Rogers 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual ReportRogers Communications Inc. 35

DTH services is another source of competition to Canadian cable companies. In April 2002, the Supreme Court of Canada

issued a decision clarifying that the decoding of programming signals, except in accordance with the authorization of a

licenced Canadian distributor, is prohibited in Canada. The decision has led to increased criminal and civil enforcement

activity against black and grey market satellite television dealers in Canada.

Cable’s objective is to offer the fullest possible range of programming and services to its customers. In September

2001, Cable launched approximately 70 of the new Category 1 and Category 2 digital services licenced by the CRTC in 2000.

Since that time, Cable has launched additional Category 2 and foreign digital services. Cable offers more third language

digital services than any other Canadian distributor. In late 2001, Cable also launched a digital offering consisting of HDTV

versions of the U.S. networks sourced from Detroit. In early 2002, Cable launched a digital timeshifting package that

included distant Canadian conventional broadcast signals and versions of the U.S. networks sourced from Seattle.

In March 2002, Cable began offering HDTV versions of selected pay and PPV programming. In 2003, Cable added HDTV ver-

sions of CityTV Toronto, TSN, Rogers Sportsnet and U.S. networks sourced from Seattle and Spokane. Cable has a large

and diverse, highly-competitive offering relative to Canadian DTH and other Canadian cable providers.

Cable’s Internet access service competes generally with a number of other Internet Service Providers (“ISPs”),

offering competing residential and commercial Internet access services. Many ISPs offer telephone dial-up Internet access

services that provide significantly reduced bandwidth and download speed capabilities compared to broadband tech-

nologies such as cable modem or DSL. Cable’s Internet service competes directly with Bell’s DSL Internet service in the

high-speed Internet market in Ontario, and with the DSL Internet services of Aliant in some of Cable’s service areas in

New Brunswick and Newfoundland. Cable also offers a less expensive Internet Lite service which has fewer features than

the standard high-speed package. Cable’s Internet Lite service competes against similar slower speed DSL services and,

because of its reduced speed, competes more directly with dial-up services.

Cable has increasingly offered its services to customers at either a discounted price for subscribing to multiple ser-

vices or, more recently, in product bundles which are priced at a discount to the sum of the prices of the individual

products if they were to be purchased separately. Cable believes that such customer loyalty programs and multi-product

bundling enable it to reduce individual product churn, increase the average revenue received from its customers by sell-

ing multiple products to them and to better service its customers by offering a single bill and single points of customer

service contact. Late in 2003, Cable and Rogers Wireless launched a combined bundle which offered combinations of their

video, high-speed Internet, and wireless services. Cable’s primary competitor, Bell, also markets similar product bundles

at similar price points in competition with Cable. However, Bell’s practice of bundling telephone services with Internet

and DTH service is currently under review with the CRTC.

Cable faces emerging competition from other utilities such as hydroelectric companies as these companies look to

utilize their infrastructure to provide Internet and other services that may directly compete with its current and future

service offerings.

Rogers Video competes with other videocassette, DVD and video game sales and rental store chains, such as

Blockbuster Inc. and Wal-Mart Stores Inc., as well as individually owned and operated outlets. Competition is principally

based on location, price and availability of titles.

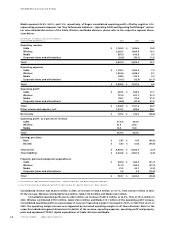

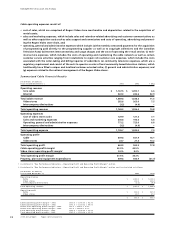

CABLE OPERATING AND FINANCIAL RESULTS

Year Ended December 31, 2003 Compared to Year Ended December 31, 2002

For purposes of this discussion, revenue has been classified according to the following categories:

• core cable, which includes revenue derived from (a) analog cable service revenue consisting of basic cable service fees

plus extended basic (or tier) service fees, installation fees and access fees for use of channel capacity by third and

related parties and (b) digital cable television service revenue consisting of digital channel service fees, including pre-

mium and specialty service subscription fees, PPV service fees, interactive television service fees, VOD and digital

set-top terminal rental fees;

• Internet, which includes service revenues from residential and commercial Internet access service and modem rental

fees plus installation fees; and

• Rogers Video stores, which includes the sale and rental of videocassettes, DVDs, video games and confectionery, as

well, Rogers Video earns commissions acting as an agent to sell other Rogers’ services such as wireless, Internet, and

digital cable.

Internet service has essentially become another service that leverages the cable infrastructure and which, for the most

part, shares the same physical infrastructure and sales, marketing and support resources as other core cable offerings.

This, combined with Cable’s expanded bundling of cable television and Internet services, increasingly led to allocations of

bundled revenues and network and operating costs between the core cable and Internet operations of Cable. As such,

commencing January 1, 2003, reporting of the core cable and Internet segments of the Cable segment were combined.

Cable continues to provide separate statistical information on its Internet subscribers as it does for the digital cable sub-

scriber subset of its core cable operations. In addition, Cable is continuing to report Internet revenues separate from

those of core cable.

Management’s Discussion and Analysis