Rogers 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual ReportRogers Communications Inc. 51

ROGERS MEDIA

MEDIA OVERVIEW

Rogers Media holds Rogers’ radio and television broadcasting operations, its consumer and trade publishing operations

and its televised home shopping service. The Broadcasting group (“Broadcasting”) comprises 43 radio stations across

Canada (32 FM and 11 AM radio stations), two multicultural television stations in Ontario (OMNI.1 and OMNI.2), an 80%

interest in a sports specialty service licenced to provide regional sports programming across Canada (“Rogers Sportsnet”),

and Canada’s only nationally televised shopping service (“The Shopping Channel”). Broadcasting holds minority interests

in several Canadian specialty television services, including Viewers Choice Canada, Outdoor Life Network (“OLN”), TechTV

Canada, The Biography Channel Canada, MSNBC Canada and certain other minority interest investments. The Publishing

group (“Publishing”) produces approximately 70 consumer magazines and trade and professional publications and direc-

tories. In addition to its more traditional broadcast and print media platforms, the Media group also delivers content over

the Internet relating to many of its individual broadcasting and publishing properties.

MEDIA STRATEGY OVERVIEW

Media seeks to maximize revenues, operating profit and return on invested capital across each of its businesses. Media’s

strategies to achieve this objective include:

• focusing on specialized content and audiences through continued development of its portfolio of specialty channel

investments, radio properties and publications;

• continuing to leverage its strong brand names to increase advertising and subscription revenues, assisted by the cross-

promotion of its properties both across its media formats and in association with the “Rogers” brand; and

• focusing on growth and continuing to cross-sell advertising and share content across its properties and over its multiple

media platforms.

MEDIA SEASONALITY

Media’s operating results are subject to seasonal fluctuations that materially impact quarter-to-quarter operating results.

As a result, one quarter’s operating results are not necessarily indicative of what a subsequent quarter’s operating results

will be. The fourth quarter is generally the strongest quarter due to increased consumer activity and subscriber activa-

tions, as well as greater seasonal advertising activity. Media seasonality is a result of fluctuations in advertising and

related retail cycles as they relate to periods of increased consumer activity.

RECENT MEDIA INDUSTRY TRENDS

Increased Radio/TV Ownership Fragmentation

In recent years, Canadian radio and television broadcasters have had to operate in increasingly fragmented markets.

Canadian consumers have a growing number of radio and television services available to them, providing them with an

increasing number of different programming formats. In the radio industry, since the introduction of its Commercial

Radio Policy in 1998, the CRTC has licenced 48 new radio stations through competitive processes in markets across Canada.

In that time, the CRTC also has licenced a large number of additional new FM stations through AM to FM station conver-

sions or other non-competitive processes for stations in smaller or unserved markets. In the television industry, the CRTC

has licenced a number of new, over-the-air television stations and a significant number of new digital Category 1 and

Category 2 services. The new services and the new formats combine to fragment the market for existing radio and televi-

sion operators.

MEDIA REGULATORY DEVELOPMENTS

The CRTC has announced that a further review of the Commercial Radio Policy will not occur until 2005. In the interim, the

CRTC will review satellite radio issues, including the establishment of a satellite radio policy and licensing framework in

response to a filing for satellite radio applications in Canada.

The CRTC has reviewed its exemption order regarding Teleshopping Programming Undertakings such as The Shop-

ping Channel, and has left the order substantially unchanged, including Canadian ownership requirements applicable to

all other licenced services.

The CRTC has released its digital television policy, covering issues such as priority carriage and simultaneous sub-

stitution. Media believes that the CRTC policy provides an effective framework for continued growth and development of

digital television broadcasting in Canada.

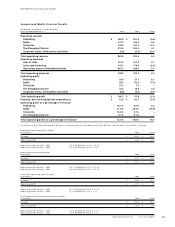

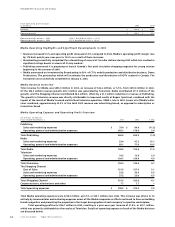

Management’s Discussion and Analysis