Rogers 2003 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report Rogers Communications Inc.

90

Notes to Consolidated Financial Statements

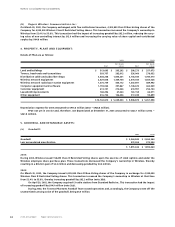

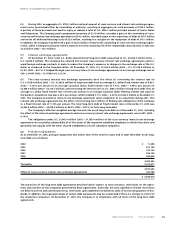

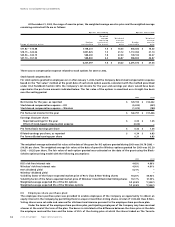

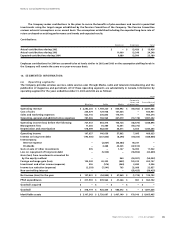

11. SHAREHOLDERS’ EQUITY:

2003 2002

Capital stock:

Preferred shares:

Held by subsidiary companies:

60,000 Series XXVII (2002 – 60,000) $ 60,000 $ 60,000

818,300 Series XXX (2002 – 818,300) 10,000 10,000

300,000 Series XXXI (2002 – 300,000) 300,000 300,000

370,000 370,000

Held by members of the Company’s share purchase plans:

104,488 Series E convertible preferred shares (2002 – 135,836) 1,787 2,327

371,787 372,327

Common shares:

56,235,394 Class A Voting shares (2002 – 56,240,494) 72,313 72,320

177,241,646 Class B Non-Voting shares (2002 – 158,784,358) 287,978 257,989

360,291 330,309

732,078 702,636

Deduct:

Amounts receivable from employees under certain share purchase plans 1,186 6,274

Preferred shares of the Company held by subsidiary companies 370,000 370,000

371,186 376,274

Total capital stock 360,892 326,362

Convertible Preferred Securities (note 11(b)(i)) 576,000 576,000

Contributed surplus 1,169,924 917,262

Deficit (339,436) (415,589)

1,406,488 1,077,673

$ 1,767,380 $ 1,404,035

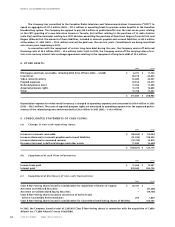

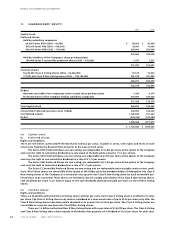

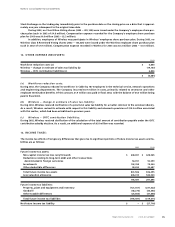

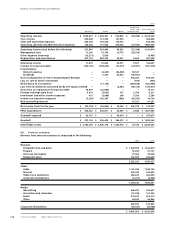

(a) Capital stock:

(i) Preferred shares:

Rights and conditions:

There are 400 million authorized Preferred Shares without par value, issuable in series, with rights and terms of each

series to be fixed by the Board of Directors prior to the issue of such series.

The Series XXVII Preferred Shares are non-voting, are redeemable at $1,000 per share at the option of the Company

and carry the right to cumulative dividends at a rate equal to the bank prime rate plus 13/4% per annum.

The Series XXX Preferred Shares are non-voting, are redeemable at $1,000 per share at the option of the Company

and carry the right to non-cumulative dividends at a rate of 91/2% per annum.

The Series XXXI Preferred Shares are non-voting, are redeemable at $1,000 per share at the option of the Company

and carry the right to cumulative dividends at a rate of 95/8% per annum.

The Series E Convertible Preferred Shares are non-voting and are redeemable and retractable under certain condi-

tions. All of these shares are convertible at the option of the holder up to the mandatory date of redemption into Class B

Non-Voting shares of the Company at a conversion rate equal to one Class B Non-Voting share for each convertible pre-

ferred share to be converted. These shares are entitled to receive, ratably with holders of the Class B Non-Voting shares,

cash dividends per share in an amount equal to the cash dividends declared and paid per share on Class B Non-Voting

shares.

(ii) Common shares:

Rights and conditions:

There are 56,240,494 authorized Class A Voting shares without par value. Each Class A Voting share is entitled to 25 votes

per share. The Class A Voting shares may receive a dividend at a semi-annual rate of up to $0.05 per share only after the

Class B Non-Voting shares have been paid a dividend at an annual rate of $0.05 per share. The Class A Voting shares are

convertible on a one-for-one basis into Class B Non-Voting shares.

There are 1.4 billion authorized Class B Non-Voting shares with a par value of $1.62478 per share. The Class A Voting

and Class B Non-Voting shares share equally in dividends after payment of a dividend of $0.05 per share for each class.