Flows.

Rogers has consistently invested in upgrading and expanding its networks and communications businesses over

time, as well as in developing and deploying new communications service initiatives, all of which are highly capital inten-

sive. Mainly as a result of these PP&E expenditures and the significant amount of debt used to help fund these initiatives

and expenditures, interest expense has remained high and resulted in cash shortfalls.

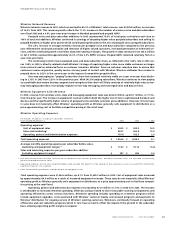

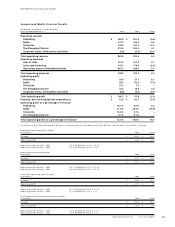

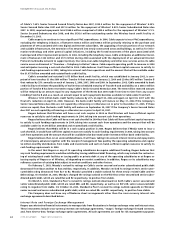

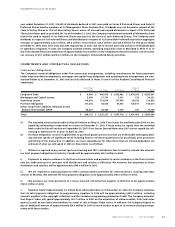

Rogers’ net income for the year ended December 31, 2003, was $129.2 million compared to net income of

$312.0 million in the prior fiscal year ended December 31, 2002. The reduction in net income of $182.8 million in 2003 is rec-

onciled as follows with non-bracketed numbers denoting changes increasing net income and bracketed items reducing

net income:

Management’s Discussion and Analysis