Rogers 2003 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

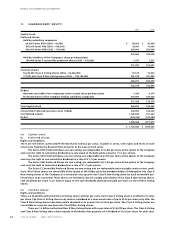

2003 Annual ReportRogers Communications Inc. 95

Notes to Consolidated Financial Statements

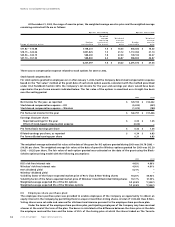

Stock Exchange on the trading day immediately prior to the purchase date or the closing price on a date that is approxi-

mately one year subsequent to the original issue date.

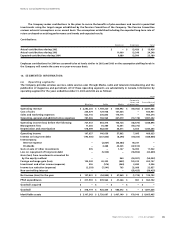

During 2003, no Class B Non-Voting shares (2002 – 339,100) were issued under the Company’s employee share pur-

chase plan (cash in 2002 of $4.8 million). Compensation expense recorded for the Company’s employee share purchase

plan for 2003 was $0.6 million (2002 – $2.2 million).

In addition, employees of Wireless may participate in Wireless’ employees share purchase plan. During 2003, no

Wireless Class B Restricted Voting shares (2002 – 135,325) were issued under the Wireless employee share purchase plan

(cash in 2002 of $1.9 million). Compensation expense recorded in Wireless for 2003 was $0.3 million (2002 – $1.0 million).

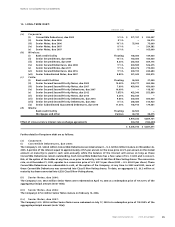

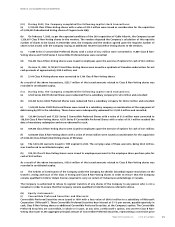

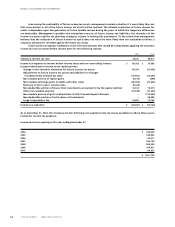

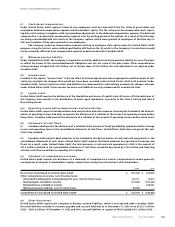

12. OTHER EXPENSE (RECOVERY):

2002

Workforce reduction costs (a) $ 5,850

Wireless – change in estimate of sales tax liability (b) (19,157)

Wireless – CRTC contribution liabilities (c) 6,826

$ (6,481)

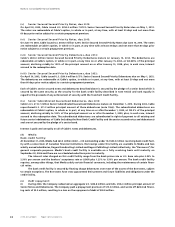

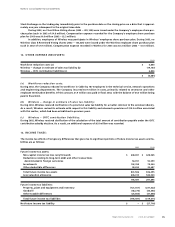

(a) Workforce reduction costs:

During 2002, the Company reduced its workforce in Cable by 187 employees in the technical service, network operations

and engineering departments. The Company incurred $5.9 million in costs, primarily related to severance and other

employee termination benefits. Of this amount, $1.9 million was paid in fiscal 2002, with the balance of $4.0 million being

paid in fiscal 2003.

(b) Wireless – change in estimate of sales tax liability:

During 2002, Wireless received clarification of a provincial sales tax liability for a matter common to the wireless industry.

As a result, Wireless revised its estimate with respect to this liability and released a provision of $19.2 million associated

with this matter, which had been established in previous years.

(c) Wireless – CRTC contribution liabilities:

During 2002, Wireless received clarification of the calculation of the total amount of contribution payable under the CRTC

contribution subsidy decision. As a result, an additional expense of $6.8 million was recorded.

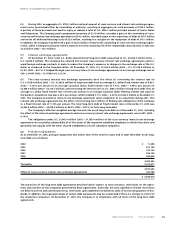

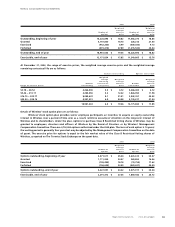

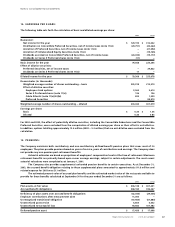

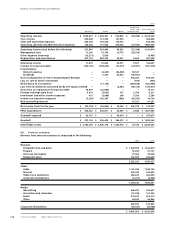

13. INCOME TAXES:

The income tax effects of temporary differences that give rise to significant portions of future income tax assets and lia-

bilities are as follows:

2003 2002

Future income tax assets:

Non-capital income tax loss carryforwards $ 608,691 $ 628,565

Deductions relating to long-term debt and other transactions

denominated in foreign currencies 50,391 92,599

Investments 103,769 79,544

Other deductible differences 38,655 35,687

Total future income tax assets 801,506 836,395

Less valuation allowance 606,015 544,500

195,491 291,895

Future income tax liabilities:

Property, plant and equipment and inventory (121,351) (237,422)

Goodwill (48,276) (34,343)

Other taxable differences (25,864) (47,846)

Total future income tax liabilities (195,491) (319,611)

Net future income tax liability $ – $ (27,716)